Deficits, dividends, deals, and deaths: pension disclosures in FTSE350 companies’ accounts

Welcome to the ninth Willis Towers Watson report discussing the impact of defined benefit (DB) pension schemes on FTSE 350 company accounts.

This report is based on the published disclosures of 95 FTSE 350 companies with defined benefit pension liabilities reporting at 31 December 2019. These companies comprise around 75% of all FTSE 350 DB pension obligations.

Unlock More

Executive summary

Uncertainty associated with Brexit was to the fore during 2019, reversing some of the past improvements in funding, reflecting falling bond yields only partially offset by rising asset values.

Towards the end of 2019 the Pension Schemes Bill was published, containing new powers and sanctions for The Pensions Regulator (TPR), and proposals on changes to the RPI were raised.

This is the background against which companies prepared the pension numbers in their 2019 accounts. This report analyses what they disclosed.

However, COVID-19 and the associated economic crisis could potentially have a much larger impact on pension schemes and so we also look to examine the impact felt in the first half of 2020.

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DB Pension Scheme Report 2020 | 1.7 MB |

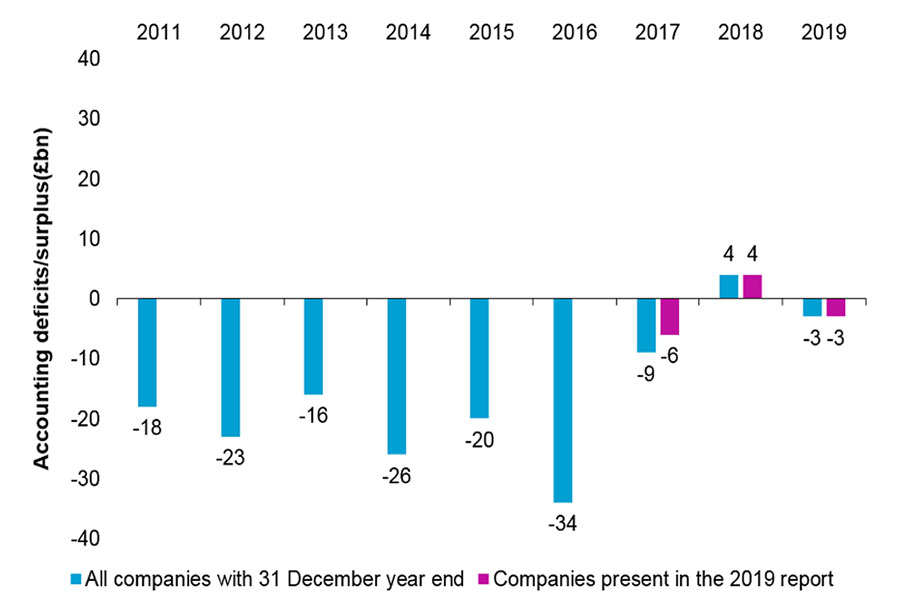

After a sustained period of improvements, aggregate funding positions on an accounting basis declined marginally over 2019, from an aggregate surplus of £4 billion at the end of 2018 to an aggregate deficit of £3 billion by the end of 2019.

As a result the percentage of FTSE 350 companies reporting a surplus on an accounting basis dropped from 43% in 2018 to 39% in 2019.

Note: Data prior to 2018 is from past reports, matching the December year end for each year.

