This article is brought to you by Human Resources Online (HRO) and WTW.

It’s an interesting time to be in HR. Inflation in Singapore, which stands at 5.5% as of February 2023, is expected to remain elevated in H1 2023 before slowing more discernibly in H2 2023, according to the Monetary Authority of Singapore (MAS). Per the regulatory body, “unit labour costs are expected to increase further in the near term”, and as such, “businesses are expected to continue to pass through accumulated import, labour and other costs to consumer prices”.

Never have economic pressures impacted HR and C&B leaders’ roles so strongly – not even during the pandemic. What is compounding the complexity in pay decisions is not only whether employers need to give salary raises to keep pace with inflation, but also the shortage of tech-qualified talent, which is placing undue strain on stretched C&B budgets.

With these issues top-of-mind, HRO’s Priya Sunil breaks down the impact of trends such as inflation, tech talent shortage, and upskilling, for HR and employers alike, as well as speaks to an expert for analysis and solutions.

With inflationary pressures weighing down, leaders are at a crossroads: to raise pay to meet employees’ expectation, or ignore the problem and hope it goes away?

Thomas Wong, Practice Leader, Rewards Data Intelligence, Singapore, WTW – a leading global advisory, broking, and solutions company, observes: “We are seeing employers across sectors – including financial services, tech, and media companies – taking a more cautiously optimistic approach in their strategies and investments for infrastructure and people.”

Interestingly, based on WTW’s latest Salary Budget Planning Report, for the Q4 2022 period, some sectors such as financial and tech sectors are implementing pretty high salary increments for 2023, at 4.5% and 4.3% respectively.

Wong, who runs WTW’s annual compensation survey, says, these figures are higher than usual, because “salary increment for Singapore has been consistently at 4.0% for the past few years prior to the pandemic”.

Wong recommends leaders to first prioritise the key jobs in the organisation. These, he shares, typically include tech/digital roles which will be very important for tech and tech-enabled organisations; as well as sales jobs and client-facing roles, since they bring in revenue.

Next, organisations should consider employees who are at the lower end of the compensation package, i.e., largely the business and technical support staff, who “play a very important role in keeping the lights on for your organisation’s operations”. These, Wong highlights, are the roles most impacted by inflation. “We have seen organisations giving one-off discretionary bonuses or allowances [to these employees],” he says, pointing to more C&B leaders taking such decisions on the basis of discretion.

As such, in the case of increases to the base salary, Wong recommends that this being a long-term investment, should ideally be done for critical roles.

He adds: “Strong communication is very important - letting employees know what is being done, what strategy is in place, and why it is so.”

Another way to look at your key jobs’ equation is to categorise by talent – employees can go into two groups: those in critical roles, and those in non-critical roles.

Critical roles, Wong says, are the ones with a surge in demand for the job (based on the percent increase in number of incumbents) and had a significant year-on-year salary increment. Whichever way you look at it, these roles are important to the business – as such, these are the ones C&B professionals will likely want to invest more in, for instance, through higher salary increments or at the base salary level.

Looking at non-critical roles, on the other hand, Wong advises the discretionary approach, keeping in mind those that are most-hit by inflation.

Key takeaway: Segmentation is key. Leaders need to analyse how inflation impacts different employee groups as well as which jobs have the greatest challenges in attracting and retaining talent. Overlay those analyses to understand which jobs are the most critical to your business, and now you have the start of an effectively segmented compensation strategy.

In November 2022, Manpower Minister Dr. Tan See Leng highlighted that despite the spate of tech sector layoffs over the last year, job vacancies – especially in the information & communications (infocomm) sector – continued to rise in H1 2022.

In the more recently released full year's report, infocomm continues to have the highest proportion of vacancies for new positions, which per the Ministry of Manpower, "reflects the industry’s dynamism in innovating and restructuring to keep pace with rapid technological changes”.

