Over the last few years, the speed of change in the life sciences industry has increased significantly, creating new and complex risks.

With years of industry experience, our specialists have a deep understanding of the changes impacting the life science industry. They can partner with you to create solutions to mitigate risk and find opportunity in change.

A good example of the change facing the life science industry was the response to the COVID-19 pandemic. It led to a shift in how life sciences businesses operate and the adoption of new technologies and scientific processes. Today, businesses are prioritizing industry collaborations over other strategic priorities, creating opportunities to merge and the potential for legal disputes over partnerships and joint ventures.

Some of the changes you can control include:

- Adoption of new technologies

- Treatment personalization

- Results-based payments

- Strategic partnerships and joint ventures

Changes that are beyond your control include:

- Regulation

- Market pricing pressures

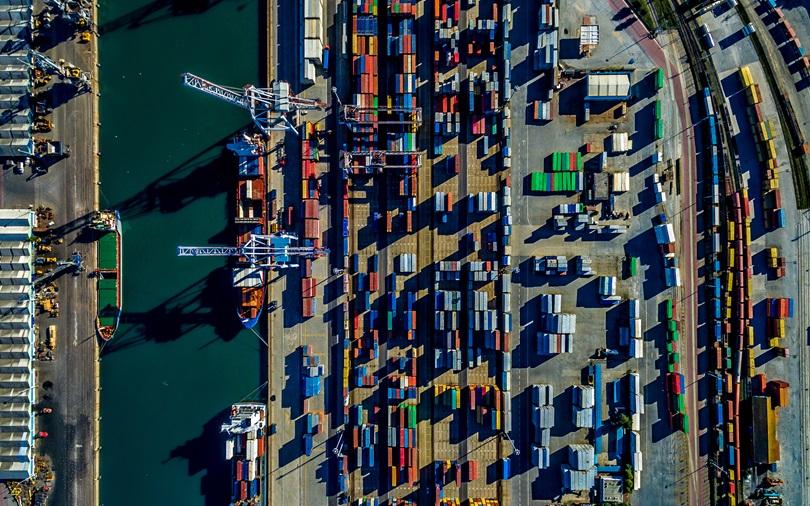

- Supply chain disruption

- Geopolitical uncertainty

In response to these changes, life science companies are growing increasingly sophisticated in how they manage risk, demanding more value from their brokers and insurer partners.

Managing a wide change of changing exposures requires a partner that understands the unique risks the life sciences industry faces and offers the breadth of services to address all your risk and people needs.

We are one of the leading risk and insurance brokers, with more than 700 life sciences clients worldwide. With offices in 120 countries, we can help your life sciences company make smarter decisions about risk.

Deep life sciences insurance knowledge

The life science industry is highly regulated and globally dynamic. Whether you’re a pharmaceutical, biotech or medical device maker, we have the knowledge and dedicated resources to help your company navigate this complex risk landscape to make smarter decisions.

Our life sciences team features a cross section of professional backgrounds and credentials, including:

- Scientists

- Attorneys

- Risk managers

- Brokers

- Underwriters

- Risk engineers

- Claims specialists

Our global footprint and multinational knowledge enable us to anticipate trends and regulations around the world and afford easy access to relevant information about virtually any location in which you do business. Together, we can help you make better decisions about risk and human capital.

200 WTW Life Sciences practitioners

700+ clients ranging from large multinational companies to early-stage start-ups

1000+ clinical trials placed globally

Data as at 4 January 2024

Our life sciences insurance expertise

We specialize in services for:

- Pharmaceutical and biotech

- Therapeutic research and development

- Generic and specialty drug manufacturers

- Medical device and digital health companies

- Contract research organizations (CRO)

- Contract manufacturing organizations (CMO)

- Diagnostic laboratories

- Nutraceutical and over-the-counter (OTC) medicines

We have a globally integrated practice with industry specialists in:

- Property and casualty insurance

- Clinical trials

- Claims advocacy

- Management liability

- Risk and loss control

- Cyber risk

- Analytical tools

- Mergers and acquisitions (M&A)

- Intellectual property risk

- Reputational risk

- Product recall

- Compensation advisory

- Employee benefits

We can provide access to comprehensive global regulatory and compliance information, ensuring that you stay informed about the latest developments affecting your life sciences business. This information is provided by country and includes:

- Non-admitted status

- In-country regulations

- Insurance limits

- Professional liability requirements

- Certificate protocols

- Specific information requirements for each country

What makes us different

- Many of our clients in the life sciences sector lack dedicated risk management professionals. This reality has prompted us to build a service model for every client designed to optimize resources while improving outcomes.

- We will provide you with regular in-depth trends and insights on emerging risks impacting the life sciences industry and insurance marketplace to help you implement the right solutions for your organization.

- Our advanced loss modelling capabilities. Connected Risk Intelligence is an innovative development in risk consulting which visualises risk in a single language and framework to empower organisations to make better risk finance decisions.

- We spend the time evaluating and analyzing your risk exposures to help minimize the total cost of risk so your life sciences organization can make smarter decisions.

- We provide direction and consultation on risk mitigation strategies and improvement opportunities to help enhance your life science business’ performance. We offer a range of solutions to address your risk and people issues.

- Our service team offers access to specialists in different lines of business including: directors’ and officers’ liability, cyber insurance, product liability, supply chain, cargo, assets and risk engineering.

Together, we can help you make smarter decisions about your risk and human capital.

For specialist help discovering smarter ways to manage risk in the life sciences sector, please get in touch with the experts listed at the top of this page.

Disclaimer

WTW hopes you found the general information provided here informative and helpful. The information contained herein is not intended to constitute legal or other professional advice and should not be relied upon in lieu of consultation with your own legal advisors. In the event you would like more information regarding your insurance coverage, please do not hesitate to reach out to us. In North America, WTW offers insurance products through licensed entities, including Willis Towers Watson Northeast, Inc. (in the United States) and Willis Canada Inc. (in Canada).