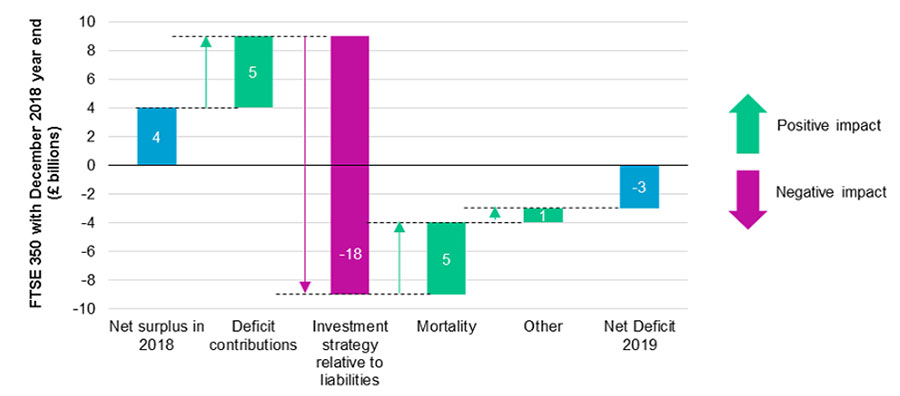

The change in accounting position was primarily due to a mismatch between the performance of scheme assets and changes in the bond yields used to calculate pension liabilities: 2019 was not a year to be ‘on risk’.

This was only partly offset by deficit contributions, falling inflation expectations, and lower assumed life expectancies.

For all FTSE350 companies, we estimate that March 2020 saw an aggregate deficit of £76bn turn into a surplus of £47bn in the space of 10 days, as corporate bond yields rose: counterintuitively, the market turmoil which saw asset values plummet was good for funding levels, at least from an accounting perspective.

However, as corporate bond yields reverted to their continuing downward trend through Q2 2020, large accounting deficits returned, reaching £47bn by 31 July 2020.

Yet the story of deteriorating accounting positions hides the wide swings and volatility seen across 2019, with Brexit uncertainty to the fore.

This was magnified, significantly further in 2020 with the impact of COVID-19 and the associated economic uncertainty.

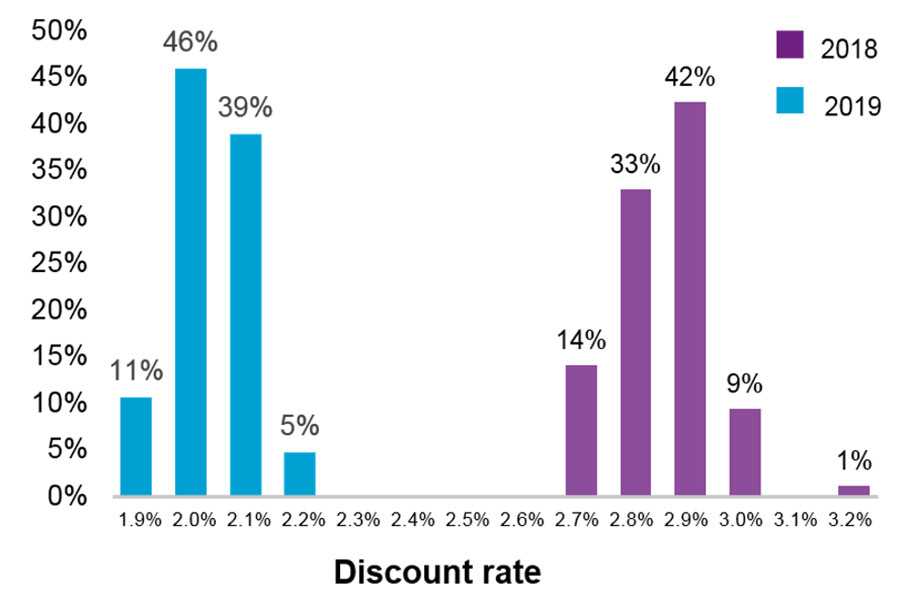

Discount rate assumptions fell sharply during 2019, from an average of 2.81% in 2018 to 2.00% in 2019.

Note: Data from December 2019, versus the data from December 2018.

This would typically increase pension liabilities by around 15% and was the primary driver of deteriorating accounting positions amongst FTSE 350 companies.

Yet 2020 has seen even more pronounced movements in liabilities due to moves in corporate bond yields (which shape the discount rate assumption).

