FOMO (/ˈfəʊməʊ/), the abbreviation of ‘fear of missing out’, is defined by the Oxford Dictionary as ‘anxiety that an exciting or interesting event may currently be happening elsewhere, often aroused by posts seen on social media’. As an equity investor, should you be experiencing a sense of FOMO? What exactly could you be missing out on?

If you are an investor with a return-seeking portfolio, chances are you will have significant exposure to equity markets. Whether or not it is articulated, this is likely driven by the belief that there is a reward to be derived from investing in the riskiest class of assets. By holding a number of different stocks, one would expect to diversify away company specific risks. Couple that with a long enough wait, or investment horizon, equity markets should deliver positive real returns over cash, as history has shown. This is known as the equity risk premium (ERP). With that in mind, average investors cross their fingers and hope their equity portfolio continues to grow.

But what if you are an institutional investor with not only a long time horizon, but also the scale and level of governance to manage more complex portfolios? How can you do more than tracking the index (be it intentionally, or getting index-like returns after fees despite using active managers)? Can you do equities better, especially in an environment where lower equity returns are expected?

We say yes. We think there is more to be had from equity investing than a portfolio of 2 to 4 managers each with a 3 percent tracking error. We believe there is a much wider opportunity set beyond long-only listed equities from which portfolio growth can be derived. We believe a more holistic equity portfolio could improve the likelihood of good outcomes.

So what is holistic equity? While many would associate the term ‘equity’ in asset class terms with long-only listed equities, we encourage considering equity more broadly, to include the likes of private equity, long-short equity etc. This reduces the reliance of the portfolio on ERP to deliver real returns. We discuss two additional return drivers – skill and illiquidity – as well as the importance of diversity within your equity portfolio.

It is our strong belief that active management adds value, but that finding skilful active managers is difficult. For this reason we devote significant resources to building our manager research capabilities.

Legendary investor Sir John Templeton put it simply: “If you want to have better performance than the cd, you must do things differently from the cd.” If the cd is represented by the market, then active fund managers need to be building portfolios that differ substantially from the broad market. A useful measure for this is ‘Active Share’. There is substantial academic research on the performance of active managers that suggests a reliable link between Active Share and long-term success in equity investing.

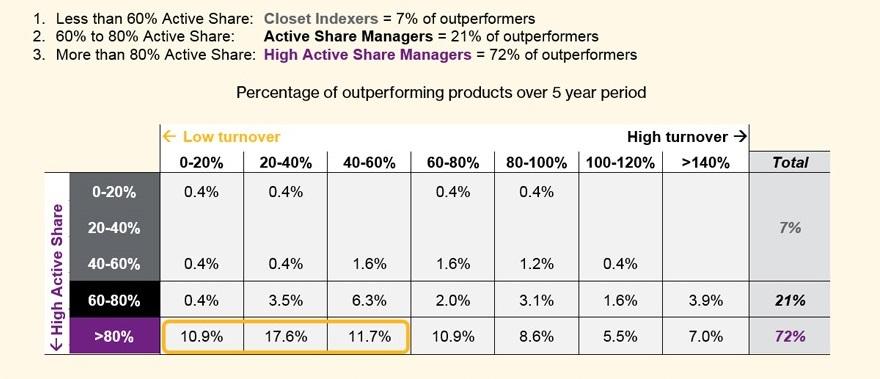

As shown in the table below, there are three different levels of Active Share and more than 70% of outperforming managers operate High Active Share strategies:

Source: eVestment, as at 31 March 2016. Accurate as of 10 June 2016. The eVestment active global equity universe is made up of 977 products. 256 of these have outperformed the MSCI World Net Dividend (USD) over 5 years to end March 2016 and are included in this analysis. Active Share and Turnover are averages over the 5 year period. Active Share is the percentage of the portfolio different from the benchmark portfolio. Turnover is the frequency of changing securities within a fund. Past performance is not a reliable indicator of future returns.

To prove the point, we show in Figure 1 above the breakdown of outperforming global equity products by Active Share and turnover. We observe that among the outperforming products, a high proportion are “High Active Share” products, with a bias to those with low turnover. We, and many others, believe highly active strategies are the best way to access skill in long-only equities.

In addition to long-only equity managers focused on long-term fundamentals and stock selection, long-short equity managers can take advantage of short term market behavioural biases. Traditionally considered as part of the complex world of hedge funds, long-short equity strategies buy (long) equities that are expected to rise and sell (short) those that are expected to fall. Including long-short equity strategies can be a different source of alpha.

Not every investor has the benefit of a long time horizon, but many of our institutional investment clients do. Due to their liability structures, a significant number of pension funds, most sovereign wealth funds/ endowments and some insurance companies, have the ability to invest with a long time horizon and ‘lock up’ their capital to some degree. This represents an important source of competitive advantage, with these investors being able to harvest the higher returns on offer from illiquid assets. The additional return an illiquid asset offers the investor over its liquid alternative is known as the illiquidity risk premium.

Perhaps the most widely known illiquid asset is private equity. In private equity investments, illiquidity gives additional time to the managers to exercise skill by taking control of private companies, and altering the operational or financial structure to drive returns. Figure 2 illustrates that private equity portfolios of public pension plans in the US have delivered substantial outperformance relative to other parts of their portfolios over the past 10 years.

Source: Willis Towers Watson, Preqin, Bloomberg, 30 June 2016. Returns are in USD.

