The general outlook for the medium term is for risk assets to achieve lower returns than what was historically possible. At the same time, bond yields are reversing a 35-year trend, meaning that the defensive attributes of bonds are compromised.

Many investors have substantial exposure to equity market risk in their return-seeking portfolio as they look to meet their return objectives. This can be a concern, especially where investors are facing challenges associated with large negative cash flows, shorter investment horizon and the need to regularly realise investments to pay out to beneficiaries.

The need for changing equities for the better

Over the past 12-18 months Willis Towers Watson has been working with many clients to assess their risk profile and ensure that the level of risk and exposure to equities in the portfolio is appropriate. A lot of time and effort has also been spent on educating investors of the merits of including diversifying assets such as alternative betas and illiquid assets in the portfolio.

Nevertheless, this creates a conundrum as a large number of investors lack the internal resources and structure required to include diversifying assets and may not yet be comfortable delegating their portfolios to an external party. Consequently, for many there is a need to continue holding on to equities as a long-term growth asset in order to meet their goals or commitments.

Based on our observations, many investors have been disappointed with the performance of their equity managers. We expect that the average active manager will continue to struggle and underperform, net of fees.

Replacing poorly performing managers with better performers in the recent market environment appears to be a ‘quick fix’, but it is a simplistic response. Blindly chasing alpha will be value-destructive and an ineffective way to successfully manoeuvre through uncertain times. An appropriate solution needs to focus on the overall equity portfolio structure and also question fundamental attributes of active management.

As a result of the above, we believe it is essential for investors to:

Investors should also question their current investment beliefs, develop the courage to ‘evolve’ their thinking and investments and prioritise their subsequent actions.

Employ strategies with high odds of success

Not all active equity strategies outperform. In fact, we expect most to underperform.

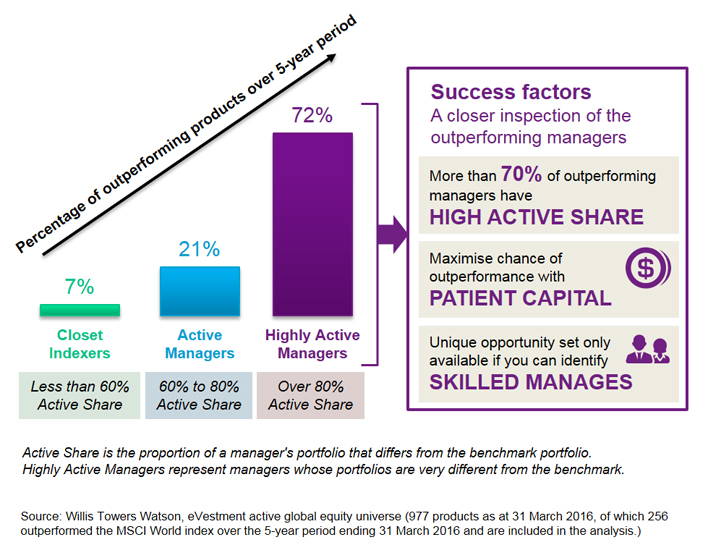

We hold an investment belief that high-quality equity mandates are able to add most value in their highest-conviction overweight positions (known as ‘High Active Share’) versus a conventional equity index. Indeed, both empirical and practical evidence confirm that high-active-share long-only equity mandates via concentrated “best ideas” portfolios (portfolios with up to 20 stocks, say), managed for the long-term, offer greater odds for outperformance after fees.

According to our research, approximately 75% of active managers underperformed, while the vast majority that outperformed pursued a high active share and low turnover strategy. The diagram below summarises the extent of active share being employed by the outperforming managers in the research.

High Active Share mandates offer greater odds of success

Yet we observe that most investors are uncomfortable with the expected higher volatility from such concentrated portfolios, particularly if they tend to think shorter-term. Moreover, even if they can access such High Active Share equity specialists, the associated higher management fees and a more effective, well-resourced governance structure needed compared to traditional equity portfolios with low to medium deviation from the underlying index, create implementation challenges for investors. Seeking help from or delegating to an external professional adviser can overcome such challenges.

Stop putting up with mediocre investments

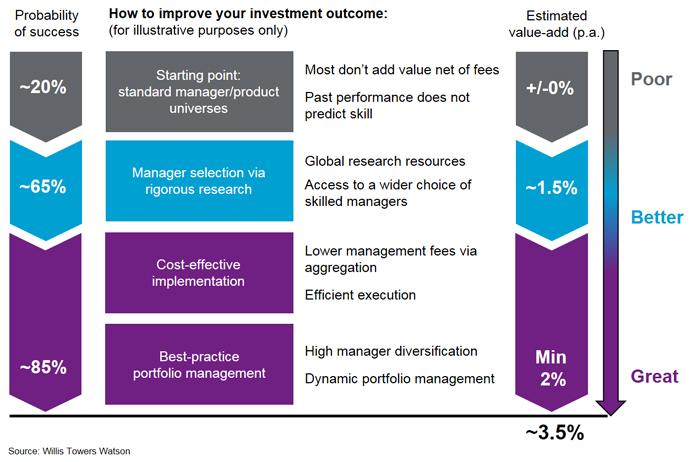

According to a study published by Standard & Poor’s and the Center for Research in Security Prices, fewer than 20% of fund products across various categories within the eVestment database outperform their respective benchmarks over 10 years, once fees are taken into consideration. This suggests that the average investor is generally better off going passive, as most fund products do not add value net of fees.

However, as outlined in the following diagram, our research reveals that it is possible to significantly increase the odds of selecting skilled equity managers through rigorous research, for example, to about 65%. This can be achieved, for instance, when employing the high-quality, High Active Share equity managers.

Despite the improvement, we observe that the combination of employing High Active Share equity managers, cost-effective implementation and best-practice portfolio management, can help clients further increase the success rate of their equity investments to about 85%. Such efforts have regularly led to a value-add of 3.5% per annum or more, and in most cases either maintaining or reducing overall portfolio risk.

Simplify your structure, or step up your game

Another common reason for poor equity investment outcomes, in addition to employing poor managers pursuing mediocre strategies, is inefficient equity portfolio construction (e.g. over-diversification, home bias). Savvy investors can consider private market opportunities, which can further improve portfolio efficiency in terms of return per unit of risk taken. These illiquid investments exhibit much lower correlations with public equity.

However, for most investors who are not able to play this more complex game or are unwilling to delegate, we view passive equity and/or enhanced beta solutions to be better options to simplify the overall structure and free up time and resources for other, higher-priority investment decisions. We advocate that investors adopt a holistic view in thinking about their equity investments.

To sum up

We believe that much is at stake if investors do not start reviewing their equity investments now. In so doing, we advocate taking a holistic view in constructing equity portfolios, appointing exclusively high-quality managers to manage High Active Share strategies, and to be open to review existing biases to investing. Taking such action will enable investors to work their assets harder and improve investment outcomes.

Willis Towers Watson has been helping clients implement better equity solutions successfully, taking the aforementioned portfolio improvements into account.

For further information, please contact Mark Brugner, head of research for investments in Asia Pacific at Willis Towers Watson.

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.