Private equity1 investors are at the forefront of providing much-needed funding to address climate change. Compared to public equity markets where vast majority of transactions involve merely ownership rights reshuffling (hence no funding provided to the underlying businesses), many private equity investments, in particular venture capital investments, directly inject cash to investee companies to support, for example, the development of technologies or scaling up the manufacturing capability. On the other hand, asset owners are increasingly looking to invest in climate solutions as more and more of them sign up for net-zero goals. It can be a powerful way to help prevent greenwashing allegations as a provider of primary funding with quantifiable impact.

Make no mistake, most asset owners are not in the space of providing concessionary capital for the sake of positive impact. Selecting private equity managers that can deliver successfully on both return and impact remains an arduous and demanding task.

Download the PDF or read more below.

| Title | File Type | File Size |

|---|---|---|

| Unlocking opportunities in climate solutions: A private equity perspective | .6 MB |

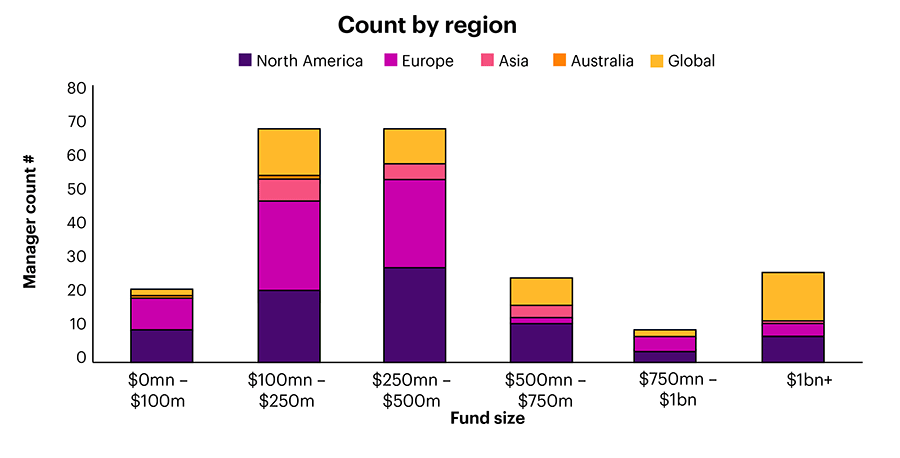

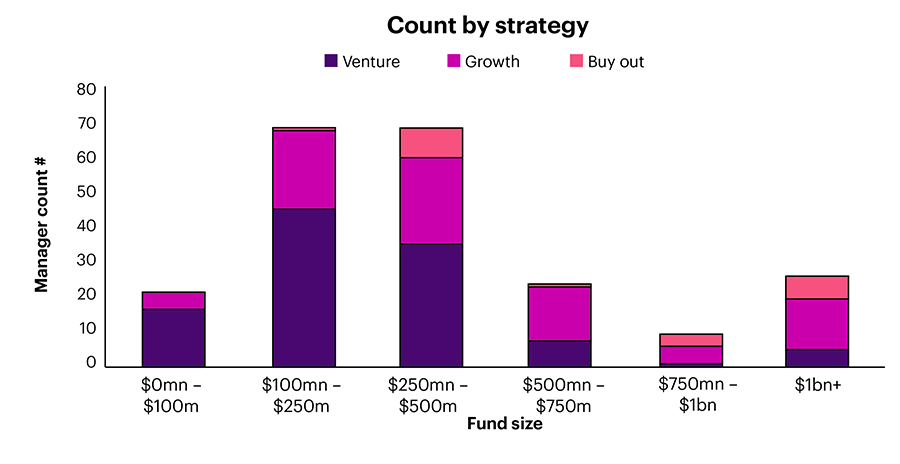

Having built a small exposure to climate solutions through our generalist private equity managers and other private market managers over the last decade (Figure 1), WTW Private Equity team has undertaken a major initiative since 2021 to investigate the global climate solutions fund raising market. Up to this point2, this live programme has involved a few thousand hours of hard work from a dedicated sub-team, which has evaluated over 250 private equity funds devoted to climate solutions, collectively looking to raise over $140bn (see more details in Figures 2 and 3). We are delighted to share with you a few key learnings from this process and it starts with understanding the scope of the space.

