Non-stationarity is not only a characteristic of climate-related hazards. Local earthquake risk is also thought to change spatially and temporally following recent activity in a region. For the purposes of underwriting and risk management, knowing where risk increases or decreases is useful in order to manage earthquake accumulation and underwriting strategy.

In light of a potentially ongoing earthquake sequence, from the 4th to the 6th of July 2019 around 150 miles north of Los Angeles, we have been considering the potential change in earthquake hazard for the region, to better support and advise clients with exposure in this area.

Willis Re leverages collaborations with academic partners through the Willis Research Network (WRN) to address such complex questions, in order to react to such industry challenges in an independent and rapid fashion.

Temblor Inc and Tohoku University have long worked to estimate the impact of current earthquake activity on surrounding faults, indicating future changes in the likelihood of events. Temblor is the only model vendor that has a service which tracks dynamic earthquake hazard, which they call Realtime Risk. They build Realtime Risk into their stochastic event sets, hazard curves, and in loss calculations. Coulomb stress transfer has been a well-recognised mechanism that can promote or inhibit subsequent earthquakes through stress changes in proximity to a ruptured fault.

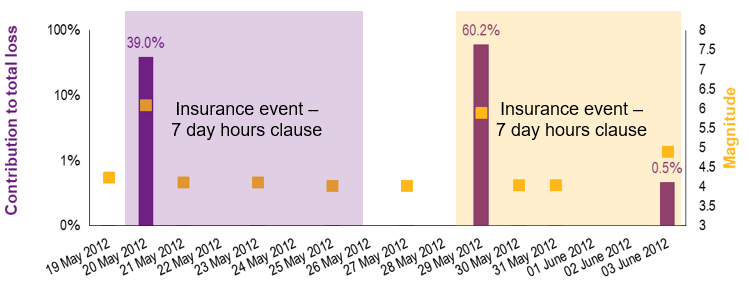

Earthquakes impart stress to their immediate surroundings, not least via aftershocks, which generally occur where stress promotes additional shaking. A recent example was the 2012 Emilia sequence in Italy, where aftershocks contributed the majority of shaking damages.

Example of a typical Italian portfolio loss by day from the 2012 Emilia EQ sequence

As was observed in the 2010-11 New Zealand Canterbury / Christchurch earthquakes, successive mainshocks also occur in neighbouring regions of stress increase, so this process is not limited to aftershocks.

While risk in some locations can increase, zones of ‘Coulomb stress shadows’ can also cause a reduction in earthquake risk, as has been the case for Santiago, Chile, following the 2010 Maule and 2015 Illapel earthquakes.

Recent examples of such analyses include 2010 Maule, 2016 Kaikoura and 2017 Chiapas/Puebla events. The output from this WRN academic collaboration are tangible recommendations as to how the risk landscape have evolved for Willis Re’s clients, linking them to underwriting, capital and reinsurance decisions.

