Inclusion and Diversity (I&D) is a vast topic, and it can be difficult to know where to begin a meaningful conversation. Here are 5 key questions we believe every investor should ask their asset manager.

01

Collecting data is critical. Data provides you with a meaningful measure of diversity and what is measured can be managed. WTW has collected comprehensive data for 1500+ investment strategies across various dimensions of diversity. Robust data and regular engagement enable us to build a forward-looking view of inclusion, equity and diversity across firms and portfolios more broadly.

Tracking diversity data regularly over time helps enable investors to understand how I&D has evolved in portfolios, with successful I&D initiatives translating into the diversity numbers and typically better managed assets.

02

Putting a commitment in writing creates structure and accountability. Going forward, WTW requires all of its Preferred rated managers to publish an I&D policy, creating alignment between our I&D commitments and the managers we work with. We encourage measurable, quantifiable objectives to ensure can progress can be measured, e.g. 25% increase in senior females by 2025 or a 90% response rate on staff engagement surveys.

03

A broad group should take responsibility for I&D, but accountability should ideally be targeted at senior leadership to encourage firm wide buy-in. Ideally, I&D is not something delegated to one team, forgotten about or siloed. Further accountability can be established by linking I&D initiatives to Key Performances Indicators and remuneration, aligning incentives and long-term strategic goals.

04

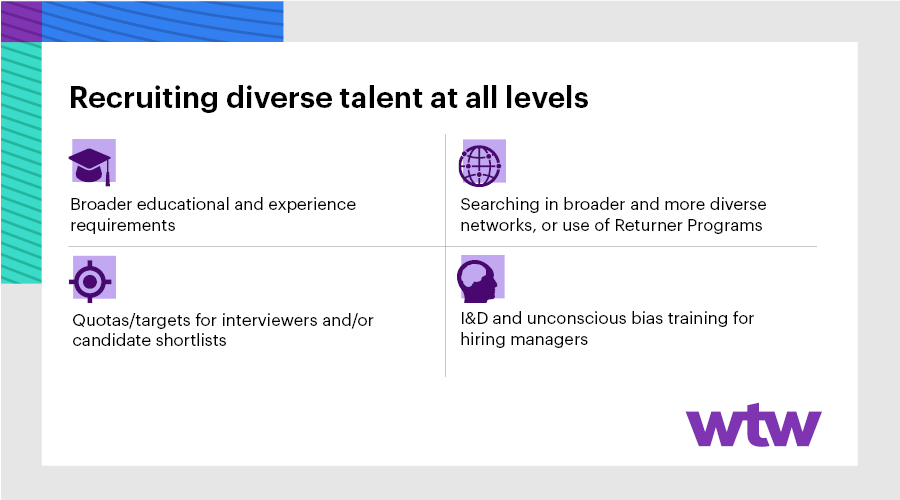

Diverse recruitment should be targeted at all levels. If an asset manager believes the talent pool is limited, WTW recommends considering:

05

An inclusive culture encourages the retention and recruitment of diverse talent. Culture is constantly evolving and directed from the top down of an organization. WTW spends its time meeting with the executive leadership of asset management firms, carrying out in-depth culture assessments and engaging with thoughtful recommendations to improve or preserve a positive culture. WTW has conducted 200+ culture reviews to date.

WTW can help bring I&D to the forefront of your investment strategy. Please contact us to start your I&D journey.