To manage insurance portfolios across multiple global entities efficiently, you need timely and precise analysis. But accessing and aggregating insurance data can be challenging for complex entities with diverse subsidiaries or businesses. Getting hold of accurate insurance insight can involve time-consuming conversations with multiple colleagues across business entities, chasing data or compiling spreadsheets that may include inaccurate information.

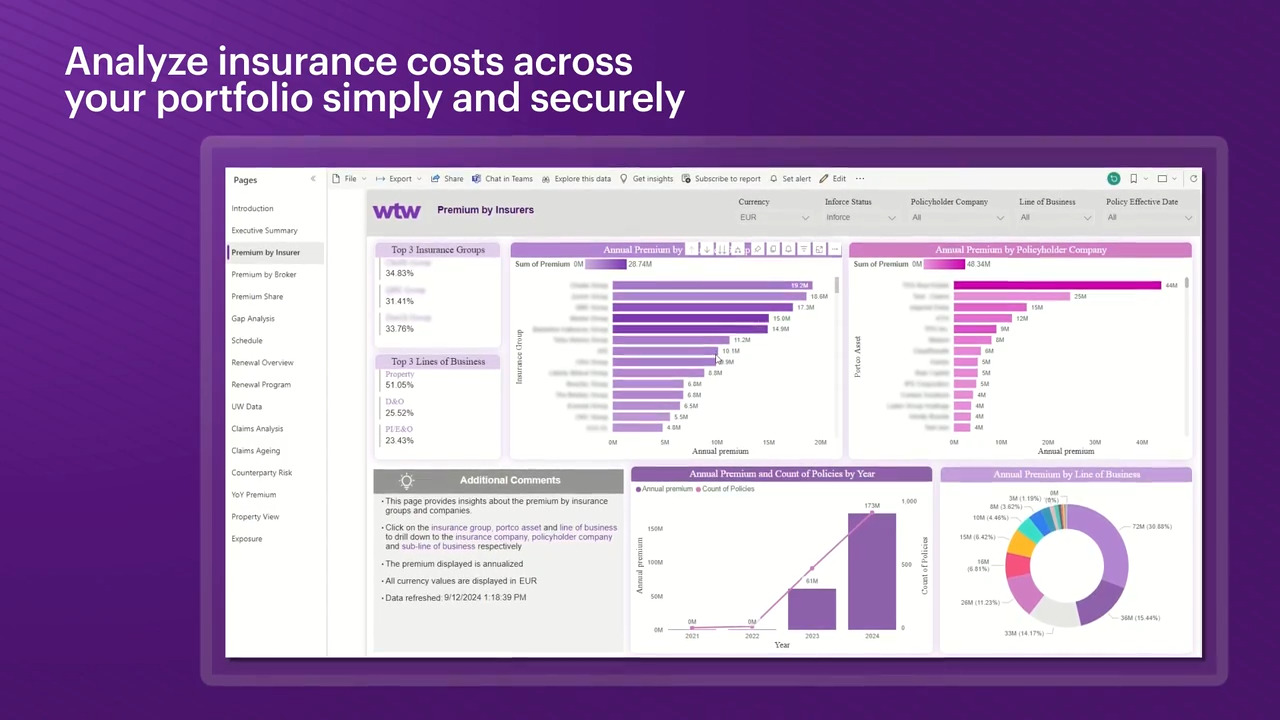

Streamline and optimize your total insurance portfolio with your own bespoke Insurance Insights Dashboard, directly accessible on Risk IQ, with risk analytics tailored to enhance value from insurance for private equity, multinationals, sovereign wealth funds and complex organizations.

Your dashboard allows you to easily aggregate and analyze your insurance data across numerous portfolio companies with their own risk management and insurance routines. With insight from your Insurance Insights Dashboard, you can more easily identify coverage gaps, assess counterparty risks and leverage your portfolio to seek enhanced value from your insurance program.

What can you achieve?

We’ve created Insurance Insights Dashboard to help organizations comprised of multiple entities more easily:

Insurance Insights Dashboard provides a comprehensive view of your insurance coverage across different companies in your portfolio or across subsidiaries. Insurance Insights Dashboard gives you rapid answers to questions like: Which entities have purchased which lines of insurance? Do your subsidiaries have coverage gaps?

Streamline and optimize your total insurance portfolio with a bespoke dashboard designed to analyze your insurance data.

Insurance analytics for private equity, multinationals and wealth funds

Insurance Insights Dashboard delivers value-adding insurance analytics designed to deliver enhanced efficiency and accuracy while helping to reduce the workload of anyone with responsibility for insurance at organizations comprised of multiple entities. The tool’s capabilities mean no more filling in fields for individual insurance lines or categories of insurance to access analytical insurance insights. Your insurance data is pre-populated, meaning all you have to do is check and approve to generate decision-useful insurance analysis.

Simply supply your insurance policy information, including all slips, binders and summaries and we’ll ingest the data using our proprietary data ingestion app and AI-enabled technology. Using Insurance Insights Dashboard means you can see your global insurance portfolio in one aggregated view, without entering data from individual entities.

We hold your insurance data on a segregated server, ringfencing this information so it’s only used to generate your analysis within your Insurance Insights Dashboard. We never share your insurance details beyond the dedicated Insurance Insights Dashboard server.

Insurance Insights Dashboard features

What questions can the dashboard answer for multi-entity organizations?

- Do your portfolio companies have insurance coverage, and if so, is it adequate?

- Are insurance policies held with high-rated insurers, or are you exposed to the risks associated with policies at lower-rated insurers?

- Are your insurance limits sufficient and in line with industry benchmarks?

- Where can you reduce insurance costs by leveraging the size of your portfolio or spend across particular lines?

- Where could taking deeper analytical dives on specific risk lines drive more sophisticated risk management and even better value from insurance?

For a smarter way to enhance value from your total insurance portfolio, request a demo of Insurance Insights Dashboard, or get in touch with our specialist team.