London, 8 July 2020 – Private equity investments appear to be weathering the impact of COVID-19 across multiple sectors and geographies, according to the results of a study by Willis Towers Watson, indicating that despite a subdued environment for exit deals in the first six months of the year, there has been little evidence of forced exits.

The survey, which took place in April across 36 private equity funds, representing 300+ portfolio companies, was designed to better understand how businesses were coping as a result of the pandemic, as well as setting out expectations for the coming months.

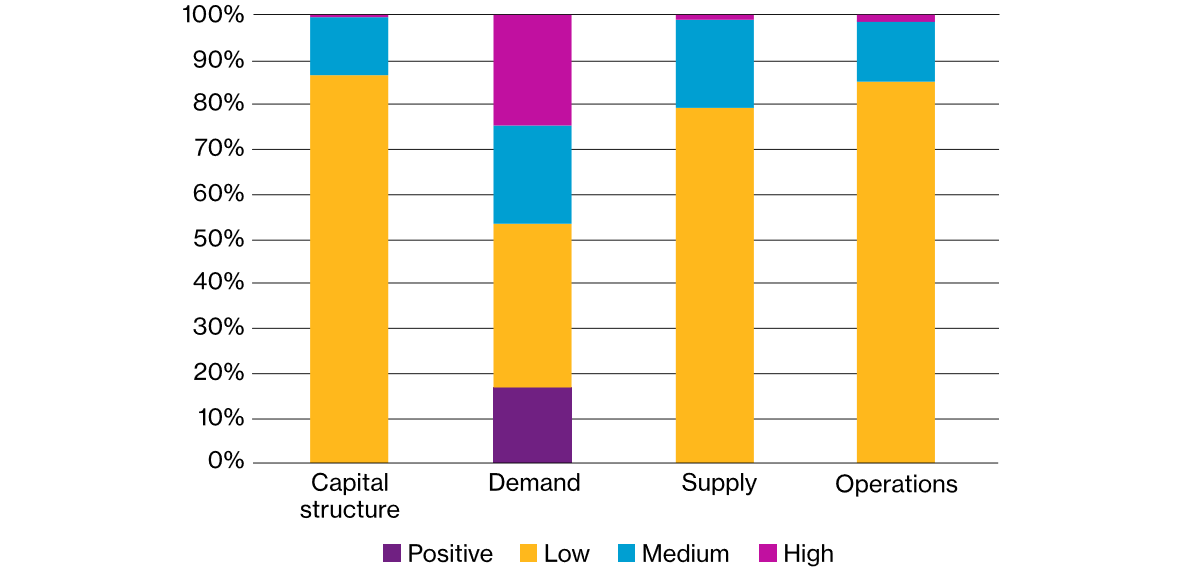

The results revealed that the significant turmoil in capital markets had little effect on the capital structures of portfolio companies, with 87% of respondents indicating that their holdings were unlikely to breach covenants as a result. Only 13% said holdings were either close, or likely to, breach covenants in the next 2 - 3 months.

On the issue of customer demand for products or services, however, the response was far more varied with 46% of respondents reporting that their holdings were feeling a medium-to-high impact from the slowdown in global economies, mostly within the consumer discretionary, industrials, energy and materials sectors. In contrast, sentiment among commercial services firms remained robust, while 20% of consumer staples firms even reported a positive impact on demand.

The impact on businesses’ supply chains and their own internal operations also remained small, with around 80% of respondents showing low levels of concern on either point, indicating that most private equity-held businesses effectively implemented alternative working arrangements to work around any disruptions arising from the COVID-19 crisis.

Andrew Brown, Head of Private Equity Research at Willis Towers Watson, said: “Private equity-owned companies have a number of structural advantages that may have allowed them to navigate such a crisis better. In addition to the expertise provided to them by private equity managers, the additional access to equity and debt capital from their sponsors may also have provided some respite.

“Beyond the short-term dislocation, we also see a number of opportunities where we can continue to deploy capital, notably in technology, healthcare, and consumer staples.”

Andrew Brown

Head of Private Equity Research, Willis Towers Watson

Whilst the first half of the year has seen a subdued environment for exit deals, managers have been able to maintain significant flexibility over both the timing and the terms of company exits. As a result, we have seen little evidence of forced exits by private equity firms into a depressed market.

Beyond the short-term dislocation, we also see a number of opportunities where we can continue to deploy capital, notably in technology, healthcare, and consumer staples. With deal volumes depressed, there appears to be far less competition for opportunities and as a result, potentially better entry pricing.”

Willis Towers Watson (NASDAQ: WLTW) is a leading global advisory, broking and solutions company that helps clients around the world turn risk into a path for growth. With roots dating to 1828, Willis Towers Watson has 45,000 employees serving more than 140 countries and markets. We design and deliver solutions that manage risk, optimize benefits, cultivate talent, and expand the power of capital to protect and strengthen institutions and individuals. Our unique perspective allows us to see the critical intersections between talent, assets and ideas — the dynamic formula that drives business performance. Together, we unlock potential.