An earthquake is the shaking and vibration of the ground due to energy released when two tectonic plates suddenly slip past each other.

On average there are around 15 major earthquakes every year around the world. It’s impossible to predict when or where an earthquake will happen.

As well as the damage caused directly by the tremor, quakes can trigger secondary catastrophes such as tsunamis, landslides and sinkholes.

They can also lead to fires and explosions if gas or electrical lines are affected. All of which increase the risk to life and property and the scale of business losses.

Earthquakes occur when two tectonic plates slip past each other. There are three main theories on the cause of plate tectonic motion:

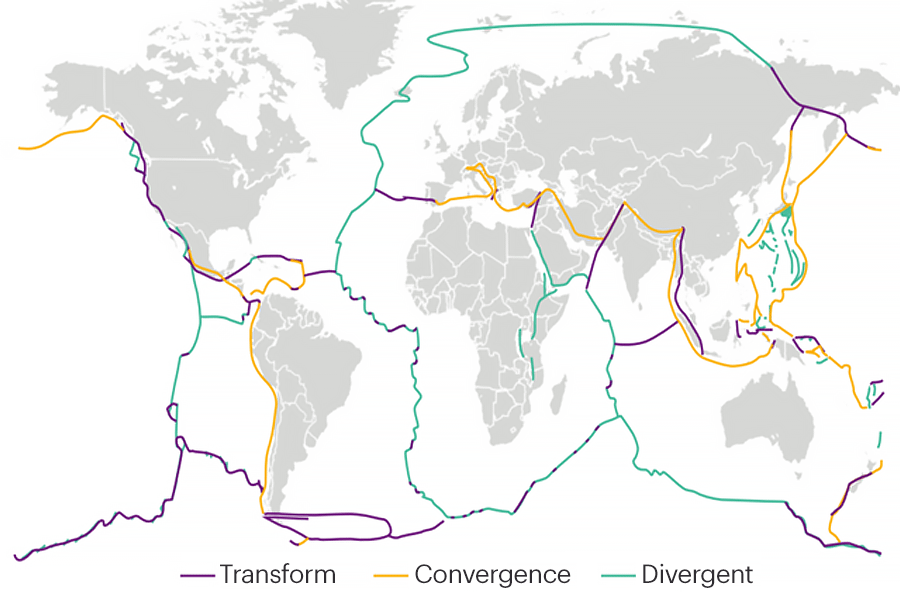

Earthquakes can happen almost anywhere depending on how the plates move. But the largest and most destructive are at the plate boundaries where there is most friction. There are three types of plate boundary that can create earthquakes, as shown below:

| Boundary Type | Cause | Strength | Found in… |

|---|---|---|---|

| Convergent | Plates collide and push into or under/above each other | Strongest can exceed Mw 9 |

Chile, southern Europe, Asia-Pacific |

| Transform | Plates slide past each other in the same or different directions | Strong up to Mw 8.5 |

California, New Zealand, South East Asia |

| Divergent | Plates move away from each other | Least strong Typically less than Mw 8 |

Iceland, East Africa |

Earthquakes can occur anywhere in the world but areas at the highest risk are usually found along plate boundaries.

Coastal regions near to fault lines also experience tsunami risk.

Convergent plate boundaries produce the largest magnitude earthquakes.

Source: Munich Re NatCatSERVICE[1]

Earthquakes can cause damage far from the faultline or epicentre depending on the geology, soil type and the vulnerability of the building or location.

In our recent webinar on Thursday 11 May 2023, we discussed how and where earthquakes happen, their impact on property and business and how risk consultancy modeling and analysis can help businesses to measure, mitigate and manage their risks.

We also explored:

We have put together a reference handbook providing an overview of the key talking points and learnings from the webinar which can be downloaded from the bottom of this page.

Earthquakes are among the most devastating natural catastrophes, in terms of loss of life, damage to property and interruption to business.

That devastation can be multiplied by secondary catastrophes triggered by earthquakes, such as tsunamis and landslides.

But identifying where an earthquake will strike and the level of damage it can cause at a particular location can be difficult, depending on geology, soil type, and the construction and structure of buildings.

Powerful analytics and modeling tools can predict location-specific risk levels and probable losses, while catastrophe risk engineering can help identify the best mitigations to reduce risks.

Alternative risk transfer, such as parametric insurance, can provide a solution for earthquake risks that are difficult or expensive to place through traditional insurance markets.

The WTW Research Network furthers understanding of earthquake risks through science-based evidence. This, in turn, helps our strategic risk consultancy and risk transfer experts to optimize solutions to fit the need of individual organizations and locations.

For specialist help discovering smarter ways to manage earthquake risks, please get in touch.

| Title | File Type | File Size |

|---|---|---|

| Mitigating, managing and quantifying earthquake risks | 3.3 MB |