In a recent meeting held by the Reserve Bank of India (RBI), lending rate of interest to the banks or the repo rate was increased by 40 basis points which is the first hike announced in nearly four years. This has pushed the 10-year bond yield to its highest levels in the last few years. Although this was an expected move to tackle the soaring inflationary pressures, the timing of the unscheduled announcement does come as a surprise.

It is to be noted that the annual inflation target until March 2026 has been set at 4% with a tolerance level of 2% on either side by the Government of India (GOI) and the RBI but the actual annual inflation rate has remained above 6% in the last three months. The annual inflation rate was 6.95% in March 2022 which is the highest since October 2020 and above the market forecasts of 6.35%. Surging commodity prices like consumer food price index of 7.68%, increase in prices of oils and fats by 18.79%, vegetables by 11.64%, fuel and light by 7.52%, clothing and footwear by 9.40%, etc. have contributed to the rise in consumer price index.

(Source: https://www.mospi.gov.in)

In order to set the inflation trajectory downwards again, it is expected that RBI may further increase the interest rates in the coming months as it aims to reduce the liquidity in the banking system. This trend is not specific to India and similar rising trends in yields are seen globally as well. For instance, the Federal Reserve Bank increased its benchmark interest rate by 50 basis points on the same day as RBI’s announcement and this is the biggest hike seen in two decades in the US to fight inflation.

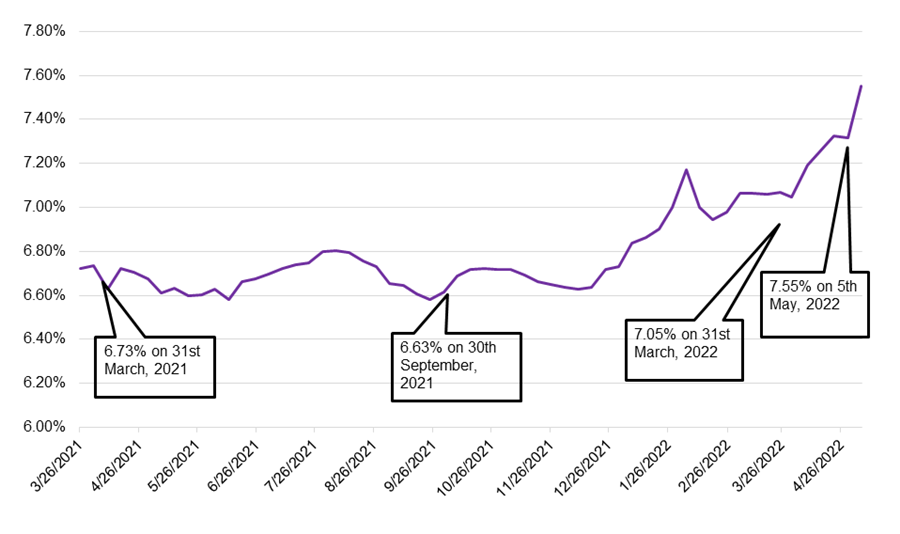

Given below is a snapshot of the Indian government bond yields over the last one year:

From the perspective of actuarial valuations, the increasing bond yields would lead to an increase in the discount rate assumption used to arrive at the net present value of the expected future cashflows. An increase of 50 basis points in the discount rate assumption could imply a decrease in the Defined Benefit Obligation of long-term benefits by approximately 4-6%, assuming the duration of the liability is about 10 years.

For funded schemes where assets are reported on market value basis, mostly in case of Exempt Provident Fund schemes and market linked Gratuity plans, the fair value of fixed income assets would also reduce with the increase in yields. Moreover, a sharp decline seen in the equity markets is likely to further reduce the fair value of assets. Such plans may not therefore, witness any significant change in the net funded status with the change in interest rates as the decrease in liabilities would be offset by the decrease in market value of assets. On the other hand, funded cash accumulation plans where assets are invested in traditional products of life insurance companies may have stable fund values and therefore see an improvement in net funded status.

Further, depending upon the accounting standard adopted and the type of employee benefit plan, the impact on liability and assets caused by increasing yields will either be recognised in the Profit and Loss account (P&L) or the Other Comprehensive Income (OCI).

Given the sharp increase in interest rates and continued volatility in investment markets, it is important that companies assess the financial impact on their employee benefit liabilities. The impact should be factored into the projected expense and accrual for the financial year 2022-23, rather than using estimates from the previous year. Moreover, with employee attrition at an all-time high, this may be a good time to review the assumptions being used for the valuations.

We will be happy to help you understand the impact of these changes on your provisions and expense for long-term employee benefits.

WTW does not perform “regulated actuarial services” in India. WTW have independent Empaneled Actuaries, who perform such services.