One of the last-minute changes to the Your Future Your Super (YFYS) legislative package was the deferral of the ‘stapling’ provisions to 1 November 2021. It’s a very short reprieve for a measure that will have far reaching effects on the superannuation landscape.

The annual performance test will, in many cases, have an almost immediate effect on funds’ investment strategy, but stapling is expected to have a longer term and more subtle impact. It will nevertheless challenge the status quo and potentially affect fund viability over the medium term.

At present, a strategic priority for many funds is to establish what they consider to be a sustainable level of scale and target that by growing organically and/or via merger. Stapling provisions will require funds to revisit their strategic priorities. Funds looking to thrive will need to have strong brand recognition, a clear strategy for engaging and retaining members, a compelling direct-to-member proposition and a technology-enabled vision.

The concept of stapling is not new. Both the Hayne Royal Commission and Productivity Commission reviews identified the proliferation of multiple accounts and subsequent layers of fees as a blight on the superannuation system. Indeed, one-in-four members of funds have more than one super account. These people pay at least two lots of administration fees and may have duplicate, and potentially distorted, insurance arrangements.

The Hayne Royal Commission recommended that: “A person should have only one default account. To that end, machinery should be developed for ‘stapling’ a person to a single default account”. The YFYS legislation gives effect to this recommendation by requiring superannuation accounts to be stapled to individual workers as they move between jobs.

Stapling will not end multiple accounts – workers changing jobs can still choose a new fund – but rather will reduce their proliferation. Nonetheless, one can argue it is a step in the right direction and, overall, we expect consumers to benefit from the YFYS stapling model.

That said, we have genuine concerns about the implementation framework, including the asymmetric advantage given to certain funds and the effect on default insurance arrangements. Stapling may also make it difficult (or even impossible) for new providers to enter the market. Longer term, this could adversely impact innovation and, ultimately, consumer outcomes.

Stapling is expected to broadly be a zero-sum game for the industry. The funds who gain a new entrant or retention advantage will do so at the expense of funds who would have otherwise received these contribution flows.

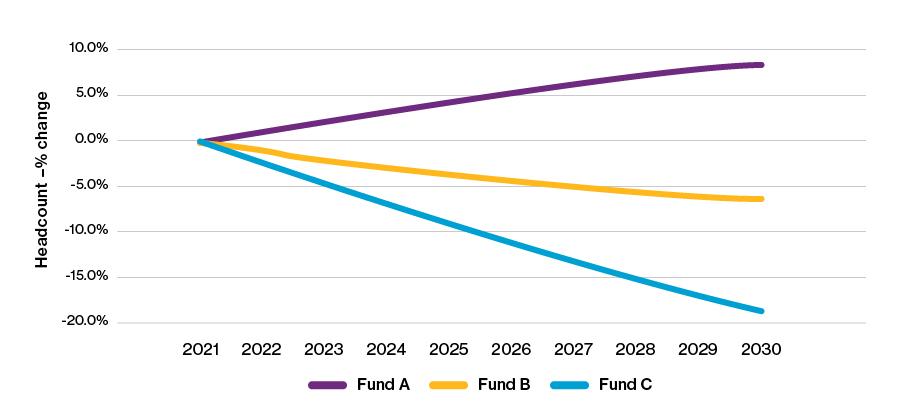

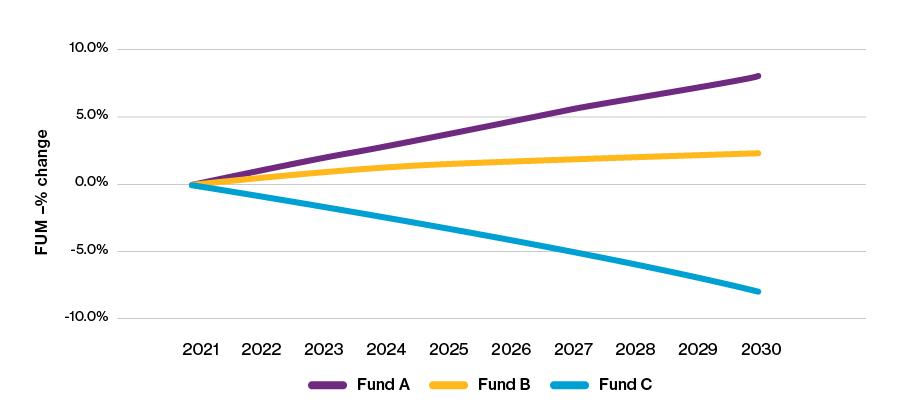

Funds will need to work even harder to retain existing members and attract new members – especially choice members – in an increasingly competitive environment. That said, there will be clear winners and losers from the stapling reform, illustrated by modelling the potential outcomes for three example funds:

* The percentage change relative to a pre-stapling projection

While the impact takes time to emerge, funds that struggle to adapt to the stapling regime are likely to experience lower levels of Funds Under Management and membership growth relative to funds that succeed and thrive in this environment. This will ultimately lead to cost pressures, potentially increased net negative cashflows and poorer member outcomes.

For better or worse, stapling is now law and the industry needs to adjust. Employers and funds must develop the necessary implementation frameworks to be ready by 1 November. Funds with a ‘first employer’ advantage will consider how to consolidate this benefit, while the rest of the industry will be grappling with how to attract choice members.

The increased competition for members in a post-stapling environment will largely be a new cost for the industry, which up until now has been reasonably civilised in terms of ‘poaching’ members from other funds. An outworking of stapling arrangements will be that, all other things being equal, the aggregate costs of operating a superannuation fund will rise and funds will need to manage these expenses to demonstrate that they are acting in the best financial interests of members.

Stapling will increase focus on developing strong new entrant flows, increasingly through the attraction of choice members. It will also increase the importance of building a loyal and engaged membership. For funds to survive and thrive they will need an overall strategy aimed at improving brand awareness, leveraging data to better engage with members, having strong systems and processes to attract members when they join an employer and investing in technology that enables real-time member interactions.

The final article in this series on YFYS explores in more detail the potential impact of stapling on group insurance.