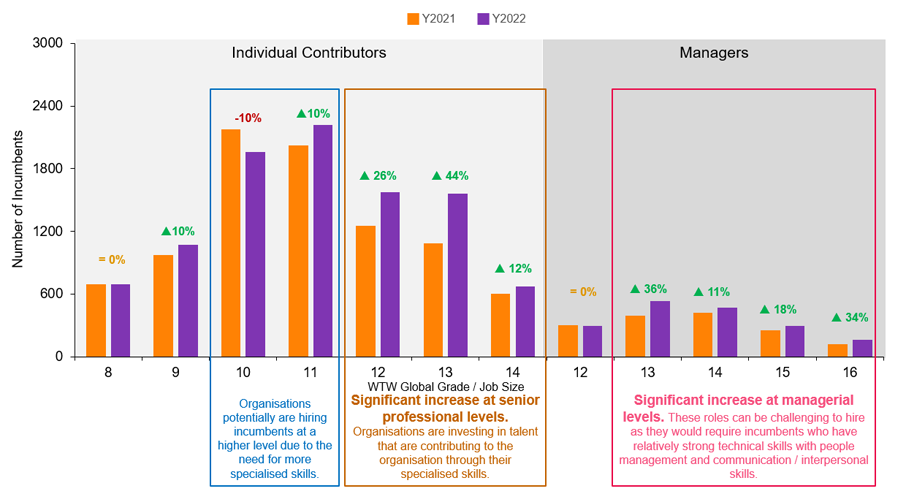

At a global level too, WTW’s Artificial Intelligence and Digital Transformation salary survey (AIDT), which focuses on demand for tech talent in both tech and tech-enabled businesses, cited a significant increase in headcount across most levels – especially at the senior professional and people management levels in 2022, compared to 2021.

The data is clear, but the reasons are not. Despite the market being flooded with supply owing to layoffs, and bolstered by fresh graduates and career switches, the demand for such talent persists to the extent of positions lying vacant – resulting in a “relatively large” gap, Wong points out.

Wong attributes this gap to two factors.

First, tech-enabled businesses continue to expand their tech teams and increase their headcount. Wong explains: “Comparing headcount in companies that were included in both the 2021 and 2022 editions of our AIDT survey, we have seen a 26% growth in headcount at the mid to senior levels, and that is pretty significant.

When comparing between organisations that participated in both 2021 and 2022 survey, the WTW AIDT showed that there has been a significant increase in headcounts across majority of the levels – especially at senior professionals and people managements level.

Source: 2022 Artificial Intelligence and Digital Talent Compensation Survey – Singapore

“Many organisations see this group of employees as critical in both being able to independently solve complex technical issues that help take businesses to the next level through tech solutions; while also being able to mentor and inspire junior tech employees. To be able to find such talent is tough, as some may be good in either-or.”

While the first factor is around talent attraction, the second factor is more focused on talent retention, especially at the junior levels where many tech and tech-enabled businesses have been struggling with high attrition rates.

Wong explains: “After two to three years, many of these employees decide to move on. And why is that so? The main reason they leave is because of a perceived lack of learning and growth opportunities in tech skills within the organisation.

“So, this may be a possible scenario: ‘I may be in a tech-enabled firm, I have learnt what I wanted to, but it seems like there are no further opportunities or projects I can work on. Let me move on to another tech-enabled firm, or possibly move back to a tech firm, so I can grow my skills and learn’.”

As such, the high attrition is largely a retention issue, and not just an attraction issue.

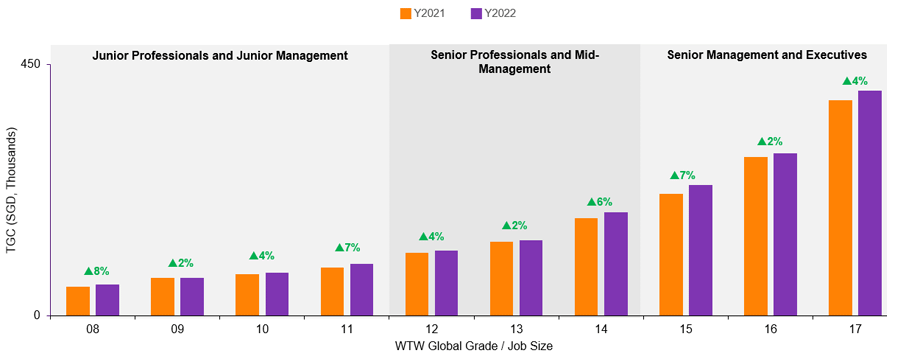

The graph below the difference in Total Guaranteed Compensation (TGC = Base Salary + Allowance) between Y2021 and Y2022. The analysis only includes organisations which are in the WTW 2021 and 2022 AIDT database.

WTW Observations

Source: 2022 Artificial Intelligence and Digital Talent Compensation Survey – Singapore

Similar to addressing the expectations brought about by inflation, tackling this issue effectively not only boils down to a competitive salary offering, but also enhanced upskilling and reskilling opportunities as a two-pronged strategy.

This is particularly relevant in a world where lines are now blurring between roles based on their outdated job descriptions, and employees taking on more skills-based roles, prompting Wong to share: "I personally see this fluid movement between roles and skills bringing a great opportunity for both employees and employers.

