Having a strong set of investment beliefs, commanding organisation wide support and informing all investment decision making is one of the core attributes of best-practice investors.

Good governance is a key factor that distinguishes the world’s very successful asset owner funds.

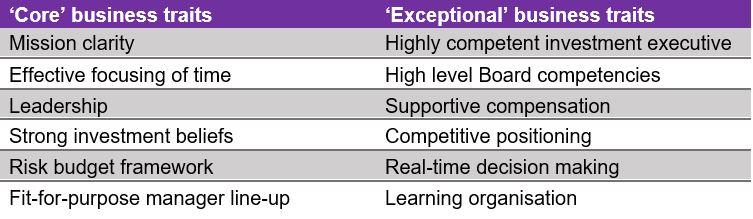

In 2007, Roger Urwin (Willis Towers Watson’s Global Head of Investment Content) and Professor Gordon Clark (Oxford University) conducted a landmark study of investment governance*. The study was carried out by examining ten exemplar funds which were selected on the basis of their reputations for strong decision-making accompanied by performance success. The key conclusion of the study was that strong governance is a critical requirement to allow organisations to achieve above average investment outcomes on a sustainable basis. The study identified 12 traits that are shared by the most successfully governed institutions. These are briefly summarised below:

* Best-practice investment management: lessons for asset owners from the Oxford-Watson Wyatt project on governance, Gordon L Clark and Roger Urwin, September 2007.

Our latest thought leadership series, Building Strong Foundations, addresses these 12 factors in turn.