The latest surprise from the Gary Gensler-chaired Securities and Exchange Commission (SEC) may cause companies to recraft their compensation discussion and analysis (CD&A) for the 2023 proxy. Its proposal last week to greatly expand what companies would include in their Dodd-Frank “pay versus performance” disclosure also would require an extensive disclosure of the many performance measures that are most important to companies. Requiring a tabular disclosure of pay measures would prompt companies to reassess how they present the details of their pay programs in their CD&As, so that some companies may decide that a more extensive or different pay discussion is warranted. As part of this reassessment, companies will need to determine how and whether to revamp their existing pay for performance disclosures, which may be viewed as less relevant to shareholders when they can review a more uniform, required table common to all companies.

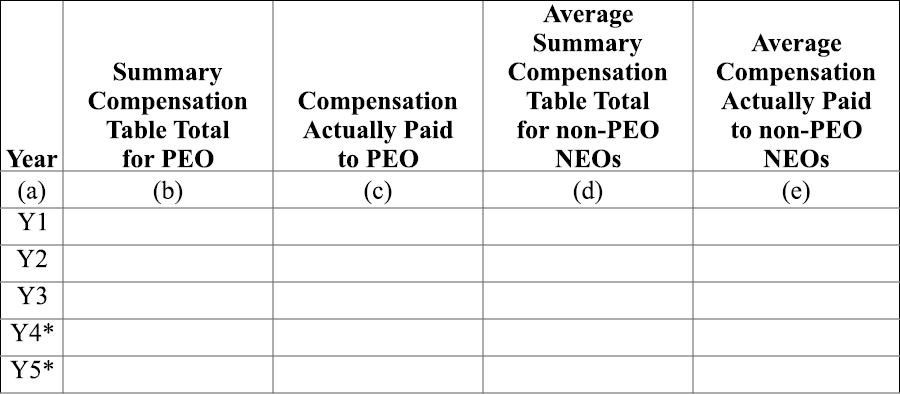

Technically, the SEC has reopened the comment period for the pay versus performance disclosures first proposed back in 2015. Not only would public companies need to provide a tabular disclosure of “compensation actually paid” to their CEOs/executive officers compared with absolute and relative total shareholder return (TSR), they would also be required to compare it with the generally accepted accounting principles (GAAP) metrics of “pre-tax net income” and “net income,” plus a “Company-Selected Measure” that represents the “most important performance measure used by the registrant to link compensation actually paid during the fiscal year to company performance.”

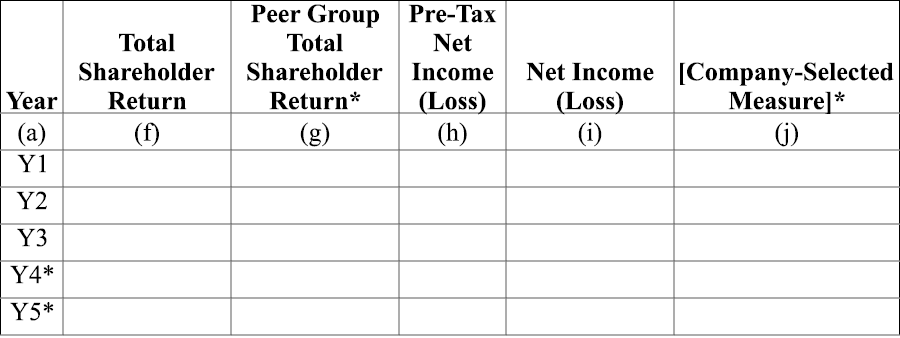

Further, the SEC is considering requiring a tabular disclosure listing the five most important performance measures that drove “compensation actually paid” as being useful to investors “related to the consideration of the registrant’s corporate performance and individual performance in the design of NEO (named executive officer) compensation required in the CD&A.”

Comments on this proposal are due within 30 days of when the proposal is published in the Federal Register, which signals the SEC has this proposal on a similarly fast track as the Rule 10b5-1 proposal issued at the end of 2021, with a strong possibility that calendar-year companies will need to include this disclosure on their 2023 proxy. This means companies will have a lot of work ahead of them to revisit their current pay for performance disclosures to sort through precisely how much information they will present to shareholder in their proxies.

How we got here

A brief and highly selective trip down memory lane recalls how we got here. Back in 2006, the SEC finalized a complete revamp about how executive pay would be presented on company proxies, with its major policy accomplishment (as touted by some commissioners at the time) being a single depiction of CEO/CFO/NEO pay as Total Compensation on the Summary Compensation Table (SCT). Rather than create a new regime for determining pay, the SEC instructed companies to value cash compensation as amounts earned during the year (roughly akin to FICA wages); for equity and pensions, it would look to existing GAAP measures of compensation. Equity grants would be shown on the SCT at the full grant date ASC 718 (FAS 123R, at the time) value, not spreading the value over the vesting/performance period as per the required presentation on company financial statements. There were compelling arguments to use this one-and-done approach to equity that, as companies soon came to understand, had some major downsides.

