In the first five months of 2021, the Financial Conduct Authority (FCA) reported that over £2m had been lost to pension scammers. That may just be the tip of the iceberg; victims are often reluctant to report that they have been scammed, or only realise it years later.

Members of pension schemes need the help of trustees, employers and the wider pensions industry to help them to make informed decisions.

It’s not only something as serious as pension scams which can take savers off-track at retirement. Most people have little knowledge of pensions and are often left to their own devices to make one of the most important financial decisions of their lives.

Sub-standard decisions can be costly and often irreversible, so it’s not surprising that so many pension savers worry about making the wrong decision. Once a defined benefit (DB) pension has been put into payment at retirement, or an individual with defined contribution (DC) savings has chosen to purchase a lifetime annuity, that decision cannot be changed.

According to Which? an estimated £1bn of pension annuity outcome is lost every year because people are not shopping around. Comparing annuity rates from different providers can provide a boost of up to 20%. If someone is eligible for an enhanced annuity, due to health or lifestyle factors, it could increase their pension income by up to 50%.

Shopping around will be just as important for those who choose to go into income drawdown at retirement. The FCA’s Retirement Outcome Review found that choosing an income drawdown provider with lower costs could boost pension income by up to 13%.

However, choosing an income drawdown provider is just one part of the puzzle. Deciding how much to withdraw and when, and choosing an appropriate investment strategy, will be crucial to ensure a pension income is sustainable throughout an individual’s lifetime. Those decisions need to be reviewed regularly, too.

In 2019/20, the FCA found that withdrawal rates in the first year of drawdown were often double what is widely considered to be sustainable. 42% of pensions withdrawals were 8% or more, and large withdrawals were particularly prevalent among those with smaller pot sizes.

The FCA also found that one-third of non-advised consumers – so those who hadn’t taken advice or guidance at the point of going into income drawdown – held their pension in cash or cash-like funds, raising concerns that poor investment decisions will lead many to lose out in retirement.

All in all, the data shows that we are sitting on a retirement time bomb. What can pension schemes and the wider industry do to help?

Investment pathways were launched in February 2021 to help DC savers choose an investment strategy for their pensions. The pathways allow DC retirees to choose from four scenarios to best describe their plans for the next five years. Do they plan to withdraw all their money, buy an annuity, leave the full amount invested or make annual withdrawals to meet their income needs?

Whilst investment pathways might help with the FCA’s goal to move away from cash defaults, many retirees from both DB and DC schemes will still need help with their options and deciding which route is right for them. So, how can schemes help?

One option is for schemes to facilitate financial advice or guidance, to make sure that members make the right decision for their circumstances.

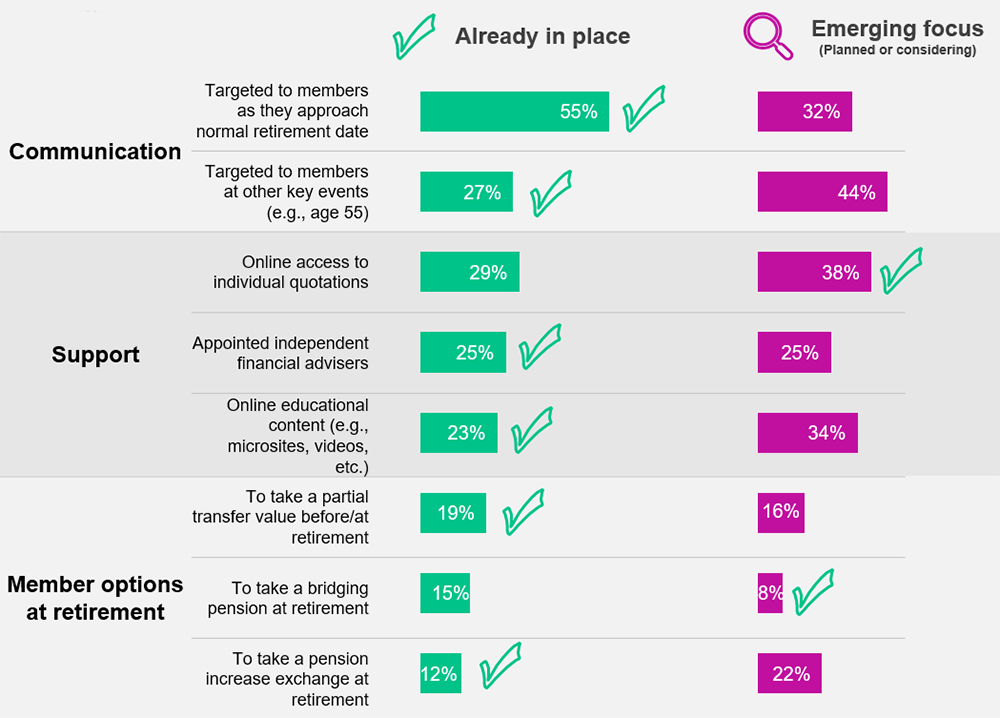

WTW’s 2021 Emerging Trends in DB Pensions Survey found that 25% of schemes already have an independent financial advisor (IFA) in place and a further 25% have this as an emerging focus. This is a great step forward. But although employees, employers and trustees are often told they are best placed to help members to access this support, some are still reluctant to do so and feel it is overstepping their remit.

