Sustainable investing is about long-term, finance-driven strategies that integrate Environmental, Social and Governance (ESG) factors into the investment arrangements, utilise effective stewardship and have a real world impact. We believe that investors who incorporate sustainable investment practices into their arrangements will likely improve portfolio risk and return outcomes over the long term, and academic evidence supports this view.

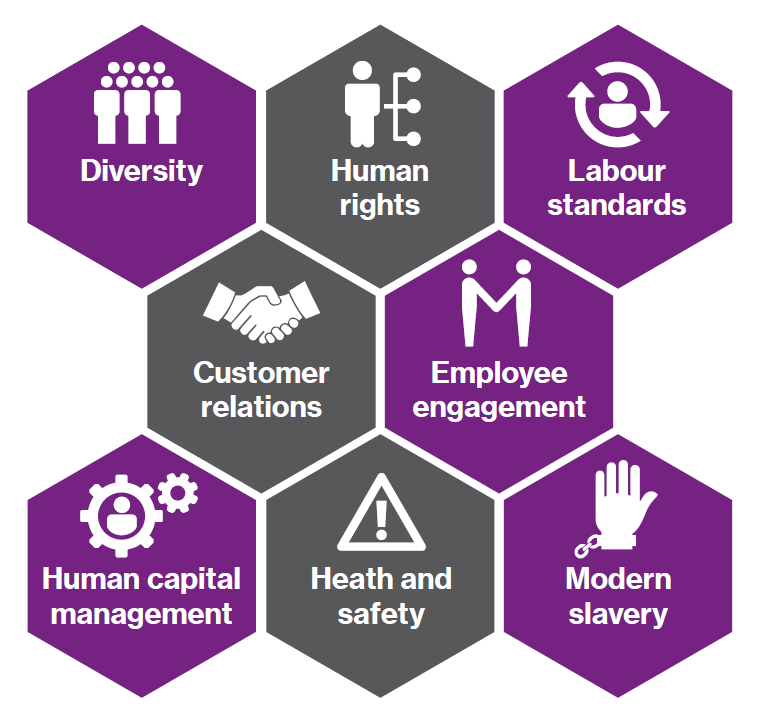

Social factors include topics ranging from employee engagement and customer satisfaction to human capital management:

Historically investors have often focused more on environmental and governance factors, partly due to the challenge of quantifying and measuring social factors. However, the COVID-19 pandemic and the Black Lives Matter movement have led to increased attention on how companies manage social issues, ranging from health and safety to human rights and labour standards. In addition, investors are now better understanding how these issues present clear financial risks and are therefore engaging further in this area.

We believe that investors who integrate ESG factors such as modern slavery into their investment process can improve portfolio resilience by identifying sustainability-related risks and opportunities and then taking action through their portfolio holdings and stewardship activities.

In this paper we focus on the following:

This page contains links to certain historical documents which were issued by Willis Towers Watson (WTW) as at the date specified on each linked document, in relation to the products offered by WTW. WTW believes that it is useful to investors to retain these documents on our website, for your information and reference purposes. Each such document was assessed as being compliant with prevailing regulatory requirements as at its date of issue, including that its contents are fair, clear and not misleading. Given that these documents were issued as at a specific point in time, WTW does not believe it would be appropriate to retrospectively amend those documents. As a result such documents have not been reviewed in light of any subsequent regulatory guidance or market practice including the FCA’s anti-greenwashing guidance (FG24/3). Any persons accessing this page, and the documents made available on this page, should not seek to rely on such documents and should use them only for information or reference purposes. Any investment decision should be based exclusively on the formal offer and subscription documents for the relevant investment product, and not these historical documents.

| Title | File Type | File Size |

|---|---|---|

| Sustainable investment practices | .5 MB |