NEW DELHI, December 6, 2022 – With Asia being one of the most vulnerable regions to climate change, companies in India are increasingly aware of the financial impact of climate change. However, they require the right expertise in managing climate risks, a conducive regulatory environment and better data availability to undertake climate-related financial reporting, according to a survey conducted by leading global advisory, broking and solutions firm WTW (NASDAQ: WTW).

The study also found:

In 2021, The Securities and Exchange Board of India (SEBI) have mandated an ESG (Environment, Social and Governance) reporting structure called Business Responsibility and Sustainability Report (BRSR) with effect from FY 2022-23, making it necessary for the top 1000 listed companies to report their sustainability performance. BRSR is benchmarked to global frameworks such as TCFD, GRI (Global Reporting Initiative) and SASB (Sustainability Accounting Standards Board). With the top 1000 listed companies in India obliged to undertake climate financial reporting based on recommendations by BRSR, the state of readiness is varied.

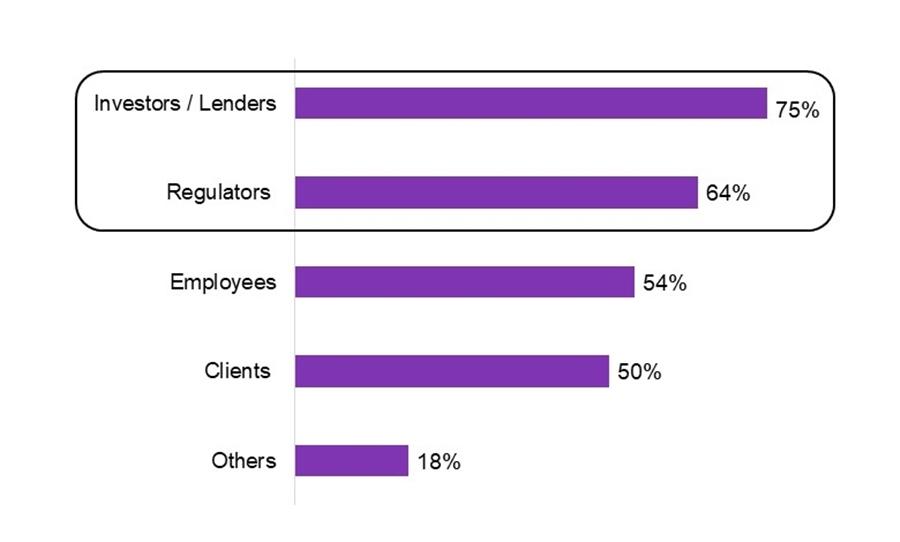

In addition, the study reveals that investors/lenders (75%) and regulators (64%) are the top two audiences of climate-related disclosures for companies. This is due to the increasing need for such disclosures for prudent investment management and for companies to comply with current and anticipated regulations.

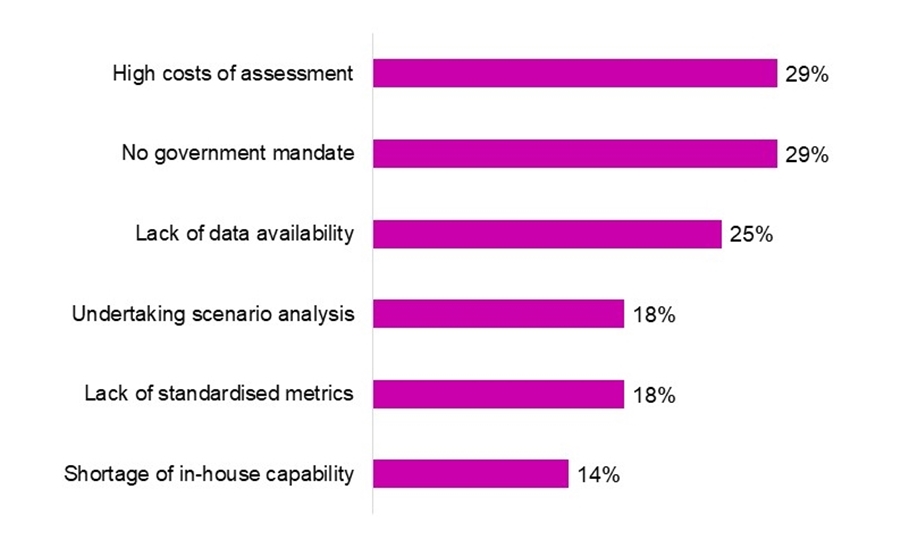

Respondents have indicated that the key barriers to wide scale adoption of climate-related disclosure frameworks, especially TCFD, are high costs of assessment, lack of regulatory mandate, insufficient data and standardised metrics, and shortage of inhouse capabilities.

