The growth and resilience of your organization begins with a quantitative understanding of your risk tolerance. Embed this view into your enterprise risk management framework and you can lay the foundation for advanced analytical insights.

Taking either too aggressive or too conservative an approach to risk can undermine long-term success. Gaining clarity and structure around your risk tolerance equips the business for better decision-making and empowers the risk function to contribute to long-term performance.

Risk Tolerance Clarified enables taking the calculated risks you need to thrive without compromising your financial standing. By giving you access to precise analytical perspectives on your risk tolerance, this powerful software also allows you to avoid risk aversion that neither reflects your risk appetite nor is likely to deliver the profitability your stakeholders require.

Sidestep subjectivity with customizable, data-driven views of your risk tolerance that allow risk management, treasury, and the c-suite to speak the same language and accurately align strategic business decisions with the company’s risk appetite.

By transforming risk tolerance conversations from qualitative to quantitative, you can align risk management to the financial performance goals of the business and deliver crucial insight for long-term resilience.

Use Risk Tolerance Clarified to:

- Empower the risk function with a data-driven view that bridges historical communication barriers with treasury

- Engage business leaders with a shared understanding of risk tolerance in line with your risk appetite, and the expectations of investors and shareholders

- Align risk tolerance with financial priorities, by putting numbers against your risk tolerance, giving internal and external stakeholders reassurance the business is taking the risk it needs to grow safely.

Putting you in control of risk tolerance

With Risk Tolerance Clarified’s software, you choose the view of risk tolerance that matters to the organization: your metrics, your thresholds, your priorities.

While both risk and treasury professionals understand the importance of a well-defined risk tolerance, the process used to determine acceptable levels of risk is too often a ‘black box’.

A lack of risk tolerance transparency could be due to limited access to reliable data, or business areas prioritizing different metrics, such as free cashflow, debt covenants, or earnings per share. This can leave understandings of risk tolerance misaligned across the organization, hard-to-track across reporting periods, and opaque to stakeholders.

A clearly-defined risk tolerance should be the bedrock for all business decisions. To achieve this, you need a transparent view that you control.

How does Risk Tolerance Clarified deliver a clearer view on your risk tolerance?

Risk Tolerance Clarified allows you to:

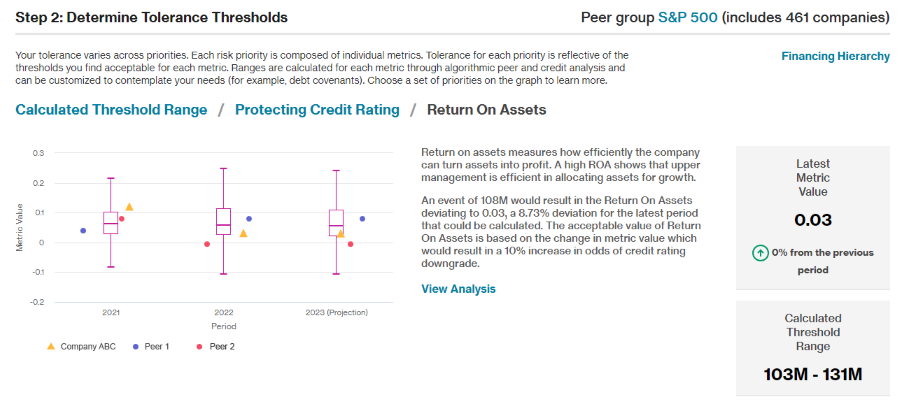

- Create explicit statements on risk tolerance and risk-bearing capacity customized to your organization’s financial goals, with transparent metrics and thresholds you control

- Define what an adverse event is for your organization, and put numbers around the level of loss that would imperil your financial resilience or negatively impact your organization’s credit rating

- Evaluate the impact of changing financial dynamics on your organization, because a smart risk financing or business investment today may not prove as smart tomorrow

- Understand the realities of your organization’s financial standing, what this communicates about your solvency, your financial constraints, earnings power and use of cash flow, and how this compares to your peers

- Generate forward-looking financial projections by customizing the financial priorities as defined by you

- Gain a common financial framework to create objectives, communicate with stakeholders and demonstrate the value of risk investments to your organization’s financial health.

How can you maximize positive impact from Risk Tolerance Clarified?

You can incorporate Risk Tolerance Clarified into your enterprise risk management and operational risk considerations within a best practice risk governance framework. Alternatively, you can use the tool as part of your quarterly financial reporting and to evaluate planned significant investments or changes to your corporate structure.

Using Risk Tolerance Clarified alongside related risk analytics can also generate management decisions based on deeper, more precise perspectives on the impact of risk.

Discover the smarter way to define and refine your risk tolerance approach by learning more about Risk Tolerance Clarified and WTW’s suite of powerful risk analytics tools.