Investing in climate solutions cuts across a wide range of sectors. It makes perfect sense as net-zero goals require contribution from all industries. Largely speaking, there are two main categories. Mitigation strategies (see more examples in Figure 4) focus on decarbonising current economic practices and examples include renewable energy, electrifying industries, alternative protein, electric vehicle and its supporting infrastructure. The other category involves adaption strategies, which fund solutions helping societies endure rising climate volatility, such as flood and wildfire prevention. Vast majority of the private equity managers we have engaged with focus on climate mitigation while adaption strategies currently only receive 7% of climate-related investment3. Amid a surging interest in climate related investment, a less crowed space could potentially represent a better investment opportunity.

| Food and agriculture | Industry and manufacturing | Power and energy | Transport | Buildings | Carbon sinks |

|---|---|---|---|---|---|

| Alternative protein | Energy efficiency | Renewable energy | Electrified road transport | Heating decarbonization | Reforestation |

| AgTech | Electrified industries | Next-gen smart grid | Long-distance solutions | Low GHG construction process | Carbon capture, use, and storage (CCUS) |

| Food supply chain GHG reduction | Low GHG alternatives to traditional inputs | Energy storage | Intelligent mobility ecosystem | Sensor-led smart building management | |

| Fertilizers | New materials revolution and circular economy | Micro mobility |

In the mid to late 2000s, there was an explosion of US venture capital investment in clean technology (e.g., renewable energy), colloquially known as cleantech 1.0. Fast forward to 2011, solar manufacturer Solyndra failed, causing an immense political backlash. The global financial crisis also led to a tightening of credit and a decline in investor confidence, which exacerbated the market correction in cleantech. Overall, investors lost about $25bn when the sector crashed. Money dried up fast. For years, cleantech was a dirty word in venture capital.

“The greatest glory in living lies not in never falling, but in rising every time we fall.”

Nelson Mandela

That said, there is a strong case to argue that this time is indeed different. Unprecedented policy support, new consumption norms created around sustainability, major technological advance, and numerous lessons learnt in terms of backing businesses that are compatible with the private equity model, all point to a brighter future for climate solutions investing.

For those who are keen not to repeat the mistakes made in the cleantech 1.0 era, look no further than the landmark research produced by MIT in 2016: “Venture Capital and Cleantech”4. Let’s unpack two key lessons learnt here.

Climate solutions often leverage technology based on substantial scientific or engineering challenges, which can take significant time – often longer than private equity’s typical time horizon of three to five years – to work out the kinks. Therefore, it is important to ask your private equity managers to what extent they are taking technology risks. We believe investing in a proven technology that just needs help on scaling up the production or expanding into a new market has a better chance of producing returns within the private equity investment cycle. In addition, private equity managers need to be clear-eyed about the potential exit routes.

A significant number of climate technologies are highly capital intensive to develop. Their capital raising needs cannot be met by private equity funding alone. Therefore, it is vital for companies to build a reliable financing network that they can tap into, beyond the early growth stage. The survival of the business might depend on it.

Climate technologies are truly at the cutting edge of human ingenuity so there is no shortage of fascinating stories that captivate people’s imagination and generate a lot of excitement and buzz. Nonetheless, these moon shots such as nuclear fusion or space mining often lack a clear and realistic plan for achieving profitability and generating cash flow over time, which sets apart a good investment from a good story.

Next time when you have a venture capital manager switching on the storytelling mode, try to contain your excitement and grill them with these questions: how do you address the execution risk, the market timing risk (a product may be ahead of its time), the competitive landscape (competition from established players or new entrants), the monetisation challenge (a new tech can achieve significant adoption but struggle to generate revenue), and regulatory risks?

As mentioned, climate solutions represent a whole heap of technologies and business models of various stages. The risk/return trade-off of individual solution can be vastly different from each other. For example, advanced nuclear, carbon capture and wave/tidal power currently have not yet passed the technological inflection point and therefore are beyond the risk appetite of most private equity investors. On the other end of the spectrum, the expected return on renewable energy projects, such as solar and wind, can be rather low, as the mainstream adoption of the technology reduces the risks. It might be hard to generate private equity like return on this side of the innovation curve. Figure 5 illustrates some of the key differences across various risk profiles.

| Generally lower | Risk profile | Generally higher | |

|---|---|---|---|

| Commercial capital | Concessionary capital | ||

| Infrastructure investment | Private equity/growth equity | Venture capital | Government grants |

|

|

|

|

Climate solutions investing requires a multidisciplinary set of skills that combine technical expertise, business acumen, and a deep understanding of the climate crisis. In addition to what makes a great private equity investment professional here are a few additional essential skills that we need to assess managers against. A foundational understanding of climate science is needed to identify promising solutions, evaluate risks and opportunities. Managers also need to stay informed about the global, regional and local regulatory and policy landscape that shapes the climate solutions space. Technical expertise is another one as investing in this space involves complex technologies. An investor must have the technical expertise, in addition to the business acumen, to evaluate the potential of new innovations and their viability in the market. It is therefore not surprising to see private equity industry expanding its reach to talent with background in environmental science, chemistry, engineering, and public policy.

