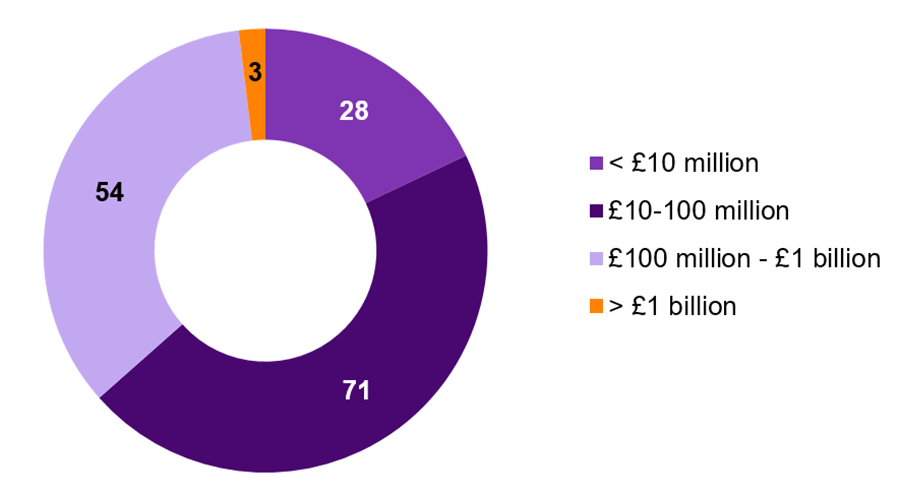

During 2021, 156 bulk annuity deals were written in the U.K. Worth nearly £30 billion, that takes total premiums since 2019 to over £100 billion. As we close out the first half of 2022, the strong activity continues and predictions of a further £35 billion in 2022 look achievable. With a daily trickle of articles in the pensions press on the latest deals, you’d think the market is all about several hundred million deals. However, that’s far from the truth - around two-thirds of the deals in 2021 were for plans less than £100 million in size, as shown in Figure 1.

Source: WTW (underlying data provided by insurance companies)

Favourable investment returns, attractive insurer pricing and a general improvement in the health of the corporate purse are some of the contributing factors to this uptick in activity for smaller plans.

Whilst there are accounting implications to carefully consider, for U.S. corporates, favourable exchange rate movements (particularly over the last year), the reduced reliance on the ERoA P&L credit generated by plans (as pension scheme assets have gradually been de-risked) and the fact that these (largely) legacy obligations are often small in the context of a broader multinational corporation have further added to the attraction of a full buyout of U.K. plans.

Despite the activity noted above, it’s only those well-prepared trustees and corporates of small plans who have been able to complete a transaction on attractive terms. Why is this?

Let’s start with the market… around three-quarters of U.K. defined benefit (DB) plans are actually less than £100 million in size1. This means there are potentially 4,500 schemes competing with your small scheme for the same insurer time, interest and pricing. This is a huge amount of competition even if only a small proportion of those schemes approach the insurance market each year.

Then, pose the question to an insurer of whether they would prefer the opportunity to bid for either a single £1 billion transaction or 20 smaller £50 million transactions - for most insurers, their response would be that the £1 billion transaction is a far more compelling opportunity. The larger deal has a much lower opportunity cost, tying up less scarce skilled resource, and it represents a significant step towards new business targets (albeit perhaps with more competition and therefore lower profit margins).

As a consequence, for small schemes, you run the risk of looking at limited competitive tension and, for the smallest of schemes, being asked for exclusivity before the insurer is even willing to give you a quote. Unfortunately this reduced competition will limit the extent to which price reductions can be negotiated and therefore the extent to which the price can be optimised.

Put simply, preparation is key. This is not “new news”. Insurers are far more likely to engage if you’ve completed all necessary due diligences, including cleaning data and getting your benefit specifications prepared and signed off. Combine this with a clear pricing target and a joint commitment from sponsor and trustee to make a transaction happen, and you can get the insurers engaged. Typically, this preparatory stage can take three to six months, but this will be time well spent if it ultimately leads to much greater insurer engagement.

Once the preparatory work is done, the aim should be to get as many insurers as possible to the table. One way of achieving this is via a packaged solution. These are designed to mitigate the above challenges via a standardised off-the-shelf process incorporating pre-negotiated legal contracts. With more insurers engaging because they understand the process and their costs are kept low, more attractive prices then follow. At WTW we have our Streamlined Bulk Annuity Service - we’ve used this to deliver 25 transactions with average premium of c£50 million over the last five years.

Even for the best prepared schemes that use a streamlined solution, trustees and sponsors of small plans may need to be flexible on timing – both when to approach the market and when to ultimately transact. It is always preferable to approach the market when the insurers are not swamped with multiple large transactions and scarce resource can be secured. That means appointing an adviser that has visibility across all segments of the market is key to getting the best outcome.

Just under a million people in the U.K. are still accruing benefits in private sector DB schemes2 - although this number is falling, and fast. You can’t buyout and wind-up a scheme that remains open to new pension accrual or one that has any other link to ongoing employment e.g., a pensionable salary link. This presents a real barrier to a number of schemes transacting a buyout. Therefore, the first priority for sponsors that wish to buyout their U.K. DB plan will be to curtail any future accruals; for most this will mean a minimum 60-day consultation period with affected members.

Further, whilst many schemes have seen their journeys to buyout accelerated over the last couple of years, for other schemes buyout remains a distant prospect without a significant cash injection. For these schemes, there are alternative, more achievable options that could be considered to manage cost and risk in the short-to-medium term, providing either a stepping stone to ultimate buyout or a real alternative end state.

So, if you have a small U.K. DB plan, are over 110% funded on your GAAP accounting basis and you’ve not recently considered a bulk annuity transaction, we suggest that now is the time to look into this. For schemes still in a GAAP deficit, you may want to start considering some of the new alternative options in the U.K.

Either way, the end game could be closer than you think.

1. Source: by asset size, the Pension Protection Fund’s Purple Book 2021

2. Source: the Pension Protection Fund’s Purple Book 2021

Towers Watson Limited (trading as WTW) is authorised and regulated by the Financial Conduct Authority in the U.K.

This publication was prepared for general information purposes only and should not be considered a substitute for specific professional advice. In particular, its contents are not intended by WTW to be construed as the provision of investment, legal, accounting, tax or other professional advice or recommendations of any kind, or to form the basis of any decision to do or to refrain from doing anything.

This publication is based on information available to WTW at the date of issue, and takes no account of subsequent developments. In producing this document WTW has relied upon the accuracy and completeness of certain data and information obtained from third parties. While reasonable care has been taken to gauge the reliability of this data, we provide no guarantee as to the accuracy or completeness of this data and WTW and its affiliates and their respective directors, officers and employees accept no responsibility and will not be liable for any errors or misrepresentations in the data made by any third party.