How to integrate sustainability metrics into portfolio management

This can be achieved by integrating sustainability or non-financial (ESG) factors into the investment process. In short, we expect an investment process that integrates sustainable and financial factors to outperform one that doesn’t over the long term.

Over the last few years, there has been a growing number of voices which have stressed the importance of incorporating sustainability into the investment process. The Principles for Responsible Investment (PRI) in its jointly published 2015 report on fiduciary duty noted that “failure to consider long-term investment value drivers, which include environmental, social and governance issues in investment practice, is a failure of fiduciary duty”. In 2017 the G20’s Taskforce for Climate-related Financial Disclosure (TCFD) made an important call for greater disclosure of climate-related exposures, both from companies and from investors themselves.

Most recently, the UK Commons Select Committee has written to the top 25 UK pension funds to ask how they will be managing climate-related risks. Proponents like these have resulted in the subject of sustainability gaining greater traction with investors in general. According to the Global Sustainable Investment Alliance’s (GSIA) 2016 review, there is now US $22.89 trillion of assets professionally managed under responsible investment strategies.

There are many investment institutions that want to incorporate sustainability into their portfolios but struggle to do so. While sustainability can be assessed based on the impact of trends on industry and societal value, the potential range of investment actions that can be taken is also complex and demands holistic thinking. For example, how to connect the short- and long-term horizons, how to connect the financial and extra-financial (for example, ESG factors) or how to integrate risk and uncertainty.

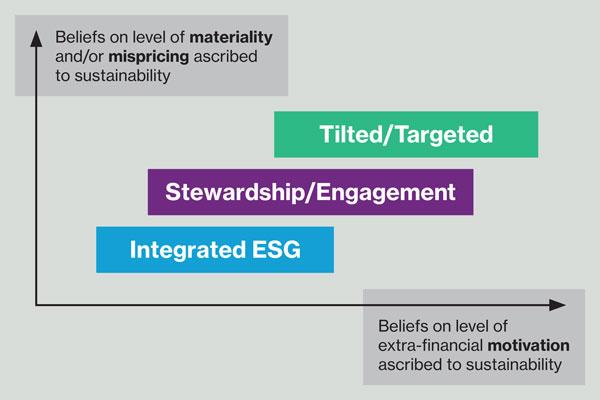

As part of our joint paper with the PRI entitled ‘Responding to megatrends’ published in December 2017, we suggested a practical solution to this hitherto intangible problem by considering the sustainability beliefs of investment institutions. We believe investment institutions should assess their positioning over the two strategic dimensions of motivation and conviction. See Figure 1.

Source: Thinking ahead institute

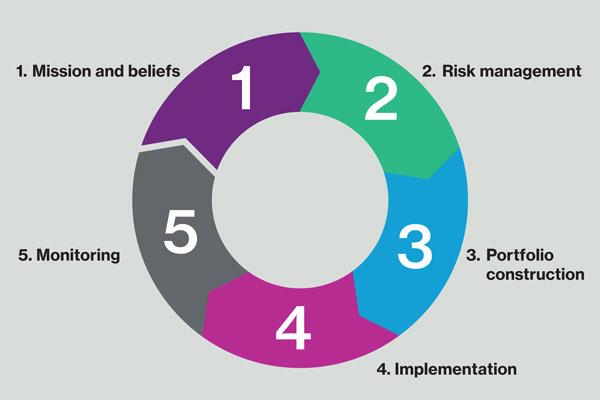

Sustainable investment principles apply to every stage of the investment process. It is worth noting that our broad use of ‘sustainable’ refers to investments that deliver returns that can be maintained over the long term, rather than narrowly defined green investments. For example, this encompasses assets resilient to the impact of climate change. Yet also includes assets which provide returns that are sustainable in light of other sources of change, such as societal (demographics and inequality) and technological change, as well as resource scarcity. We set out below how we believe sustainable investing can be factored into the investment decision-making process for asset owners.

In summary, given the increased research and coverage of investing sustainably, we believe an investor, including pension funds, will become more motivated and engaged in this topic. This should lead to better managed portfolios and the identification of investment opportunities as the market develops in this area. Being at the forefront of these changes will be beneficial for investors.