Crucial to this delivery is an intimate understanding of the factors driving pricing pressure to avoid significant premium increases and tightened terms and conditions. New APRA reporting requirements will lead to an environment where it will be easier for members to compare funds’ insurance offerings. In this ensuing era funds will need to demonstrate greater transparency, improved governance and better harness their data.

Undertaking analysis and investigation to ensure your insurance pricing and design is ‘fit-for-fund’ has never been more important.

Among a host of recent fundamental changes to the provision of default insurance in superannuation, the most disruptive from a fund perspective has been the implementation of the Protecting Your Super (PYS) and Putting Members Interests First (PMIF) packages.

These took default insurance in super from default cover for all members with the ability opt out, to a system of no default cover for a substantial group of members who have low account balances, are aged under 25 or have inactive accounts. These members must make an active opt-in decision to obtain any cover.

Beyond PYS and PMIF, change is being driven by a heightened focus on inappropriate erosion of retirement benefits by insurance, member outcomes legislation, and regulator scrutiny of Activities of Daily Living (ADL) TPD definitions and the default occupational ratings being used by some superannuation funds.

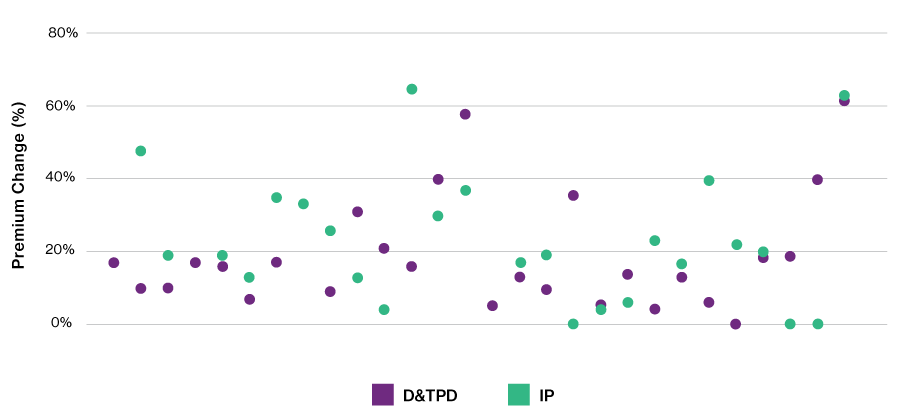

The cost of complying with the new requirements and the resulting change in profile of insured members explains, in part at least, the increase in insurance premiums that has been observed in many funds over the past two years, as illustrated in Chart 1.

* Sourced from publicly available data sources

While the industry successfully implemented these changes, often under significant time pressure, in our experience some funds handled the gamut of pricing and product changes better than others.

Those funds who engaged early with their insurers were able to challenge them, where appropriate, to ensure certain components of pricing such as opt-in rates, anti-selection factors and COVID-19 ratings were ‘fit for fund’ and reflected the fund’s underlying demographics and experience. The early engagement around pricing also enabled product offerings to be adjusted to manage affordability pressures.

The experience of the last few years has strongly highlighted the need for funds to engage early, proactively and regularly with insurers on all aspects of pricing and design as a critical component of good insurance governance. Waiting and responding to an insurer re-rate has often left insufficient time to challenge the insurer, before the necessity of implementation kicks in. This will continue to be true as pricing becomes more transparent and its incorporation into member outcomes becomes more comprehensive.

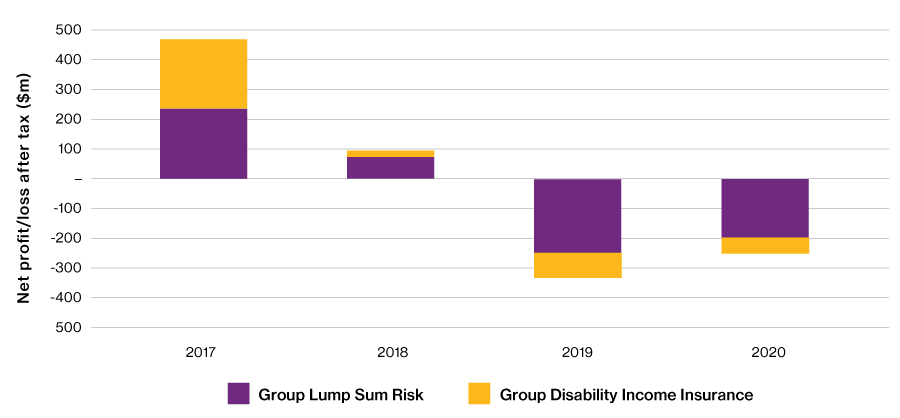

Following the well-documented premium increases of the last few years and continued losses reported by life insurers, particularly in disability insurance, it is clear the trend towards premium increases may yet have more steam. Chart 2 shows the changes in the industry’s group risk profits and losses from 2017 to 2020.

* Sourced from APRA Quarterly life insurance performance statistics December 2020 (issued 4 March 2021)

The sustainability of insurance pricing is a clear concern to APRA as evidenced by its March 2021 letter to superannuation fund trustees and life insurers. In it, APRA draws parallels between recent premium increases and those experienced by funds between 2012 to 2016, with the suggestion that the next few years could result in a similar deterioration of claims experience and further premium rate increases.

