How can you justify your D&O insurance strategy to the board? How can you evidence the level of D&O protection you’re recommending to your directors is the right choice? D&O Quantified delivers answers on those areas of D&O insurance strategy on which you’re being most pressed.

WTW’s global predictive modeling technology makes validating and communicating your D&O insurance strategy to both your board and risk and finance colleagues simple. We define the risk model and the quantification process to support risk specialists in their conversations across the organization. It’s designed to help you optimize your D&O risk management strategy by quantifying D&O risk, providing data-driven insight on public company directors’ and officers’ liability loss.

Tactically engage with both internal stakeholders and insurance markets by comparing quotes from insurers using financial decision support metrics such as risk adjusted benchmarking, value from insurance and premium return on investment. And with D&O Quantified, you can support and inform your board of directors with concise and compelling reporting outputs based on this insight.

Communicate value from D&O insurance recommendations

With D&O Quantified’s interactive technology platform you can easily show the trade-offs between the costs, limits and the levels of risk you’ve evaluated to arrive at your D&O insurance recommendations.

Test alternative strategies in real-time with D&O Quantified’s dynamic and customizable technology, rapidly responding to your board’s enquiries, including:

- How do you know your recommended side A D&O limits are adequate?

- What assurances can you offer on getting return on investment on premiums?

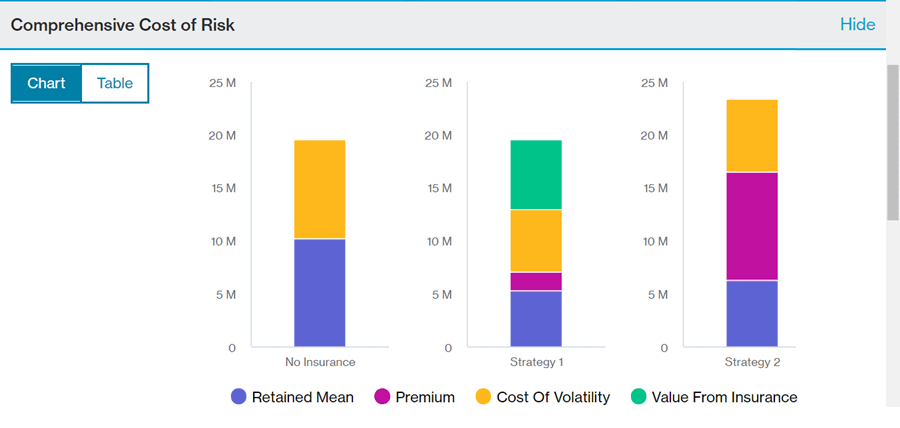

- How does your strategy impact the comprehensive cost of risk?

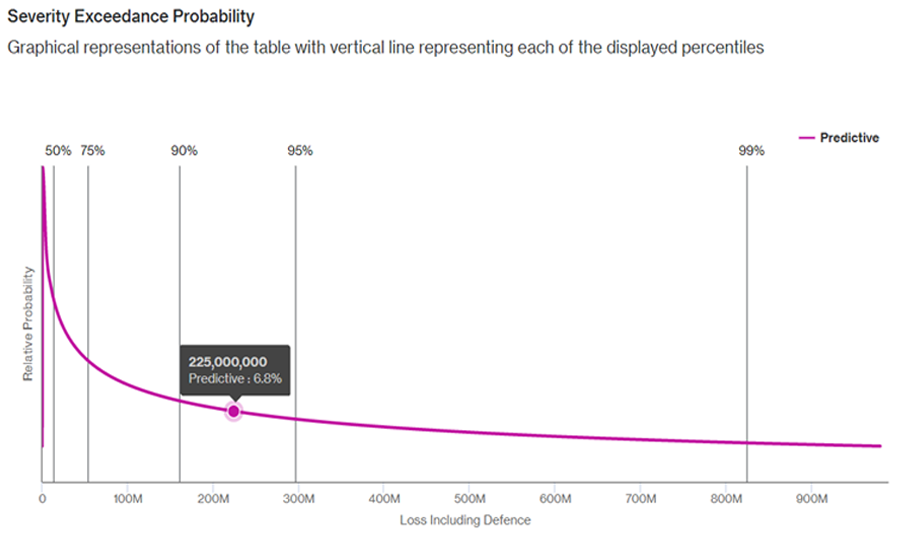

- What’s the range of possible loss amounts, including defence costs, for a single event?

- What’s the relative probability of experiencing a loss that size?

- D&O Quantified gives you the clarity and certainty you and your directors’ need.

Go beyond benchmarking to justify your D&O insurance decisions

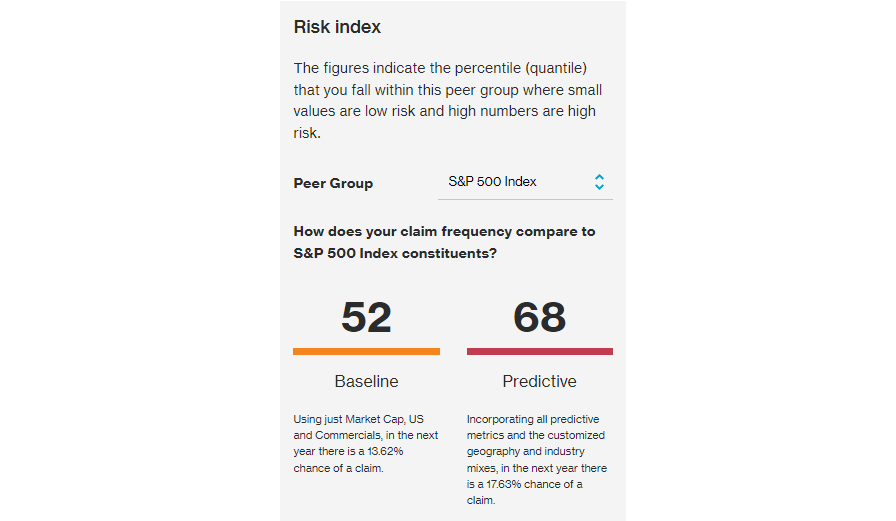

D&O Quantified offers the reassurance of going beyond benchmarking to evaluate the risks individual directors may face. And by using variables specific to your organization (not simply its market cap and sector), you get a refined evaluation of the value of your D&O insurance approach and an elevated view of your risk.

D&O Quantified can reveal the specific drivers of D&O risk for your organization, readying the business to assess optimized ways of reducing, mitigating, and transferring it.

Optimize your D&O risk management strategy

D&O Quantified supports you in optimizing your approach to D&O risk management by enabling you to:

- Understand your D&O exposure through insight into the potential frequency and severity of claims

- Create and adjust potential insurance strategies to reveal hidden value

- Compare the relative value of differing risk finance strategies side-by-side

- Design your optimal insurance structure based on your unique exposure profile

- Facilitate tactical engagement with insurers

- Assess your D&O loss potential at any time to inform your enterprise risk management strategy.

Which organizations can benefit from D&O Quantified?

D&O Quantified is designed for publicly traded companies of all sizes and in all geographies.

This tool is not designed to evaluate smaller local D&O policies required for regulatory reasons. Our Employment Practices Quantified model can assess D&O loss potential and evaluate insurance for privately held and nonprofit organizations. To discover smarter ways to evaluate your D&O exposure and loss potential, get in touch to learn more.