In an increasingly integrated global economy, an investment approach that identifies economic, political, industrial, demographic and social trends can be used to exploit ‘themes’ to generate attractive investment returns. We believe there are many such opportunities in the private equity space, for example:

In reality, illiquidity in private equity is typically overestimated. Even though lock-up terms are 10 years, cash flows are received throughout the term and the value remaining in a fund at year 10 is typically minimal. The growth of the secondary market also increases liquidity.

When hiring one manager, dependency on that manager for long-term success is a one-sided bet. However, combining several uncorrelated managers provides far more diversity of thought, research process and decision making, thus increasing the odds of success over the long term.

Similarly, relying on a diverse range of return drivers other than the ERP to deliver long-term portfolio growth should give a better chance of improving risk-adjusted returns, especially when equity return expectations are low. As to how these return drivers are incorporated into the portfolio, it should be based on a combination of beliefs as well as the ability and willingness to embrace complexity.

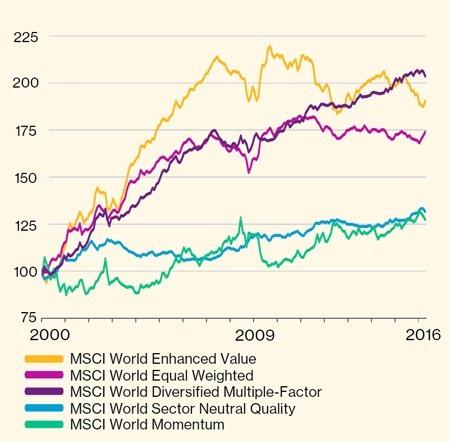

In addition to empowering skilful managers and investing in private equity, there are other ways to increase the diversity of the equity portfolio, for instance:

Source: Willis Towers Watson, MSCI, Bloomberg. June 2016. Returns are in USD.

What we have set out so far is not new. The savviest investors are continuously improving their equity portfolios with a combination of skill, illiquidity and diversity. This holistic equity portfolio structure provides better long-term risk adjusted returns than standard existing equity portfolio structures (we estimate that it improves Sharpe ratio by as much as 60%).

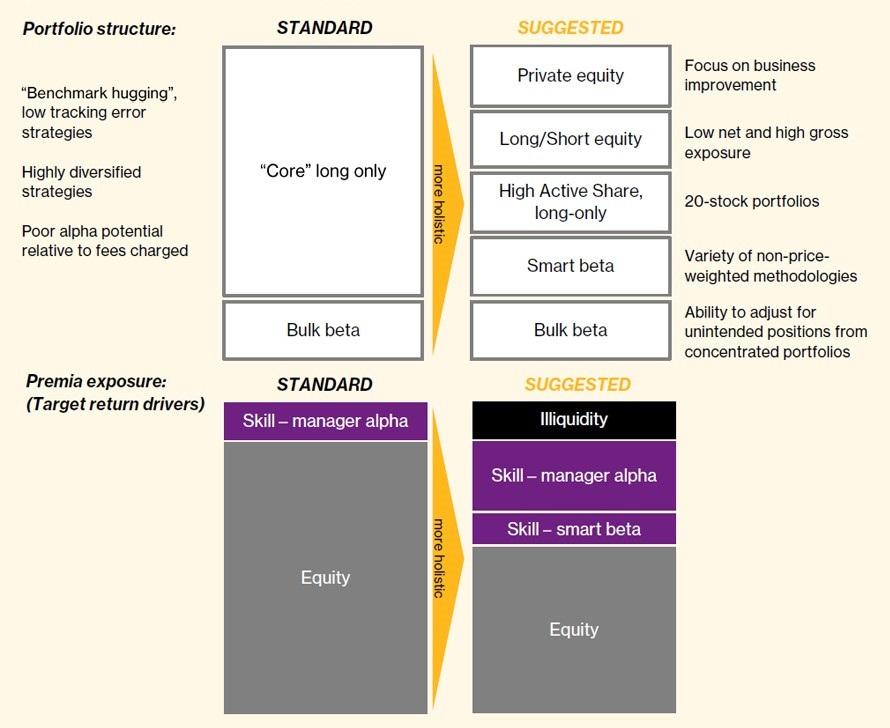

So what does this equity portfolio look like in practice?

In Figure 4 above, we compare the standard equity portfolio with the suggested holistic version, and their respective target return drivers.

Given our low medium-term equity market return expectations, we feel it is a particularly attractive time to adjust portfolios to a more diverse structure. If limited governance budget and size of assets in the equity portfolio are restricting access to these return drivers, outsourcing arrangements for non-traditional investments should be considered.

Empower skill, go illiquid, and embrace diversity. That is what the best investors are doing. That is what needs to be done to be competitive. How is that for peer pressure? Are you beginning to have FOMO? You should be.

Visit our Asia Insights on Better Equities mini-site to learn more about equity investing or contact us at investment.solutions.asia@wtwco.com

The contents of this article are for general interest. No action should be taken on the basis of this article without seeking specific advice.

Willis Towers Watson has a series of Advisory Portfolio Groups (APG) within the Investment line of business around the globe, based in the Americas, Asia, Australia, the UK and EMEA. The APG in Asia seeks to identify and develop best ideas and approaches that can offer a competitive advantage to Asian institutional investors, while spearheading Asian-focused investment research and portfolio construction advice. Further, the group is responsible for ensuring high quality and consistency of advice, and works with client teams to design portfolios.

This paper was written by members of the APG for general information purposes only.

Produced by:

Kar Wye Leong, CFA

Investment Consultant

Reviewed for APG by:

Jayne Bok, CFA, CAIA

Head of Investments, Asia

| Title | File Type | File Size |

|---|---|---|

| Portfolio Matters: “FOMO?” Building a holistic equity portfolio | .3 MB |