The task of the megamerger of 10 public sector banks into four anchor banks (Punjab National Bank, Union Bank of India, Canara Bank and Indian Bank) is not a simple one. This is a merger of complex organisations, fraught with risk but also opportunities for all stakeholders – the organisations themselves, customers, employees, shareholders and the larger community.

When considering the ‘employee’ or the ‘people’ aspect of the merger, few experiences invoke more stress or uncertainty than a workplace merger or acquisition. Combined with the security that a public-sector job provides, any transition or change not manged well can result in sub optimal outcomes.

While business strategy and technology are key in integration, success or failure of such M&A’s depend significantly on how well the people and culture integration is undertaken to unlock the real value of such deals.

Based on the global M&A pulse survey conducted by Willis Towers Watson, effective and open employee communication is considered as one of the top most priority in 65% of the organisations with more successful M&A transactions compared to 40% in less successful M&As.

HR integration, if not managed well in an M&A transaction, can adversely impact employee engagement and trust in the organisation and increases the risk of losing key talent in the critical integration phase. As two entities with different culture, leadership style, organisation structure, policies and practices merge, it creates a lot of anxiety in people at both ends. It is important for organisations to maintain a transparent communication channel with their employees and keep them updated on developments and their continued role in the process.

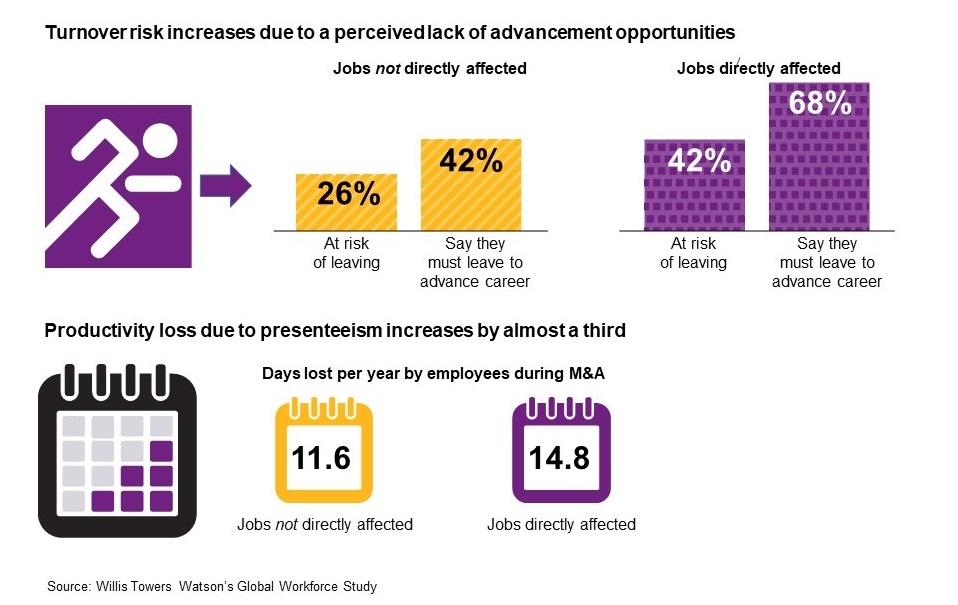

Losing key talent is a big risk for organisations undergoing an M&A transaction, as turnover can increase due to a perceived lack of advancement opportunities.

As per Willis Towers Watson’s Global M&A Retention Study, the most common reasons given by employees who exit in such instances are:

Talent retention plans should be prepared early in the transaction lifecycle and should be supported by active leadership interest, robust job evaluation, clear career path framework, competitive benchmarking of pay and benefits policies and open communication during the integration phase.

Willis Towers Watson’s Global Workforce Study shows that in the jobs which are directly affected by the merger, there is a risk of 42% of the employees leaving, while 68% of the employees perceive that they would need to move to a different organisation for career advancement and tend to look out for other opportunities.

In comparison, in the jobs which are not directly affected due to a merger, there is a 26% risk of leaving and about 42% of these employees perceive that they would need to move to a different organisation for career advancement.

In addition to pay and benefits, organisations must also keep sight of the factors that foster long-term retention, including strong leadership, career development opportunities and pay differentiation for top performers. For some time now, regulators in India have been mulling over performance linked stock-based incentives for top executives and this appears to be an opportune moment to introduce it.

Leaders and managers play a pivotal role in creating an environment of trust where employees believe that their best interests will be considered. The global M&A pulse survey conducted by Willis Towers Watson shows that effective leaders and managers make a critical difference to the success of a merger. Their role can lead to employees who are six times as likely to be highly engaged through an M&A transaction.

Employees are three times more likely to perceive their leaders as effective and good at their job, if they are effective at communicating goals and strategy to the employees.

Despite the criticality of people and culture issues in a merger, they still don’t command the same level of rigor and focus that financial or operational issues.

While HR aspects of a merger need to be aligned to business strategy, a specialised and focused HR integration exercise is equally vital to drive success. As seen in the recent case of Bank of Baroda’s merger with Vijaya Bank and Dena Bank, an independent committee/ team focused on HR integration and harmonisation is a positive step in this direction.

In conclusion, M&As provide enormous potential for growth that simply can’t be achieved as quickly through organic and incremental development. However, success rates in M&A are not very high, rendering them an expensive and high risk. When organisations pay close attention to the people aspects of a merger or an acquisition, they greatly increase the chances to fulfil the M&A promise. That’s why, as is often said, “people and culture” eventually make or break an M&A.

*The article was first published in People Matters.

| Title | File Type | File Size |

|---|---|---|

| Solving the People challenge of the Mega Merger | .4 MB |