People move jobs – and for years, they have faced the difficult task of trying to keep track of the pension pots they have built up with different employers. It is all too easy to lose track of savings, as highlighted by the recent expansion of the government’s Dormant Assets Scheme. The losses mount up: people have misplaced or forgotten about pension pots worth an enormous £19.4 billion, according to the Association of British Insurers.

The good news is there’s light at the end of the tunnel for savers. Pensions dashboards are intended to help them to keep track of their pension pots. People will be able to log into dashboards and view all their pensions in one place.

With any kind of initiative of this magnitude, a huge amount of work needs to happen behind the scenes. Read this guide to find out:

“Pensions dashboards will enable individuals to access their pension information online, securely and all in one place, thereby supporting better planning for retirement and growing financial wellbeing.

Chris Curry | Principal, Pensions Dashboards Programme

Dashboards will fundamentally change how people find out about and engage with their pensions. There are three overarching design principles:

The concept of a dashboard has been around for a long time, and the idea is now becoming a reality.

After a procurement exercise in 2021, the Pensions Dashboards Programme appointed Capgemini and Origo to help us build the dashboard’s central digital architecture. This week, I saw a demonstration of the architecture which has been built. Good progress has been made, and the build will continue into the summer of 2022.

“The concept of a dashboard has been around for a long time, and the idea is now becoming a reality.”

Paul Noone, Head of Onboarding, The Pensions Dashboards Programme

In the summer of 2021, we signed up seven key pension providers to work with us throughout this part of the programme. Together with third-party administrators and software providers, they will help us to test the dashboard’s ecosystem and its ability to connect with pension schemes.

More recently, we have signed up three potential dashboard providers. They will help us to test the connectivity of dashboards and the user experience.

Working with our partners, we will move from the test environment into a private beta phase at the end of the summer of 2022. At that point, we will start working with other key organisations within the pensions industry to help them prepare to connect to dashboards. In particular, we are seeking early involvement from the key software suppliers from both the regulated and the trust-based world.

The DWP, the FCA and the FRC are all at various stages in the consultation process on the proposed requirements for pension schemes and dashboards. The next step will be to refine our industry standards after the initial testing period. We will consult with the industry on the detailed standards in 2022, and then they will be confirmed later in the year.

Getting ready for pension dashboards is a significant undertaking for pension schemes and the wider industry. We know this is a lot of work, but it is also a real opportunity – not just for savers to get a grip on their retirement savings, but also for the industry to tackle underlying data issues.

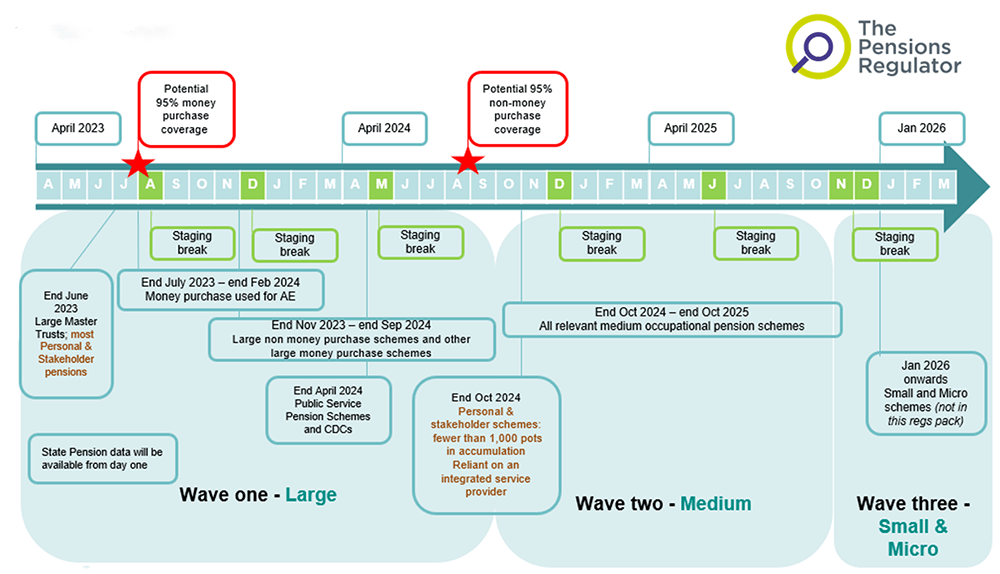

Source: The Pensions Regulator

The staging timeline has been developed with two principles in mind. The first is to get the vast majority of savers represented on dashboards, as quickly as possible, which is why the largest pension schemes are set to link up to the dashboards first. The second is to make sure that staging is done in a way that makes it possible to regulate the process smoothly and efficiently. TPR and the FCA must be able to process the schemes in terms of onboarding, compliance and enforcement.

“Getting ready for pension dashboards is a significant undertaking for pension schemes and the wider industry.”

Angela Bell | Industry Outreach Lead, The Pensions Regulator

At TPR, we are keen to ensure that we provide industry with the appropriate information and support and as you can expect we are planning a programme of communications and engagement. We are developing web content, webinars and tools, such as nudges (a behavioural economics technique which prompts people to change their behaviour – putting fruit at eye level in the supermarket, for example). We will be looking to start this series of nudge communications around a year in advance of a scheme’s staging date.

We will issue targeted communications which explain schemes’ duties clearly and signpost where to go for further support. These communications will be directed at trustee chairs: we will be asking them to nominate a key contact who is helping them to connect to dashboards. That is likely to be their administrator, software provider or possibly an integrated service provider.

TPR is bound by public law principles. Therefore, we need to be proportionate, targeted, consistent and reasonable in our approach. In terms of compliance and enforcement: we will be setting out our proposed compliance and enforcement policy for consultation in the summer of 2022. Schemes and the industry will have a chance to look at our proposed approach and to know what to expect.

We will be pragmatic where we see good intentions, but where we see deliberate non-compliance, we will be robust. We will be using our powers at our discretion and where appropriate, which will include compliance notices, third party compliance notices and penalty notices.

The Pensions Regulator’s door is open to schemes and the wider pensions industry. We are keen to understand the industry’s concerns and work together to find solutions.

“We will be helping our clients to identify overlaps, minimise duplication and maximise efficiencies.”

Jane Murray | Head of Transactions & Administration Solutions, WTW

Karen Dawson is data service delivery lead at WTW and Jane Murray is global head (non-North America) of WTW’s pensions outsourcing business.

Unlock More

Useful resources

Thank you so much for reading this guide. We hope it has given you a useful insight into how you can prepare for pensions dashboards now, as well as the work that has been happening across the industry to get dashboards ready. If you have any questions or would like to talk further about preparing for the dashboards, please contact your WTW consultant or one of the contacts below.