In early March 2020, yields hit record lows. However, within two weeks corporate bond yields spiked sharply, with the credit spread doubling, shrinking liabilities.

Over the past couple of months corporate bond yields have fallen further, setting fresh record lows, and leading to accounting positions deteriorating again.

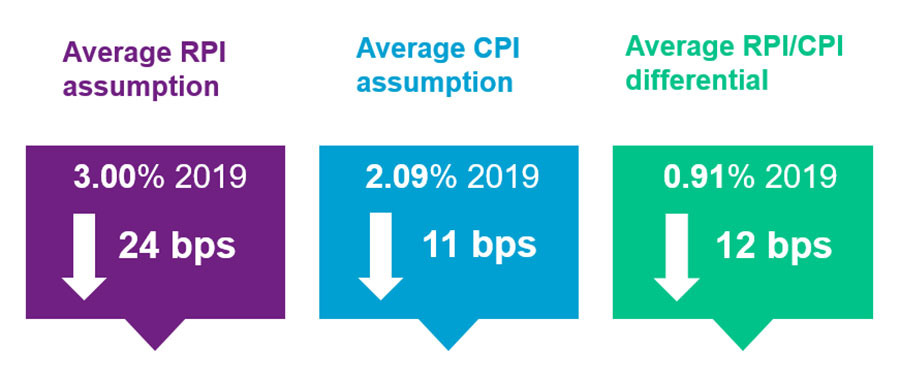

In September 2019, the UK Statistics Authority announced plans to align RPI with CPIH. It can do this unilaterally from 2030 but would need the Chancellor’s consent to make the change any earlier. A consultation on when between 2025 and 2030 this should be permitted is due to close on 21 August.

Note: data of December 2019. versus the data of December 2018.

Hence, the narrowing of the gap in assumed RPI and CPI figures likely reflects some (initial) anticipation of potential changes to RPI.

Source: RPI and CPI market price 15 year swap rates

The moves seen in RPI expectations will though reflect both a period of ‘no change’ in the earlier years and a bigger change later on – at least after 2030.

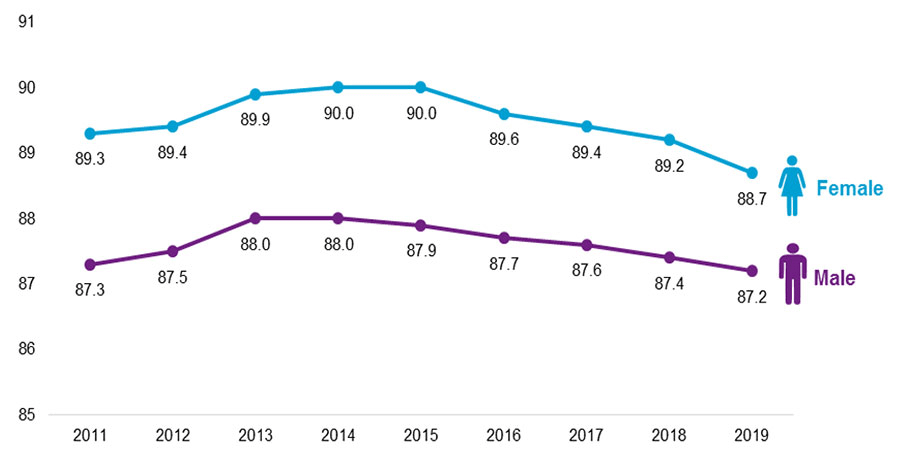

Life expectancies disclosed for scheme members reaching the age of 65 peaked in 2014 (88.0 for men, 90.0 for women) and have fallen every year since then. 2019’s accounts incorporated further reductions: 6-in-10 companies have reduced their future life expectancy assumptions (for a 65 year old male).

On average, life expectancy assumptions for a member reaching age 65 fell 0.2 years for men and 0.5 years for women, with life expectancies of 87.2 and 88.7 respectively.