Further results from our survey with actions already taken place and those with emerging focus.

Unlock More

Three points to consider before putting an IFA in place

Research shows that people learn in different ways. Broadly, only 30% of people learn through reading, so providing communications in just a written format will only work for a minority of your membership. Many schemes still only use paper communications but there is a growing trend towards online to recognise the benefits of a more diverse communications strategy, alongside the benefits from a sustainability perspective. Online information can be provided in video format for visual learners, and in play form – such as retirement tools – for kinaesthetic learners. A good mix of these styles will achieve the best engagement and inform decision-making.

Consider all your members, including those for whom English isn’t their first language, and the 7 million people in the UK with dyslexia, and deliver information in ways that work for them.

How people will engage with content will depend on their learning styles.

Brain segment sizes are not proportional.

To empower people to make retirement decisions, it’s important to get them thinking about it five to ten years beforehand. Schemes could use a mixture of online tools, videos and webinars to have the best chance of engaging people.

But even when people receive that kind of help, they’re still likely to want to speak to someone to make sure they fully understand their options. We've also seen some pretty compelling results when it comes to offering individual guidance at the point of retirement.

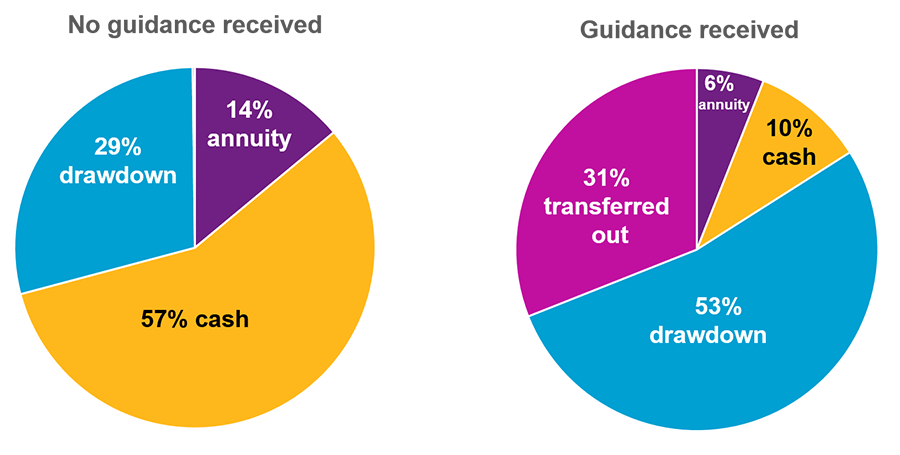

As a case study - WTW recently worked with a large financial services organisation who wanted to offer individual guidance to all of their retirees. The guidance is supplemented by an annuity broking service and default income drawdown provider which has been selected by the trustees. The take up of the guidance service has been strong. So far, WTW have given guidance to around 300 retiring members, which is around 40% of the retiring population. And we're seeing some quite significant differences in the retirement decisions made by those individuals in the two groups.

Source: WTW case study with a large financial services organisation.

For example, annuity purchase was 8% lower amongst those who opted to use the guidance service. We also saw very few people with larger pot sizes opting to withdraw their pension funds in one tax year. This indicates that once they've benefited from the guidance service and understand the implications of large income withdrawals in one tax year, they are acting differently.

The member feedback has also been really great, with 97% giving positive feedback. We have also seen an increased level of confidence from employees, both in terms of the decisions being made and in their belief that they can now meet their retirement goals. The very strong feedback has reinforced the employer’s belief that there was a real employee need for additional support to improve retirement outcomes.

Members of pension schemes need the help of trustees, employers and the wider pensions industry to help them to make informed decisions. By communicating clearly and connecting them to people who can give them guidance or advice, pension schemes will give members the best possible success of maximising their income in retirement. Sometimes, people just need to speak to someone knowledgeable on a one-to-one basis; it’s worth thinking about how you could create that opportunity for your scheme members.

We hope the ideas in this article have given you some food for thought. If you’d like to discuss anything in more detail, please get in touch with your WTW consultant, or one of the authors listed below.