One of the most compelling was that showing the full grant date value of equity almost always would be a different value than the executives ultimately received, and many companies were left on the defensive to explain that fact to shareholders and then demonstrate they paid for performance. Within a few years, many companies would move to add a CD&A pay for performance presentation of “realizable pay” or “pay realized” compared with absolute and/or relative TSR (the definitional details of how each of these compensation measures is applied — a matter for a longer article). These calculations presented both the actual goals attained for performance grants and changes in share values from the grant date, better reflecting the true value of compensation granted to executives. Over time, these presentations became an expected part of CD&As, with proxy advisory firms embracing their use and seeking those depictions.

The enactment of the Dodd-Frank Wall Street Reform Act of 2010 overlapped this timeline. Section 953(a) required the SEC to require proxy disclosure of “information that shows the relationship between executive compensation actually paid and the financial performance of the issuer, taking into account any change in the value of the shares of stock and dividends of the issuer and any distributions.” However, the SEC did not propose regulations for this disclosure until 2015, well into the maturation of voluntary pay for performance disclosures, when it sought a tabular disclosure that compared CEO and average NEO SCT compensation (with some adjustments) and compensation “actually paid” to both absolute and relative TSR, over a five-year period. This was proposed as an additional tabular disclosure; the SCT and all other required tabular disclosures would remain unchanged.

No movement to finalize this proposal was made until last week.

More details on how to complete the table

We’ve synopsized the rules here underneath the table. The 2015 proposal includes extensive descriptions of how the mechanics of each of these calculations will work. We expect the final regulations to provide even more guidance.

- Compensation actually paid would continue to be defined as SCT compensation, excluding changes in pension value, with a different manner of valuing pensions and with the value of equity awards at vesting rather than when granted.

- CEO and the average of other NEO compensation would appear with both SCT values (columns [b] and [d]) and compensation actually paid values (columns [c] and [e]).

- Performance measures to be disclosed, in what we will call the “Pay vs. Performance Table,” would be the company TSR (column [f]); the TSR of the company’s peer group, as chosen by the company (column [g]); pre-tax net income (loss) (column [h]); net income (loss) (column [i]); and a company-selected measure.

- Five years of history would be required to be disclosed on the table. Small reporting companies must show only three years. Exempt from the disclosures would be foreign private issuers, registered investment companies and emerging growth companies (EGCs).

- The five most important performance measures that drove compensation actually paid, in a separate tabular disclosure titled “Five Most Important Company Performance Measures for Determining NEO Compensation.” We call this the “Top 5 Table.”

A sea change or just an adjustment to executive compensation disclosure

The SEC’s proposal would ask companies to provide tabular disclosures with very different information than required under current rules, although we’ve noted that most companies already have vibrant pay for performance disclosures in the CD&As, either in prose or via tables and diagrams. This is because the CD&A instructions specify, as the SEC points out, that examples of material information to be included may include how executive compensation relates to company performance and what items of corporate performance affect compensation decisions and plan design. We would assume the SEC wants this information disclosed because it does not believe that existing disclosures are not sufficiently transparent for shareholders to compare pay for performance analyses across companies.

The new Pay vs. Performance Table, if mandated, will present both tactical and strategic considerations for companies.

- Selecting a measure for the Pay vs. Performance Table in year one is going to be a tricky proposition for many companies. We read the rule as requiring a disclosure of any measure the company selects, although the release does not yet clarify that this measure needs to be one that is used to determine executive pay. We assume that it will be defined more along the lines of “the most important measure used in determining executive pay,” or something similar, in that it would be difficult to argue that a measure is important that is not a performance condition in the pay programs. That said, two of the commissioners expressed optimism that companies would select an ESG measure as the most important company-selected measure, but we are not sure how that arises unless the company is in an industry where net income measures plus TSR performance drive a large portion of executive pay. In that case, perhaps picking an additional measure may be an exercise in judgment on how they portray themselves to the public.

For industries where pay earned is driven by financial measures outside of net income and TSR, the decision about “most important” could have many layers. We don’t expect the SEC to mandate that this determination be made mathematically (e.g., greater than 50% of pay is driven by this measure), which would seem out of character for an SEC that previously has permitted companies to make materiality choices on their own. And companies tend to have a few key metrics that, when balanced, they believe should be the focus of executive attention. We are betting this determination will be a matter of judgment.

This raises a bunch of considerations, in that whatever is selected as “most important” is going to drive shareholder perceptions of company success, at least as it pertains to executive pay. A threshold question will be how does a company in a competitive industry try to forecast what its peers will determine is the “most important” measure? A company could be at risk of being considered an outlier compared to its peers if it chooses wrong, which will mean it needs to have very specific and detailed discussion about why it made the choice it did.

Another question is: How will companies reconcile the fact that the measure “most important” in their CEO pay programs may not align with that in their pay programs for other NEOs. The SEC mentions this as a question it will need to resolve in its final rules.

