In Jayesh Patel’s recent article on How companies can help DC pension savers with the rising cost of living he explored the ways in which employers and trustees can educate and protect DC pension savers during these difficult and uncertain times.

But it got me thinking; Do DC pension savers who reduce or stop their pension contributions to help with the current cost of living really know the true impact? What does this mean for them and their retirement? While there are completely understandable and legitimate reasons why someone might decide to cut back on pension savings, are individuals being given enough support to make informed decisions?

It is incredibly important that employers, trustees and individual pension savers understand the decisions available and the impact they have. We wanted to highlight what an employee could be missing out on and bring this to life with a pound and pence example.

So, what is a person giving up by reducing or stopping their pension contributions? This depends on a number of factors, such as age, salary, contribution design and investment choice. But there are some constants.

Mo is a 30-year-old earning £30,000 a year, hoping to retire at age 65.

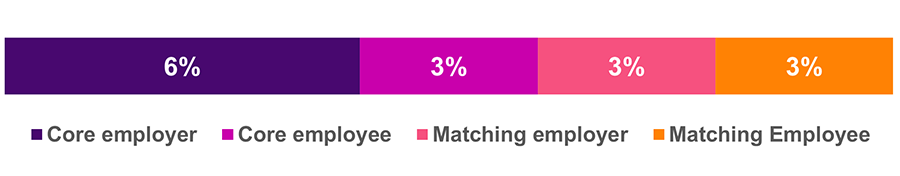

Mo’s pension scheme offers 6% core employer contributions and 3% core employee contributions. In addition, Mo’s employer contributes a further 3% of his salary, if Mo contributes an extra 3% too.

Up until now, Mo has always made the maximum matched contributions by salary sacrifice. However, with his outgoings increasing, Mo decides to stop his 3% matching contributions for the next year. What happens now?

* Calculated in today's terms assuming a 5.5% pa real return and 0.3% pa charges.

In summary: £600 extra income now could mean £10,000 less in Mo’s retirement savings at age 65.

Now, what if Mo were to forget to change his contributions back up or becomes more comfortable with the increased take-home pay? If Mo were to take five years to resume matching contributions this could cost him £45,000 in his retirement savings at age 65.

The Financial Conduct Authority certainly expects pension providers to be alert to the risks of employees reducing pension contributions, and ensure they take action to inform individuals; writing out to providers in December last year to set out their expectations in relation to the cost of living. A quick search of The Pension’s Regulator’s website also shows their concern at the current situation, with the warning to employers that “It’s important that people maintain their pension contributions, whenever they are able to, as stopping contributions could have a serious impact on their retirement living standards in later life.”

It’s clear that employers have an important part to play and that, right now, education is more important than ever. My colleague Frances Fourgeaud recently shared some of her engagement expertise on how to connect with employees in her article: More members can now save more today, tax-efficiently.

Employees need to understand, in simple, relatable terms, the consequences of cutting back on pension contributions. When times are tough financially, something often has to give. That’s why it’s important we educate savers about pensions and, just as importantly, wider financial wellbeing, so they can make the right decision for them. For example, cost saving tips and signposting employee discounts can help employees save on their everyday costs and boost the amount left for pension savings each month.

If an employee requests to reduce their pension contributions they need to be given clear, actionable support. And if they decide to go ahead and stop or temporarily pause pension contributions, an employer’s ability to help does not stop – instead they need to continue to engage ready for when it’s time to start pension saving again. It also makes sense for employees to be given regular opportunities to update their contribution choices, so that their pension savings can change as their circumstances change too.

If you would like to discuss how to engage with or support your employees with pension savings and/or wider financial wellbeing, please do get in touch.