Closely linked to these challenges are areas where companies need support on reporting under TCFD. One in five companies see scenario modelling as a key area where advice and external support is needed. Other key areas of support sought include setting the TCFD format and approach (39%), physical risk assessment (36%) and transition risk assessment (36%).

“We expect to see increased attention and scrutiny from a wider set of stakeholders on climate-related disclosure and risk management in India. This is a specialist function, so it is understandable that most companies lack inhouse capability. Companies should partner with experts to bridge the gap with relevant data, analytics, and insight to support climate change governance,” said Vivek Nath, Head of India, WTW.

“WTW has invested in data, expertise and technology to develop a comprehensive climate diagnostic tool that enables companies to generate tailored insights for reporting climate-related disclosures, assess physical and transition risks. We have also developed an ecosystem of partners that allow companies to work together with the insurance markets on their climate transition plans,” he added.

“Companies should partner with experts to bridge the gap with relevant data, analytics, and insight to support climate change governance.”

Vivek Nath | Head of India, WTW

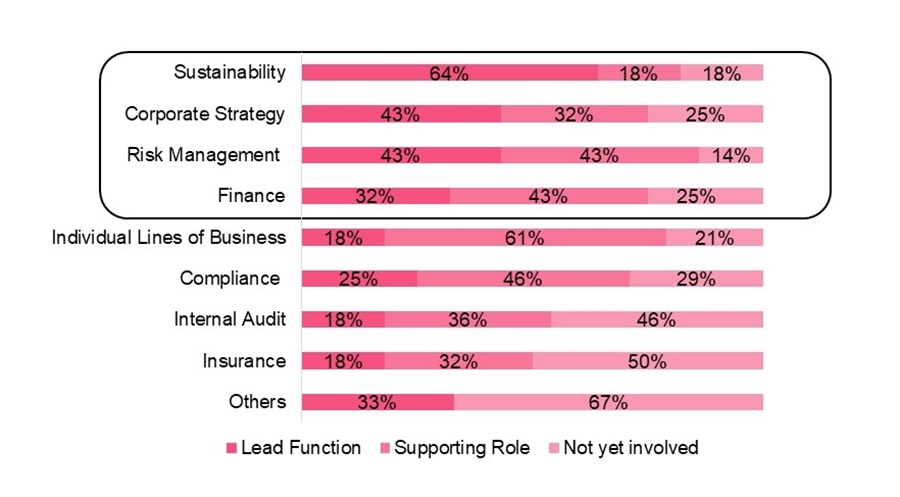

Sustainability, Risk Management and Corporate Strategy, closely supported by the finance function, are the business units that often take the lead on climate-related financial risks and opportunities. This highlights the importance of multiple functions working together to assess climate-related transition, physical and liability risks and opportunities, understand their financial impacts and source the required investments to fund actions for an organisation’s climate journey.

“While the current impetus to climate-related disclosures is regulatory requirement or investor and consumer expectations, it is critical for companies in India to integrate climate risk mitigation and by extension Environment, Social, Governance (ESG) linked actions into their climate transition roadmap. An important step in that direction is to also extend climate-related KPI’s to executive and board compensation. This will create a wider culture of climate disclosure and responsibility by the company,” said Nath.

At WTW (NASDAQ: WTW), we provide data-driven, insight-led solutions in the areas of people, risk and capital. Leveraging the global view and local expertise of our colleagues serving 140 countries and markets, we help organisations sharpen their strategy, enhance organisational resilience, motivate their workforce and maximise performance.

Working shoulder to shoulder with our clients, we uncover opportunities for sustainable success—and provide perspective that moves you.