An update on social factors – the “S” in ESG

Sustainable investing is about long-term, finance-driven strategies that integrate Environmental, Social and Governance (ESG) factors into the investment arrangements, utilise effective stewardship and have a real world impact. We believe that investors who incorporate sustainable investment practices into their arrangements will improve portfolio risk and return outcomes over the long term. Academic evidence supports this view, with studies demonstrating a positive relationship between strong sustainability practices and financial performance1.

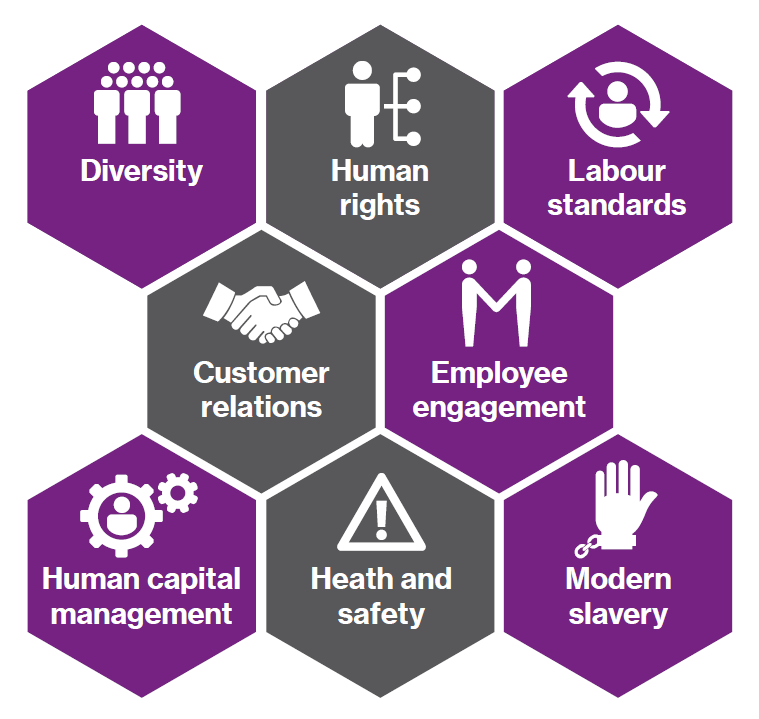

Social factors include topics ranging from employee engagement and customer satisfaction to human capital management:

Historically investors have focused more on environmental and governance factors, partly due to the challenge of quantifying and measuring social factors. However, the COVID-19 pandemic and the Black Lives Matter movement have led to increased attention on how companies manage social issues, ranging from health and safety to human rights and labour standards, as investors now better understand that these issues present clear financial risks.

The way a company treats its employees has come under increased scrutiny during the COVID-19 crisis. We have seen some companies support workers by adapting factories for social distancing and providing personal protective equipment whilst other companies have put their workers at increased risk of infection due to poor health and safety standards, resulting in reputation and brand damage.

The crisis has exacerbated human rights and labour standards issues and highlighted the inequality that exists within society by hitting the poorest and most vulnerable the hardest. The International Labour Organisation estimates that the equivalent of 400 million full-time jobs were lost globally during the second quarter of 20202 due to lockdowns and workplace closures, with low paid migrant works and those in the “gig economy” disproportionately impacted. Lockdowns and border closures around the world have resulted in many retailers delaying payment or invoking force majeure clauses to cancel orders, putting millions of already vulnerable factory workers in global supply chains at increased risk of serious exploitation.

The Black Lives Matter movement has brought attention to racial injustice and systemic inequality around the world. This has led to renewed focus on indigenous rights in Australia, at a time when Rio Tinto legally destroyed 46,000-year-old sacred sites in the Juukan Gorge in Western Australia, which resulted in widespread public outrage.

Companies that can better manage social issues are likely to be more resilient over the long term and investors who integrate social factors into their investment process can materially improve long-term risk and/or return outcomes.

The way a company manages social issues can have a material impact on their reputation and social license to operate. We believe that companies that can better manage social issues are likely to be more resilient over the long term and that investors who integrate social factors into their investment process can materially improve long-term risk and/or return outcomes.

Modern slavery is an umbrella term that includes a range of serious exploitative practices and labour rights abuses, such as human trafficking, debt bondage, forced labour and the worst forms of child labour. Poor labour practices such as substandard working conditions or underpayment of workers do not meet the definition of modern slavery, but these forms of exploitation are high risk factors that may lead to modern slavery over time.

The International Labour Organisation estimates that 40.3 million men, women, and children were victims of modern slavery on any given day in 2016, with 24.9 million in forced labour; and women and girls over-represented, making up 71% of modern slavery victims3. Modern slavery can occur in any country around the world but is most prevalent in Africa and the Asia-Pacific region, with more than half of the victims of forced labour in the Asia-Pacific region4. A lack of available data means that these numbers are likely to underestimate the true extent of modern slavery, particularly in countries experiencing conflict.

Modern slavery can also occur in any industry, at any point in the supply chain, but is often hidden deep down the supply chain and so can be difficult to detect. High risk industries identified by the Human Rights Working Group of the Responsible Investment Association of Australasia (RIAA) include agriculture and fishing, apparel, construction and building materials, electronics and electronics recycling and mining. Examples of red flags that might identify modern slavery include complex and long supply chains with many intermediaries, supply chains with predominately migrant workers and oligopolistic industries with a small number of companies putting pricing pressures on their suppliers5.