As a nascent area, there is no shortage of managers launching a first-time fund with newly put-together team, limited track record and untested investment strategy. There are a small number of “survivors” from the cleantech 1.0 era, and their track records are likely not spectacular. But don’t write them off too soon - the key is to make an assessment whether they have learnt their lessons.

All managers are grappling with building a fit-for-purpose impact assessment framework. The World Bank’s International Finance Corporation (IFC) has called on asset managers to disclose their impact investing methods, and to have their alignment with the IFC’s best-practice principles independently verified. Several big private equity firms have signed up to the IFC principles. While carbon emissions can now be measured and audited, climate impact can only be estimated via a forward-looking lens of how much emissions will be avoided, compared to a hypothetical counter-factual scenario (i.e., if this climate solution was not developed). During the fund due diligence, it is worth digging into the assumption setting and forming a judgement whether there is a risk of “green washing”.

Other challenges include surging capital inflows which have driven valuations in certain pockets of the market to unseen levels. Accessing channels are currently fairly narrow, with vast majority of opportunities residing in venture and early-state growth but we expect the industry to mature over time, hence creating more diversified entry points including late-stage growth and buyouts.

These are simply additional considerations on top of the standard set of success factors that investors need to examine, in the areas of business, people and process, when selecting any private equity manager5.

John Doerr, a partner at the prominent Silicon Valley VC firm Kleiner Perkins, made a prediction in a 2007 TED talk, “Green technologies - going green - is bigger than the Internet. It could be the biggest economic opportunity of the 21st century.” In 2007, he was rather alone with that view, and, judging by the experience of cleantech 1.0, a bit ahead of his time. But the jury is still out, with nearly eight decades to go in this century. He might well turn out to be right.

1. The term here is used to represent all private equity investment strategies including venture capital, growth equity as well as buyouts.

2. March 2023

3. It’s Time to Invest in Climate Adaption, 2022, Ravi Chidambaram and Parag Khanna, Harvard Business Review

4. Venture capital and cleantech: The wrong model for clean energy innovation, 2016, MIT

5. For more on WTW’s approach to private equity, please refer our white paper Institutional allocation to private equity – A maturing industry calls for a differentiated approach

The information included in this presentation is intended for general educational purposes only and should not be relied upon without further review with your WTW consultant. The information included in this presentation is not based on the particular investment situation or requirements of any specific trust, plan, fiduciary, plan participant or beneficiary, endowment, or any other fund; any examples or illustrations used in this presentation are hypothetical. As such, this presentation should not be relied upon for investment or other financial decisions, and no such decisions should be taken on the basis of its contents without seeking specific advice. WTW does not intend for anything in this presentation to constitute “investment advice” within the meaning of 29 C.F.R. § 2510.3-21 to any employee benefit plan subject to the Employee Retirement Income Security Act and/or section 4975 of the Internal Revenue Code.

WTW is not a law, accounting or tax firm and this presentation should not be construed as the provision of legal, accounting or tax services or advice. Some of the information included in this presentation might involve the application of law; accordingly, we strongly recommend that audience members consult with their legal counsel and other professional advisors as appropriate to ensure that they are properly advised concerning such matters. Additionally, material developments may occur subsequent to this presentation rendering it incomplete and inaccurate. WTW assumes no obligation to advise you of any such developments or to update the presentation to reflect such developments. In preparing this material we have relied upon data supplied to us by third parties. While reasonable care has been taken to gauge the reliability of this data, we provide no guarantee as to the accuracy or completeness of this data and WTW and its affiliates and their respective directors, officers and employees accept no responsibility and will not be liable for any errors or misrepresentations in the data made by any third party.

This document may not be reproduced or distributed to any other party, whether in whole or in part, without WTW’s prior written consent, except to the extent required by law. Unless WTW expressly agrees otherwise. WTW and its affiliates and their respective directors, officers and employees accept no responsibility and will not be liable for any consequences howsoever arising from any use of or reliance on the contents of this document including any opinions expressed herein.

Views expressed by other WTW consultants or affiliates may differ from the information presented herein. Actual recommendations, investments or investment decisions made by WTW and its affiliates, whether for its own account or on behalf of others, may not necessarily reflect the views.