Note: Data prior to 2018 is from past reports, matching the December year end for each year.

Sadly, the COVID-19 pandemic means that fewer scheme members will remain alive at the end of 2020 than had been anticipated. The Continuous Mortality Investigation estimates that, by the 24 July 2020, the number of UK deaths registered was around 62,000 more than if mortality rates had remained at 2019 levels. Pension scheme members are, however, more likely to belong to socio-economic groups where the effect has been smaller.

Viewed as a one-off event, 2020’s high death count should not have a large effect on pension scheme liabilities. However, changes to assumptions about how long member will live in the future could have a more material effect on liability estimates – both because there are many more of these members and because they are typically younger.

These assumptions may in time be affected as evidence emerges about the longer term effects of the coronavirus – from enduring medical effects on people who have recovered, to the backlog of untreated illnesses, and to economic and behaviour changes.

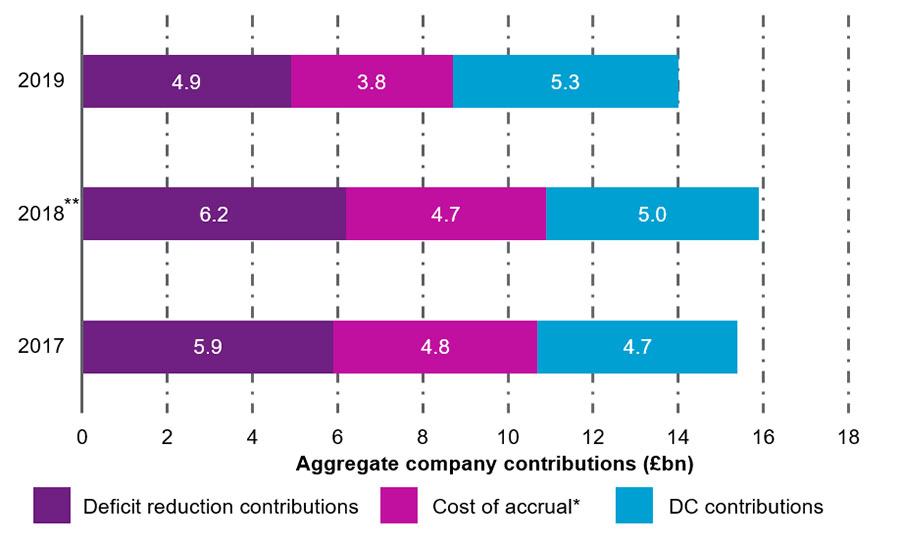

Not all companies disclose how much they pay in deficit contributions, but we derive an approximate estimate by deducting service cost from total contributions to DB plans. On that basis, deficit contributions in 2019 totalled £4.9bn.

Note: Shown for companies with data in 2017, 2018 and 2019.

*This has been estimated based on the service cost.

**RBS paid over £2 billion DRCs in 2018

This is a decline in aggregate (with fewer very large one-off payments), but ‘typical’ deficit contribution payments are little changed.

In a change from previous years, these payments in respect of past promises were smaller than the aggregate value of employer contributions to the defined contribution plans that most employees are now in (£5.3bn), even though companies which have only ever offered DC plans are excluded from the analysis.

We have also seen a decline in contributions paid towards the cost of further DB accrual, suggesting DB membership numbers are falling even if closures have stalled.