“For employers, it forces them to think and be open to hiring candidates that may not have the experience in performing in that particular role, but have the necessary skills which can help to bring them up to speed for that role.

“It also allows employees to be empowered to take on new roles, as well as keep up-to-date with the latest skills. This is very much in line with the skilling agenda the Singapore Government has been pushing for.”

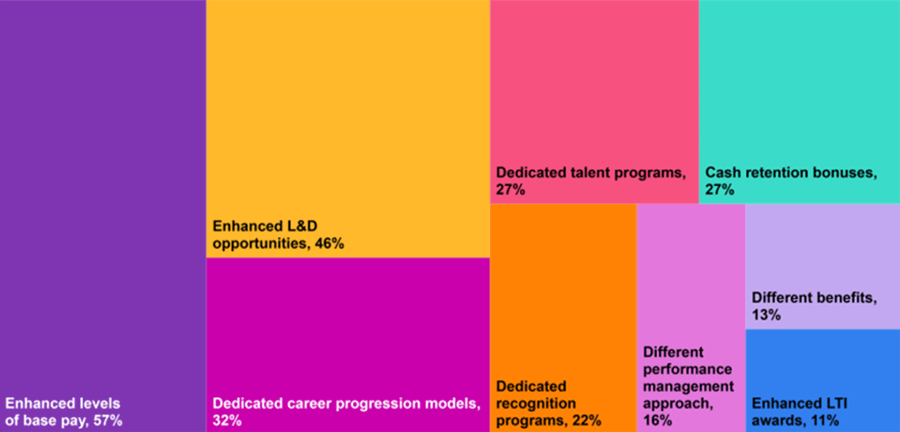

Around 6 out of 10 organizations (62%) in APAC offer differentiated reward programs for digital talent.

Of which, 57% offer enhanced levels of base pay, 46% offer enhanced L&D opportunities, and almost one-third of organizations (32%) offer dedicated career progression models.

Source: 2022 Digital Transformation Practice Report – Asia Pacific

Key takeaway: Talent attraction and retention will go hand-in-hand. As important as it is for pay to keep pace with employee expectations, cash is not the only motivator. The workforce is driven and excited to grow their skills and career, with the end goal of being future-proof.

When people flourish, organisations prosper: Approaches to align rewards and skills Wong elaborates on two approaches for talent leaders to consider in harmonising rewards and skills.

The first, he shares, is an outward-looking approach, which is to do a market comparison. “At WTW, we have just rolled out a new product called the Talent Intelligence Report, which helps organisations see some of the hot skills and in-demand jobs from leading organisations in various industries.

“This report aims to provide insights into the global talent market trends by industry, analyses job vacancies from leading organisations in the industry, identifies high-demand jobs and their respective skill, and examines top skills of industry critical jobs that contribute to competitive differentiation.”

Such reports, he adds, can help leaders understand the latest global talent market trends and be quick to make informed decisions on any rewards or work matters in order to remain competitive.

Next, he talks about an inward-looking approach: “I always tell my clients that market reports are data points for organisations to take reference to. At the end of the day, HR leaders have to work very closely with your business partners, to constantly re-examine the skill sets that are important to your own organisation.”

“I genuinely believe in this – best practice in the market might not be the most appropriate practice for your organisation – so it is important to re-examine and see how it can play out in your organisation in terms of the skill sets.”

“Certain tech-enabled businesses may be ahead of the curve in terms of technology and digitalisation, while others may be at the nascent stage, thus the skill sets that are required are also very different. So, it's very important to be sure of what is required and to pay [your employees] according to the skill sets that are required by the organisation,” Wong affirms.

As we wrap up the conversation, Wong reminds us that there remain a lot of challenges in implementing the practice of paying employees based on skills not roles.

“For example, once you give somebody that additional allowance for skills, how are you going to take it back? Therefore, instead of [immediately] rolling out a strategy that requires a lot of moving parts, organisations should consider taking a step back, and taking a more careful and informed approach with knowledge on what is necessary for the organisation,” Wong advises.

With the number of complexities and considerations that go into rewards & talent decision-making, working with a reliable partner goes further than we think in lightening the load on HR’s shoulders. You must be able to count on the right partner to have data-driven, insight-led conversations, which is WTW’s expertise. Providing solutions in the areas of people, risk, and capital, WTW helps organisations in more than 140 markets sharpen their strategy, enhance organisational resilience, motivate their workforce, and maximise performance.