In our view, while today’s pricing environment contains some similarities with that of 2012 to 2016, the underlying drivers of current pricing are fundamentally different.

The premium increases from 2012 to 2016 were a function of poor claims experience and reinsurers exiting the market, whereas the recent bout is driven by:

The extent to which these factors will continue to influence claims is uncertain as is the fundamental question of whether the poor claims experience of the last few years constitutes a trend or a once-off event. Certainly, the impact of selection should reduce within a couple of years, potentially leading to downward pressure on premiums at the next renewal. The extent to which insurers have correctly priced for COVID-19 related claims arising from the economic downturn will also emerge over the coming years.

Therefore, as part of any sustainable pricing discussion it is imperative for funds to closely monitor overall claims experience, with a strong focus on claims arising from opt-in members.

In addition to sustainable pricing, it is important for funds to view any conversation around pricing through the dual lens of member affordability and adequacy of outcomes, as these two concepts are intrinsically linked. Funds must find the sweet spot that obtains the appropriate level and the appropriate cost of default cover. While metrics for member affordability and overall sustainability can be determined via the 1% of salary test (or other rules) and independent reviews of pricing respectively, adequacy is much more fund specific and requires funds having a strong grasp of both the underlying demographics of their members and what constitutes member insurance needs.

Funds who do not actively mine their own data and feed it into their decision-making processes to ensure their insurance arrangements are appropriate may find APRA supervisors holding them to account over member outcomes, or being compared unfavourably with other superannuation funds.

APRA’s super data transformation project is well underway and appears to be a priority for the regulator. The new Reporting Standard (SRS 251.0 Insurance) will require reporting of a whole gamut of insurance data pertaining to premiums paid, claims admittance, claims processing, TPD assessments by definition, occupational data and various other information.

The data requested appears to be sufficient for APRA to prepare and publish detailed superannuation fund comparisons including loss ratios, rates of claim admittance, claim duration periods, default occupational ratings and TPD definitions.

With the sheer quantum and granularity of data collected by the regulator, funds themselves must have a strong grasp of their underlying insurance data.

Prudential Standard (SPS) 250 Insurance in Superannuation is in the process of being reviewed with changes proposed to be effective 1 January 2022.

A major addition to SPS 250 is in the area of independent certification. The draft changes require that, where an insurer is a connected entity of a trustee, independent certification will be needed to state (among other things) that it is reasonable for the trustee to form the view that the insurance arrangement is in the best interests of the beneficiaries. Whether or not an insurer is a connected entity, the same best interests independent certification is still needed where the contractual terms of the insurance arrangement provide the insurer with a priority or privilege.

While very few funds have a connected entity as their insurer, all funds will have to consider the question of whether the contractual terms of the insurance arrangement provide their insurer with a priority or privilege.

Draft Prudential Practice Guide SPG 250 paragraph 53 explains that a priority or privilege may occur where the terms of an arrangement provide the insurer with a current or future competitive advantage relative to other insurers, or where the terms of an arrangement favour the insurer relative to the trustee or the beneficiaries of the fund. While paragraphs 57 and 58 of the draft provide examples of priority and privilege rights, it is not yet clear how funds will interpret them in practice.

Our experiences of the last few years further highlighted an independent review of pricing and product as a valuable component in any premium rate changes during the rate guarantee period (i.e. PYS and PMIF insurance changes) to ensure members’ best interests were prioritised.

Irrespective of the final wording of SPS 250 and SPG 250, we believe independent certification is fundamentally good practice and funds should embed this process within their pricing and product teams as a matter of good governance. This is particularly important when premium rates are being renewed and a market tender has not been conducted.

APRA has also proposed that SPS 250 be updated to require trustees to detail in the Insurance Management Framework how the insurance outcomes assessment in section 52(11)(d) of the SIS Act will be documented in the annual member outcomes assessment.

In addition, paragraphs 24 to 26 of draft SPG 250 provide detailed guidance on APRA’s expectations for the member outcomes insurance assessment. In particular, member outcomes analysis should incorporate cohort analysis, including actual and target premiums and claim payment ratios as part of annual member outcomes assessments. This suggests that insurance pricing and claims experience potentially needs to be considered separately for each cohort of members and that by implication cross subsidies between different cohorts need to be explicitly and transparently considered.

Some resulting issues for funds to consider include whether unisex rates or existing cross subsidies between age and product type remain appropriate. While the draft changes do not force funds to make product changes, they suggest funds should have a compelling reason to justify that current arrangements satisfy member best interests tests.

As the industry moves through the current phase of consolidation, there will be a greater onus on funds to measure, monitor and manage their insurance product and pricing to continually assess whether member best interests are being met.

While this is considered good practice, the experience of the last few years indicates APRA will continue to push for these changes through greater regulatory oversight. Irrespective of where the APRA super data transformation project or SPS 250 changes land, our view continues to be that good governance and acting in member best interests dictate funds embed processes that independently demonstrate all premium and product changes are fair and reasonable.

In addition, funds should be working with their insurer and advisors to begin conducting detailed cohort analysis as part of regular insurance reviews and consider whether further product changes are needed to provide greater transparency, demonstrate equity between cohorts and the compelling reasons for product design decisions.