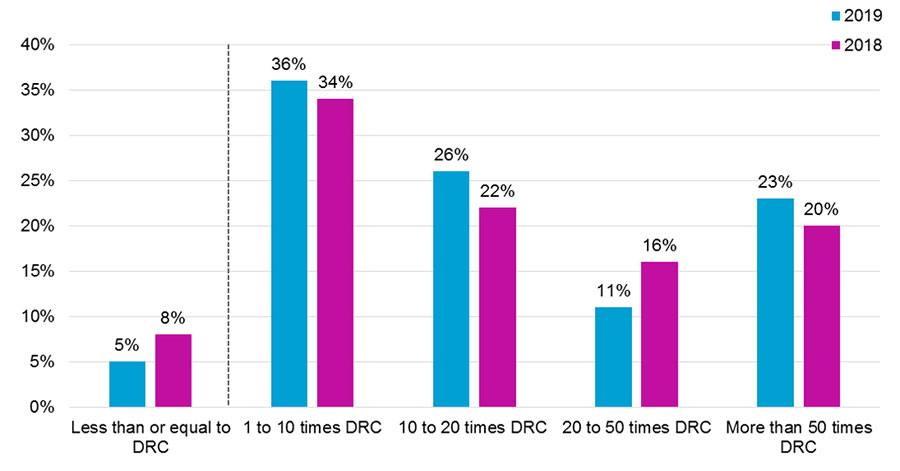

Of those companies paying deficit contributions in 2019, only one in 20 paid deficit contributions that were at least as big as their dividends – although that is perhaps understandable for this group of large, global companies. Nevertheless, we expect these ratios to change significantly in 2020 – not because deficit contributions will rise, but because they should fall by less than dividends do.

Note: Shown for companies making DRCs in 2018 or 2019

Since the onset of the COVID-19 pandemic, many companies in the FTSE350 have stopped shareholder distributions before they have contemplated renegotiating pension payments.

Looking at the FTSE350 as a whole, roughly 40% of companies cancelled, cut or suspended dividends in March and April 2020.

Meanwhile, the Pensions Regulator says that around 10% of DB scheme sponsors (not just those in the FTSE 350) have agreed a suspension of deficit contributions with scheme trustees, though this number may yet increase.

The Regulator says trustees should make dividend suspension a red line when agreeing to contribution deferrals and that dividends should not resume until deferred contributions have been paid.

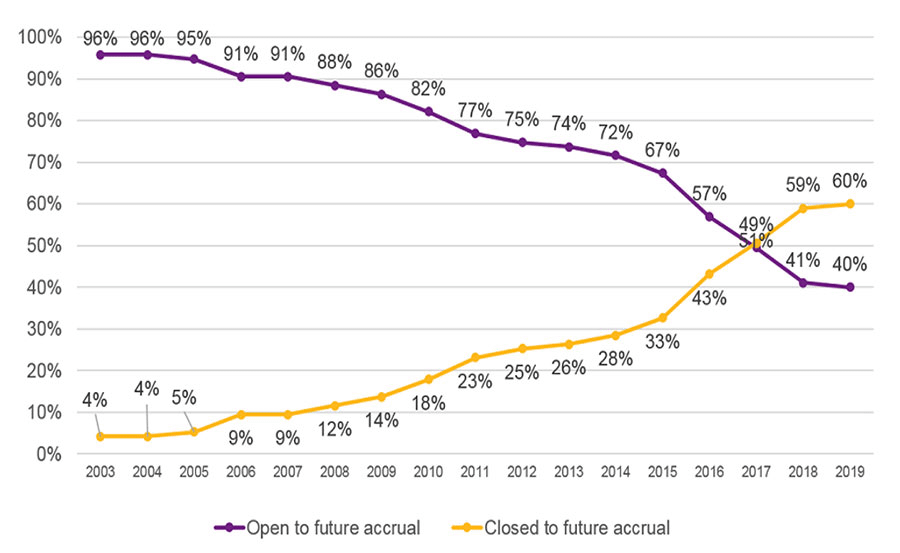

The proportion of defined benefit plans still open to future accrual barely moved in 2019, falling from 41% to 40%. It had previously fallen sharply; as recently as 2014, 72% had (some) members still accruing DB pension benefits.

Note: Shown for companies making DRCs in 2018 or 2019

In some cases, DB plans remain open to accrual because the sponsor has no choice (for example, where conditions were guaranteed on privatisation); in others, the tiny number of active members means that closing a scheme may appear not worth the efforts involved.