Modern slavery is now recognised as a global problem that requires a co-ordinated response from governments and companies around the world. The UN Guiding Principles on Business and Human Rights sets the standard for countries and companies to prevent, address and remedy human rights abuses committed in business operations, while target 8.7 under the UN Sustainable Development Goals (SDGs) aims to take action to eradicate forced labour and end modern slavery6. In addition to these global initiatives, governments around the world have taken steps to address modern slavery, introducing human rights legislation and reporting requirements in California, France, the UK as well as more recently, in Australia.

The Commonwealth Modern Slavery Act 2018 (the Act) came into force on 1 January 2019. It requires entities with operations in Australia and with more than $100 million in consolidated annual revenue to produce an annual modern slavery statement, that describes the actions they have taken to assess and address modern slavery risks in their global operations and supply chains. The Act aims to improve transparency around what entities in Australia are doing to monitor modern slavery risks, with the Federal government committed to lead by example and issue its own modern slavery statement by 31 December 20207.

The Act has broader requirements than the UK Modern Slavery Act 2015, and includes both internally and externally managed investment portfolios in the definition of operations and supply chains. The annual modern slavery statement must be approved by the Board of Directors and will be publicly available, with the deadline for the first statements extended from 31 December 2020 to 31 March 2021, due to the COVID-19 pandemic. The government’s online register has recently been launched with the first Australian entities having published their statements for the year ending 30 June 20208. Whilst there is no penalty for failing to comply with the Act, the government may publish information on an entity’s failure to comply, which could lead to significant reputational damage.

Whilst the legislation focuses on risks to people, modern slavery also presents a financial risk to companies and investors. Research has found that 77% of companies believe there is a likelihood of modern slavery occurring at some stage in their global supply chains9 with forced labour generating US$150 billion a year in illegal profits10. Companies that rely on illegal or underpaid workers in their operations or supply chain may be subject to sudden cost increases and are unlikely to produce sustainable earnings over the long term.

Human rights and labour standards issues may also create reputational risks for companies, that can lead to brand damage and an adverse impact on their social license to operate. Improved company disclosure on these issues will assist asset owners in undertaking stewardship activities, including voting and engagement, either directly with companies or indirectly through investment managers or third parties. Investors can also participate in collaborative engagement with public policy makers, regulators and standard setters to protect and enhance the long-term value of their investments.

Asset owners should therefore assess material portfolio exposures to ESG risks. They may also need to prepare their own modern slavery statement to provide transparency around the actions they are taking to assess and address modern slavery risks in their operations and supply chain. Several useful resources have been developed by industry working groups, including a modern slavery reporting guide for investors, that includes practical tips and examples to help asset owners prepare their own modern slavery statement11. A due diligence questionnaire for investment managers, developed by the Financial Services Commission ESG working group and RIAA, also provides a standardised approach for reporting across the industry.

We believe that investors who integrate ESG factors such as modern slavery into their investment process can improve portfolio resilience by identifying sustainability-related risks and opportunities and then taking action through their portfolio holdings and stewardship activities. We provide examples of practical actions that asset owners can take below:

Assess portfolio exposure to ESG risks such as modern slavery

Identify exposures to high risk countries and sectors in internally and externally managed portfolios

Engage directly with companies on ESG issues such as modern slavery or indirectly through investment managers and collaborative groups

Participate in collaborative groups such as the Principles for Responsible Investment (PRI) that aim to address ESG issues such as modern slavery

Conduct a beliefs exercise to examine and benchmark current sustainable investment beliefs

Review existing policies and incorporate ESG issues into investment policy documents

Integrate ESG issues such as modern slavery into the entire investment process

Prepare a modern slavery statement following guidance from the Responsible Investment Association of Australasia (RIAA) and the Australian Council for Superannuation Investors (ACSI)

1 Clark, Feiner, Viehs From the Stockholder to the Stakeholder: How Sustainability Can Drive Financial Outperformance, University of Oxford,

Arabesque Partners (2015). Available at: https://ssrn.com/abstract=2508281

2 ILO Monitor: COVID-19 and the world of work. Fifth edition. Updated estimates and analysis

3 https://www.globalslaveryindex.org/2018/findings/highlights/

4 https://www.globalslaveryindex.org/2018/findings/regional-analysis/asia-and-the-pacific/

5 https://www.responsibleinvestment.org/wp-content/uploads/2018/08/HRWG-Investor-Tool-Kit.pdf

6 https://www.un.org/sustainabledevelopment/economic-growth/

7 https://www.homeaffairs.gov.au/criminal-justice/Pages/modern-slavery.aspx

8 https://modernslaveryregister.gov.au

9 https://www.ethicaltrade.org/sites/default/files/shared_resources/corporate_leadership_on

_modern_slavery_summary_0.pdf

10 https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_243201/lang--en/index.htm

11 https://acsi.org.au/wp-content/uploads/2020/02/ACSIModernSlaveryGuide2019_1Nov.pdf

This page contains links to certain historical documents which were issued by Willis Towers Watson (WTW) as at the date specified on each linked document, in relation to the products offered by WTW. WTW believes that it is useful to investors to retain these documents on our website, for your information and reference purposes. Each such document was assessed as being compliant with prevailing regulatory requirements as at its date of issue, including that its contents are fair, clear and not misleading. Given that these documents were issued as at a specific point in time, WTW does not believe it would be appropriate to retrospectively amend those documents. As a result such documents have not been reviewed in light of any subsequent regulatory guidance or market practice including the FCA’s anti-greenwashing guidance (FG24/3). Any persons accessing this page, and the documents made available on this page, should not seek to rely on such documents and should use them only for information or reference purposes. Any investment decision should be based exclusively on the formal offer and subscription documents for the relevant investment product, and not these historical documents.

| Title | File Type | File Size |

|---|---|---|

| Sustainable investment practices | 2.8 MB |