- Pay program and disclosure changes in year two and beyond will create other questions. The SEC has not yet determined how frequently companies will be permitted to change the disclosure of their “most important” measure. Not permitting annual flexibility means that disclosures might not be able to follow the actual pay plan designs, in that executive pay programs can be malleable from one year to the next. Perhaps the SEC will only permit changes in the measure where the pay program designs change materially, which could mean that a company that wanted its disclosed “most important” measure to change would need to make a significant enough change to trigger materiality. Remember, the table includes a five-year history, so there will be interpretive questions for the SEC to resolve for companies that switch and how they would present their five-year history after a change.

In the near term, companies that learn after the first year of disclosure their pay program design is out of step with that of their peers may move more quickly to recalibrate their plans simply to blend in better with the herd. Other companies whose plans differ from those of their peers may decide to hold the course with their plan designs if and until their pay versus performance results change, in which case they may feel pressure to change their measures. What remains unclear is how shareholders will view companies where metrics change frequently from year to year. We think, as with most pay for performance questions, if the company is being proactive to calibrate their approach and is successful, all is good. But we could foresee proxy advisors creating a rule advising that serial changes are frowned upon if they don't have a positive impact on pay for performance.

In the longer term, these new disclosure rules will provide shareholders, proxy advisors, academics and pay critics far more data to analyze about how different pay plans overperform and underperform compared with those of peers. If a consensus arises as to optimal pay program designs that reward pay for performance for a particular industry, perhaps this will push companies to more homogenous designs over time.

- The addition of a Top 5 Table reflects an even more aggressive SEC push for transparency that will provide shareholders a direct line of sight into what company pay plans truly focus their executives on achieving. While it is true that for many companies, the same information appears elsewhere — either in the Grants of Plan Based Awards Table and its footnotes and/or in the CD&A itself — the SEC appears to believe it is difficult for shareholders to tease relevant information on pay measures from them. The measures would now be in an easy-to-follow, single disclosure that would be required to have cross-references to those other sections of the proxy where more description is provided. It appears these are for all NEO pay, so that it may be a disclosure that mixes CEO pay measures with those for other NEOs, but the SEC will need to clarify this issue.

Populating this table is going to require a lot of thought, particularly where more discretionary metrics would make the Top 5. Based on commissioner statements in support of expanded tabular disclosure, our read is that the SEC wants to see whether companies have in place environmental, social and governance (ESG) measures that would make the Top 5 Table and is hopeful this will prove true. Companies need to be aware that the absence of ESG measures in this table may be viewed negatively by shareholders where peers already have them in place.

- Existing proxy depictions of pay for performance will need to be revisited, as will the entire question of how the proxy’s executive summary is written. Companies will need to decide if the Pay vs. Performance Table will become the de facto standard by which they can demonstrate pay for performance, or will it make sense to have several depictions, including their current realized or realizable pay disclosures.

Proxy advisors will also help drive this decision and have previously endorsed companies using realizable pay. In the short-term, we think that companies will still need to provide a consistent disclosure from year to year about how they attained pay for performance, so we don’t think these disclosures will disappear in the short term. Over time, as users are presented with easy to digest electronic data from the Pay vs. Performance Table (the SEC proposal requires that each element of the table is tagged electronically using the Inline eXtensible Business Reporting Language (Inline XBRL)), we would anticipate there will be a meaningful opportunity to undertake rigorous analyses of whether pay programs are delivering the results they promise. Whether this means realizable pay analyses are less necessary will be influenced by how shareholders and proxy advisors continue to measure pay for performance.

A more immediate question for 2023 will be how companies will assimilate the new tabular disclosure (it will appear at the end of the current tabular disclosures) with their pay for performance arguments in either the executive summary or a separate section of the CD&A. Our initial take is that many will consider whether to transpose these tables, in part or in whole, to the start of the CD&A, although how this can be best accomplished will require a lot of work. Also, companies will have to consider whether using the Top 5 Table earlier in the CD&A as a template for showing goal attainment for the pay measures disclosed will make sense.

Immediate action steps

Our view is the SEC seems eager to get this disclosure finalized, and we would anticipate this disclosure will be required for at least calendar-year companies in their 2023 proxy. It is not unheard of for the SEC to move even sooner for fiscal-year companies, wherein they establish an effective date for the disclosure for proxies issued after a date certain. We wouldn’t venture a guess on what that date might be. The upshot is that companies need to start planning for the disclosure now.

We mentioned many of these issues above, but here is a quick reference on what to do now:

- Model the Pay vs. Performance Table for 2021 based on the proposal: This will prove a useful exercise, both in understanding how the rules will work and in anticipating how to determine the “most important” measure. It may be too early to discuss with the compensation committee what they might think is the proper measure to use in the table for 2023, if required, so consider modeling the table with those measures that might be in play. This model should include the five-year history, as well.

- Create a Top 5 Table: Similar exercise as for 1 (above), list the five most important company performance measures for determining NEO compensation. The rules will seek a cross-reference to where those measures are discussed elsewhere, so charting those appearances may be useful.

- Start thinking about existing pay for performance depictions: We discussed above some of the myriad challenges in assimilating existing pay for performance disclosures along with this new pay versus performance tabular disclosure. This will be an important exercise to think about now.

A version of this article appeared in Workspan Daily on February 10, 2022. All rights reserved, reprinted with permission.