But, for a number of companies, the financial strain caused by the coronavirus pandemic will put closure firmly back on the agenda as a cost-saving measure.

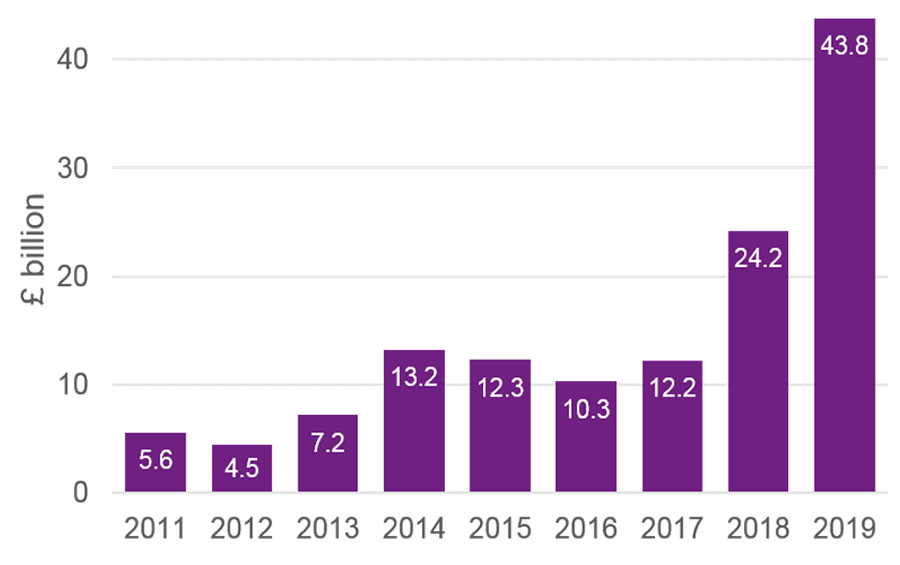

2019 was a record year for bulk annuity transactions with £44bn of pension liabilities secured. FTSE 350 companies accounted for around half of this activity.

In 2020, wider credit spreads during the early stage of the coronavirus crisis contributed to attractive bulk annuity pricing and already there have been a number of transactions both in Q1 and during lockdown in Q2.

The aggregate value of bulk annuities to date in 2020 is, though, down on the previous year (largely because there were not the same number of very large deals).

A single deal in January 2020 saw the second biggest longevity swap ever, with pension schemes sponsored by Lloyds Banking Group reinsuring £10bn of longevity risk. This was not far short of the total amount of liabilities subject to longevity swaps in 2019 (£12bn).

Pricing has now weakened (with narrowing credit spreads) but activity is expected to continue in 2020 and pricing may improve again later in the year as the year-end approaches.

Accounting positions in the first half of 2020 have seen huge swings due to moves in equities and credit spreads (corporate bond yields reached record lows), and we expect volatility to be a feature of the rest of the year.

c60% of companies in the FTSE350 with DB plans cut dividends in March and April 2020. But only around 10% of all UK schemes have so far agreed suspensions or cuts to deficit contributions.

2020 has seen high levels of de-risking transactions, if not quite at the levels of last year. Pricing has now weakened, but potentially greater capacity for “end of year sales” in 2020.

Of those companies with DB plans still open to accrual, nearly half have already made dividend cuts in 2020, suggesting further cost saving measures may be required.

Pricing of RPI has fallen reflecting the broader economic environment and the potential for reform to RPI. But there is potential for further material falls in 2020 and 2021.

Possibly limited immediate impact on liabilities (c0.2%), as predominant effect felt at older ages. But could have more significant long-term effect on health of younger pensioners.

| Title | File Type | File Size |

|---|---|---|

| FTSE 350 DB Pension Scheme Report 2020 | 1.7 MB |