It's best to identify portfolio weaknesses early

A healthcare professional won’t conclude the state of someone’s health by looking at just one indicator based on a diagnosis. Similarly, we do not merely focus on past performance results when assessing the health of an investment portfolio. The focus should be on identifying what went wrong, which area needs more attention and possible treatment.

In any medical check-up, there is a benchmark for each diagnostic test in a report, such as the normal level of glucose in the blood or the right level of cholesterol. To check whether a portfolio is doing fine, we can expect a diagnosis for an investment portfolio to firstly examine and compare various areas of the portfolio to ’best practice’ and then generate a report that is a holistic assessment of the portfolio.

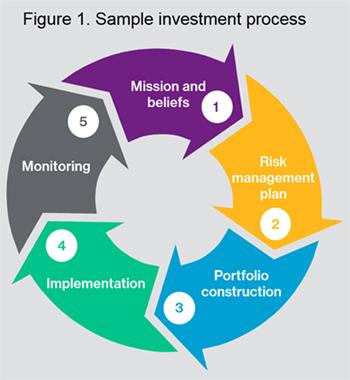

One way to structure a portfolio health check is to follow different stages of an investment process that begins with ‘mission and beliefs’ and ‘risk management plan’, as shown in figure 1. At each stage the portfolio is diagnosed and the areas that require consideration or improvement are highlighted.

Let us focus on the active management approach under portfolio construction as an example, where the following three areas are measured against best-practice criteria:

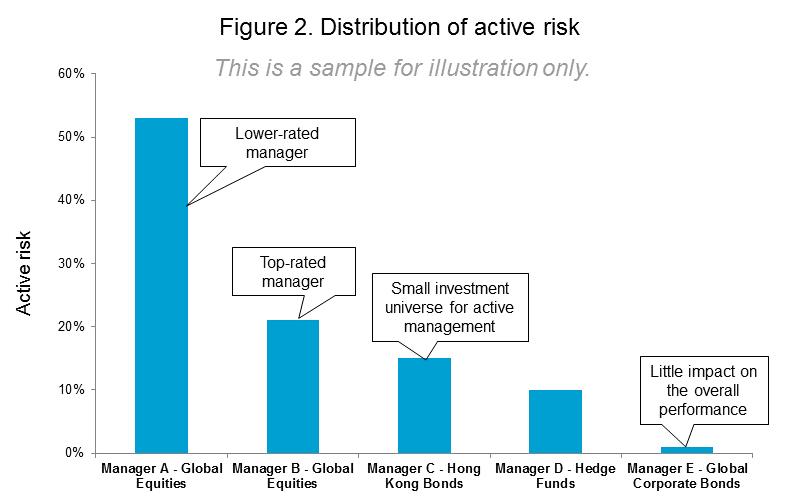

To illustrate how the diagnosis helps fund fiduciaries prioritise their time in managing and monitoring the portfolio, we have a case that shows a fund employing a range of active managers. Its portfolio is split among four asset classes, including global equities, Hong Kong bonds, hedge funds and global corporate bonds.

Its portfolio health check report provides the distribution of the active risk (figure 2) across five managers of the portfolio. Active risk represents the risk taken as a result of active management decisions and can be measured by tracking error.

One of the best-practice criteria is taking active risk in the right place. The diagnosis would highlight that Manager E’s returns on global corporate bonds, whether good or bad, are going to have little impact on the performance of the portfolio as a whole due to the small amount of active risk that Manager E is taking.

Given the time required to monitor its performance and the fee paid to that manager, the suggested action is to consider whether or not to retain Manager E.

Another observation is that the opportunities arising from Hong Kong bonds to add value are slim due to the small investment universe for these instruments. So inherently there are capacity restrictions on Manager C’s ability to outperform by deviating from its benchmark for Hong Kong bonds. The diagnosis would recommend not to consider active management in an asset class that does not provide greater scope to generate alpha from active management.

The focus should be on the managers that take the most risk – that is, watch out for the investment with the highest bet. In this example, looking at the global equity mandates that dominate the risk distribution, Manager A accounts for a large portion of active risk, making Manager B less relevant in the context of the overall performance of the portfolio.

In addition, Manager B is top-rated, while Manager A is lower-rated, according to a consultant’s research. The diagnosis would indicate that it is not sensible to place the biggest bets on Manager A, and reducing the exposure to Manager A should also be considered.

Based on the diagnosis as discussed, there are two bond mandates that require change. It follows that a further review of the manager structure can ensure that the distribution of active risk is sufficient and appropriate.

The above example is focused on active manager structure for the purpose of illustration. In practice, a core part of the portfolio health check considers asset allocation strategies that have the largest impact on achieving investment goals.

In summary, the portfolio health check helps with the filtering process and gives a holistic overview of the different aspects of an investment portfolio. By conducting this check annually, trustees or investment boards can identify priorities for discussion in future trustee or board meetings and consider the appropriate or suggested action to be taken.

Prevention is better than cure. Symptoms can be detected earlier and healed with proper treatment. Trustees and fund fiduciaries can take good care of portfolio health with annual check-ups by consulting an external professional adviser.

Please contact your usual Willis Towers Watson consultant or email: investment.solutions.asia@wtwco.com.

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.