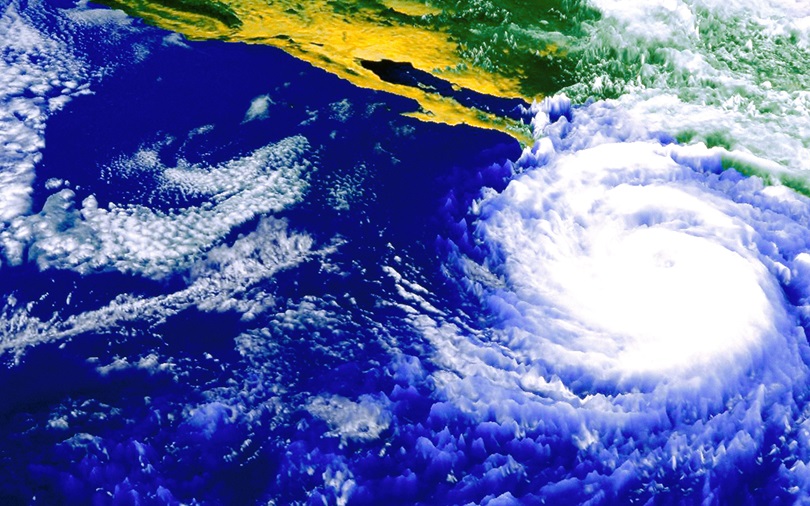

Just like the rest of the world, environmental and climate exposures are typically the first risks that come to mind in terms of environmental, social, and governance (ESG) in Southeast Asia. That said, risk management extends into the social and governance categories as well. Essentially, effective risk management – and its impact on people and capital – is also part of good ESG management. Similarly, sustainable investment transcends ESG categories while also incorporating dimensions of people, risk and capital.

To fulfil commitments, organisations should adopt a multifaceted yet integrated approach to ESG. Neglecting any aspect may result to consequences on numerous fronts, such as shareholder value, ability to attract and retain top talent, and loss of brand equity, among others. As such, WTW helps organisations address an array of ESG challenges through three distinct yet connected primary areas of focus:

- Board advisory and governance

- Climate and resilience

- Risk and analytics

WTW Spotlight Series

With these three broad lenses in mind, a six-episode on-demand series is developed to discuss various Environmental, Social and Governance-related topics. Bookmark this page and hear from our experts on issues and challenges, the new realities and opportunities for companies as they move towards a green economy. Our spotlight series will provide you with insights on sustainability governance, including the importance of driving ESG priorities, the challenges and opportunities in achieving climate resilience, and transitioning into net-zero. This will also zoom into specific sectors such as energy, and explore the role of insurers in the ESG, climate and sustainability journey. Lastly, the series will showcase how WTW can work hand in hand with you to transform tomorrows.

Episode 6: Integrating ESG into risk management

The significance of ESG goes beyond being a trendy term; and what sets today apart is the pressing need to tackle ESG issues, which presents both risks and opportunities for organisations. With ESG and associated risks gaining prominence, companies must take proactive measures in reinforcing their ESG strategies to avoid the risk of being denied access to financing or insurance. In light of this, the last episode raises the question, “What risk management tactics can companies implement to manage and reduce ESG risks in Asia?

Episode 5: Roles of the Insurers in Climate Resilience

In this episode, we discuss the impact of climate change on the insurance industry and the actions that insurers can take to be more resilient in the face of these challenges.

Episode 4: Managing climate transition risk in Asia: - Understanding impact from transition

Companies must adapt to avoid challenges. Investors should consider the impact of policy, technology and consumer changes on companies because the transition has the potential to create value but can also cause significant losses. This episode discusses the ways of facilitating the transition to net-zero emissions for both the public and private sectors and explore the question of whether we can measure transition risk.

Episode 3: Managing climate transition risk in Asia: What actions can companies take?

Unlike in the West, the resources in Asia are completely different. While the West has enormous amounts of natural gas, the price of gas is much higher in Asia because of limited supplies. Further, Asia’s massive coal presents a liability to the climate.

Episode 2: Achieving Climate Resilience and net-zero

Hear from Rowan Douglas CBE, Head of Climate and Resilience Hub at WTW, in this fireside chat on the issues and challenges faced by governments and companies en route to net-zero and in achieving climate resilience.

What are the three and a half main buckets that regulators have divided climate risk into? Discover why Adam Smith, the great economist of the 18th century, was mentioned in the fireside chat. Watch the video to learn more!

Episode 1: Sustainability Governance – Profits or Purpose?

The way organisations manage environmental, social and governance (ESG) and sustainability issues and incorporate them into all they do has become a critical board-level issue and opportunity. In this first episode of WTW Spotlight Series, we share our views on the role of the Board in driving ESG priorities. Are companies doing this for a purpose or for profits?

Watch the video and hear from Shai Ganu, WTW Global Head of Executive Compensation and Board Advisory, on how the Board should start on this journey, the types of targets the Board should set to measure success and the main driving force for companies to integrate ESG into their business.