Royal Mail and the Communication Workers Union jointly engaged with Government in 2018 to enable the introduction of Collective Defined Contribution (CDC) pension schemes in the UK. The objective was to enable an alternative to existing defined benefit (DB) and defined contribution (DC) pension schemes, and seek to:

With the legislation required to establish CDC schemes completed earlier in 2022, and TPR having set out how it intends to authorise these schemes in its Code of Practice, we expect to see the Royal Mail CDC scheme open to accrual early next year. Moving beyond Royal Mail, the Government has plans to further extend the legislation to allow different types of CDC schemes to be set up, including multi-employer CDC schemes and CDC master trusts, with the first consultation on this expected later this year.

Our 2020 guide to CDC, provides an in-depth look at CDC. In light of the renewed interest in CDC, this article serves as a reminder of the key points and provides an update on some subsequent developments.

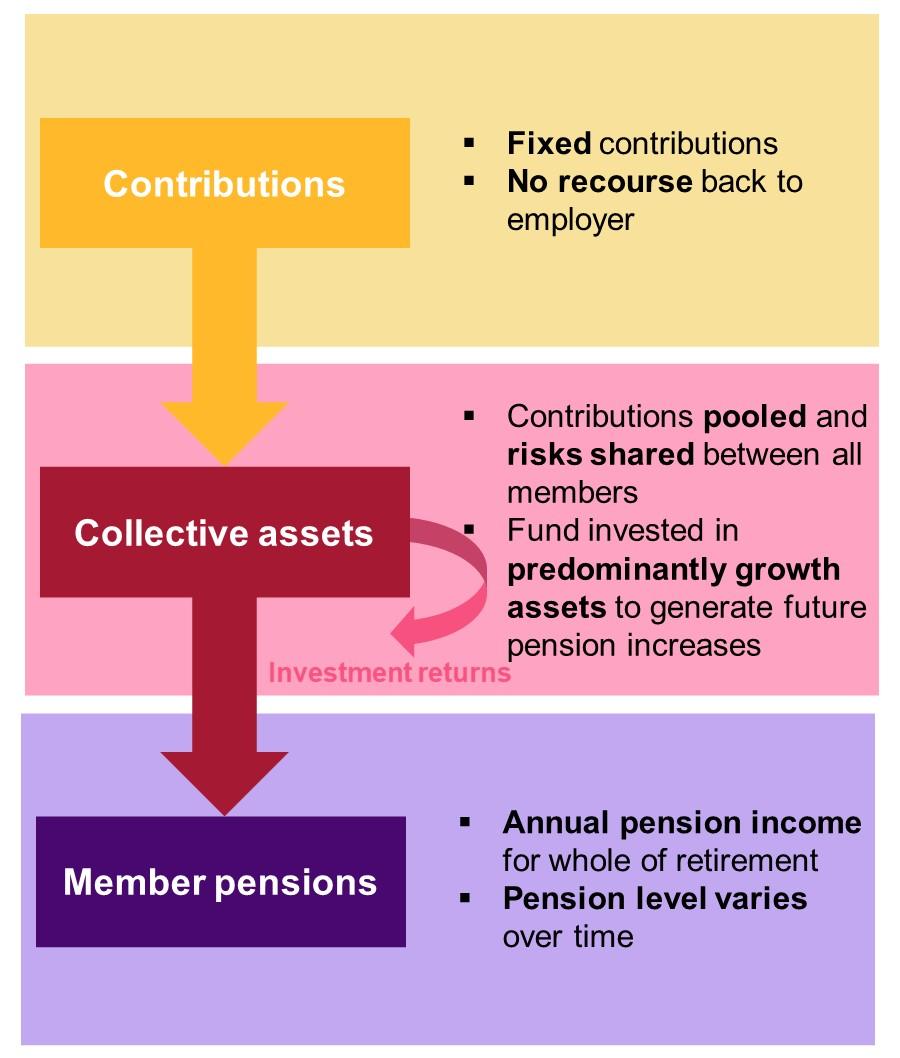

While CDC schemes share some similarities with individual DC schemes in that contributions are at a fixed rate, their collective nature means there are some key differences.

There are three key advantages of CDC schemes relative to existing provision through DB or DC schemes:

| Fixed cost | Higher expected pension | Income for life | |

|---|---|---|---|

| DB | No | No | Yes |

| DC – annuity | Yes | No | Yes |

| DC – drawdown | Yes | Yes | No |

| CDC | Yes | Yes | Yes |

CDC of course does not come without its challenges. The key challenges arise from the fact that the pension increases are variable – so that you could have higher increases, or lower increases, or maybe even a pension cut in any year. This can be mitigated by the design of the scheme - making sure that the expected pension increases are relatively stable, as well as distributed fairly across the generations and that there is a limited risk of pension reductions. Members must understand the nature of their benefit, how it works and that the benefit is not guaranteed. They must also be able to trust the scheme, that increases are awarded in line with the design and in a transparent manner and the increase they receive is appropriate. Therefore, great communication and governance would be vital to a CDC scheme, and indeed much of this is required through the Regulations that came into force in August this year.

Much of the turmoil in the market recently has highlighted the challenges faced by DB pension schemes that have adopted highly leveraged LDI strategies to manage the risks associated with providing guaranteed benefits. An LDI strategy would not be suitable for CDC schemes - CDC does not offer guarantees and so does not need to match cashflows with gilts or bonds - so would not be subject to the same pressures some DB schemes have faced in light of the rapid changes in gilt yields recently.

Additionally, in the current high inflation environment, a DB pension would typically have pension increases that are ‘capped’ in payment – CDC pensions are uncapped and therefore we would expect a higher pension increase to be paid out under current market conditions.

On the DC side, we noted earlier that annuities are looking better value than they have in recent history. However, we assess that a CDC scheme would still be expected to provide a higher pension level than provided by typical current annuity rates.

Considering income drawdown, recent falls in asset values will have made income drawdown less attractive because the overall size of pots will have fallen, and so individuals withdrawing a fixed percentage each year will see a fall in income just as inflationary pressures are increasing their spending needs. The trustees of a CDC scheme would typically take a longer-term view, and spread experience through pension increases, thus resulting in a smoother retirement income. An individual in drawdown would also likely need to hold back some of their pot against their uncertain future life expectancy. As a CDC scheme can pool this individual risk across many members, they can take a broader view and provide a higher ongoing level of income to each individual.

With a range of pressures currently facing pension schemes and their members, including rising costs and increased uncertainty about the future economic outlook, we believe CDC schemes will provide a compelling alternative to existing DB and DC schemes, allowing lower costs for companies and/or higher benefits for individuals, for the benefit of society as a whole. In time, we expect CDC provision to grow to have a significant presence in UK pensions.

If you would like to discuss any of these points, please contact your WTW consultant or one of our CDC specialists listed below.