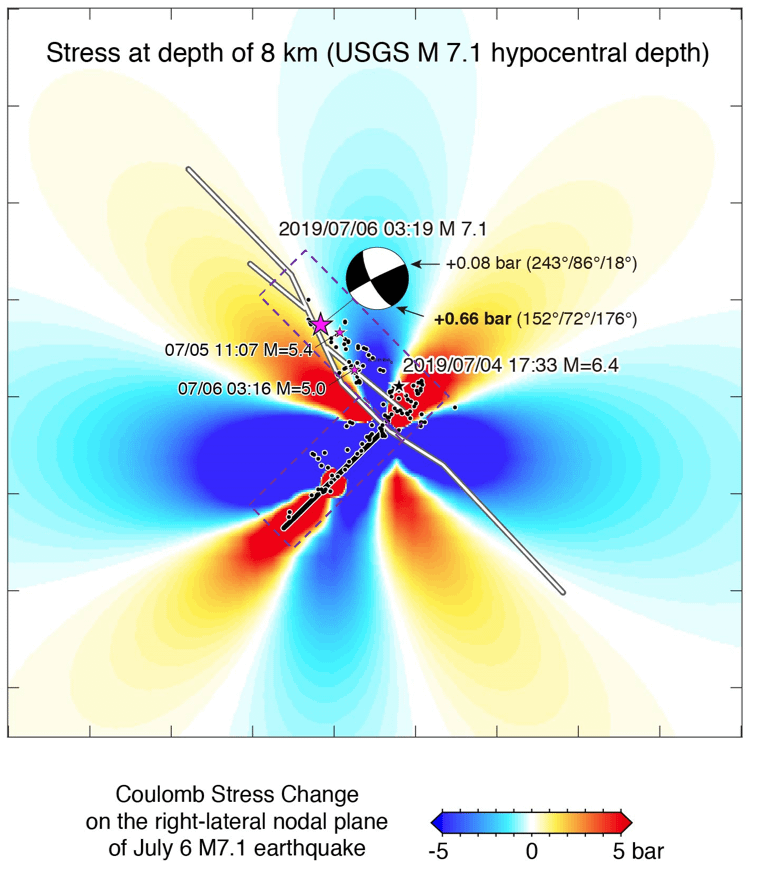

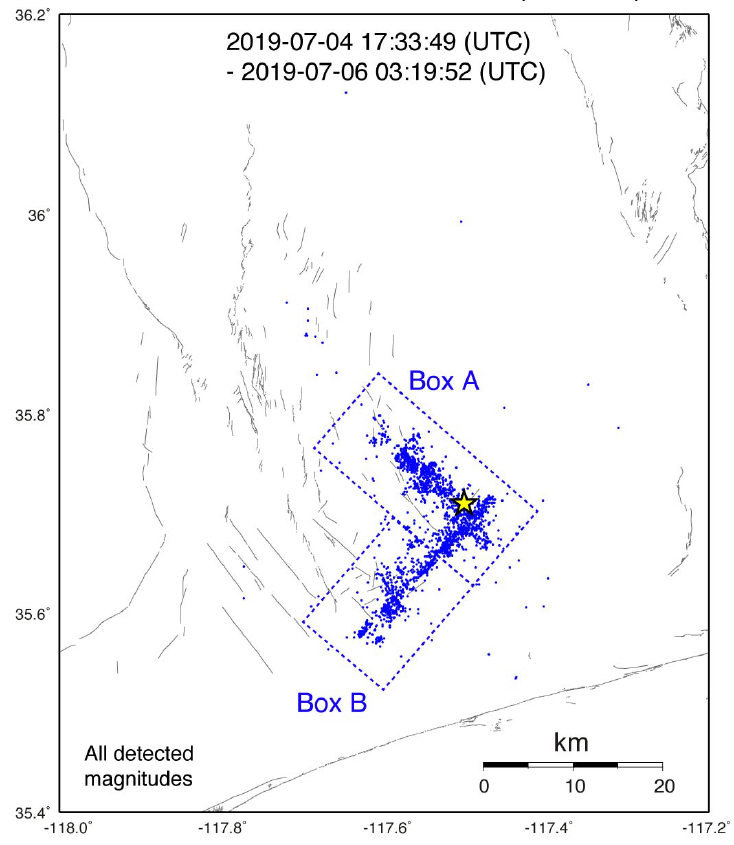

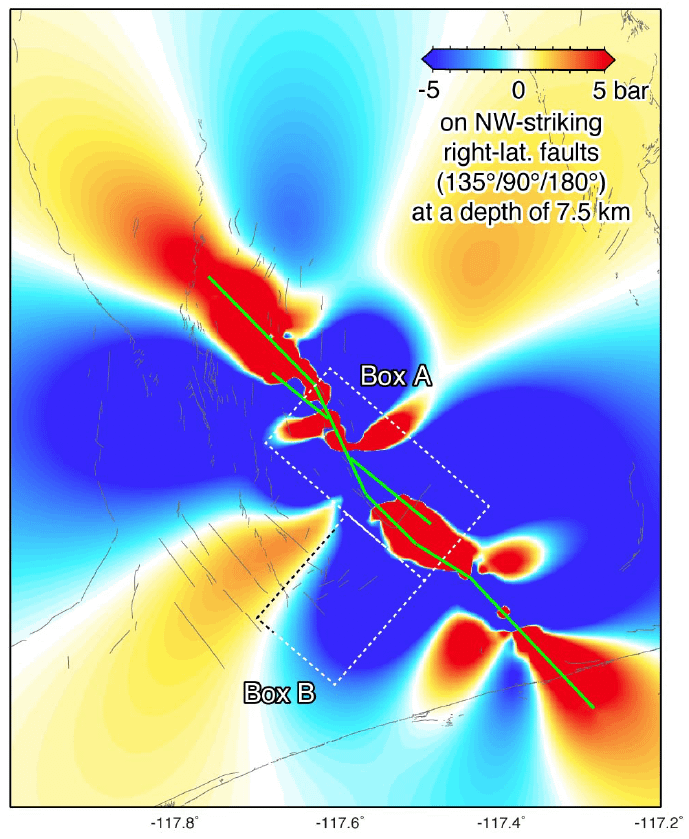

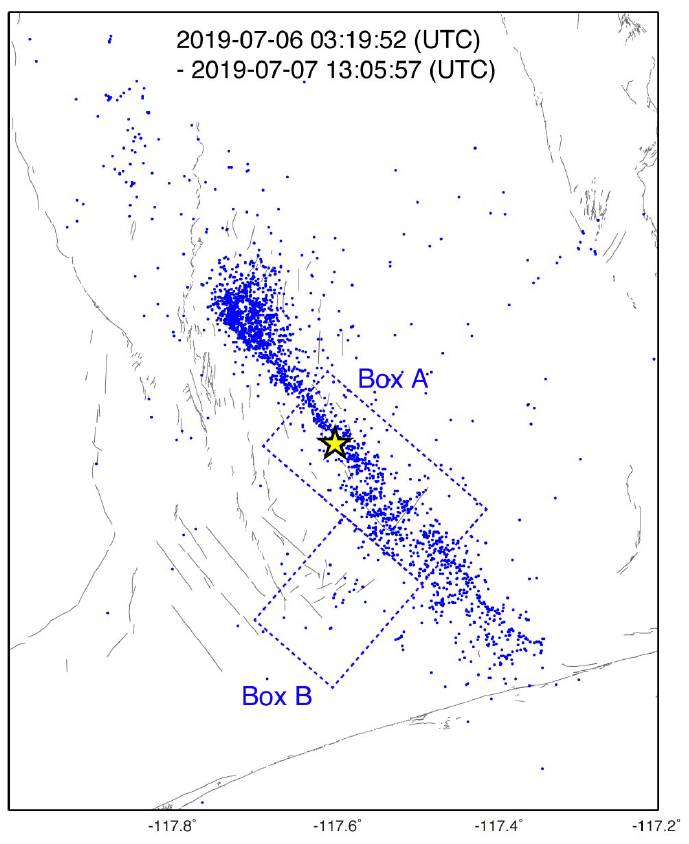

In this live and ongoing case, the first earthquake in Ridgecrest was a magnitude M6.4 event, on 4th July 2019, leading to stress increases towards the NW of the rupture, where a subsequent M7.1 event then struck 34 hours later. The Coulomb stress transfer methodology had been successful in identifying areas of promoted or inhibited risk, as highlighted by the distribution of aftershocks recorded (2a and 2b) between the two events and (3a and 3b) after the latter event. A magnitude M5.8 earthquake that stroke on the 24th of June 2020 further validates the approach, as it also lies in an area of forecasted stress increase.

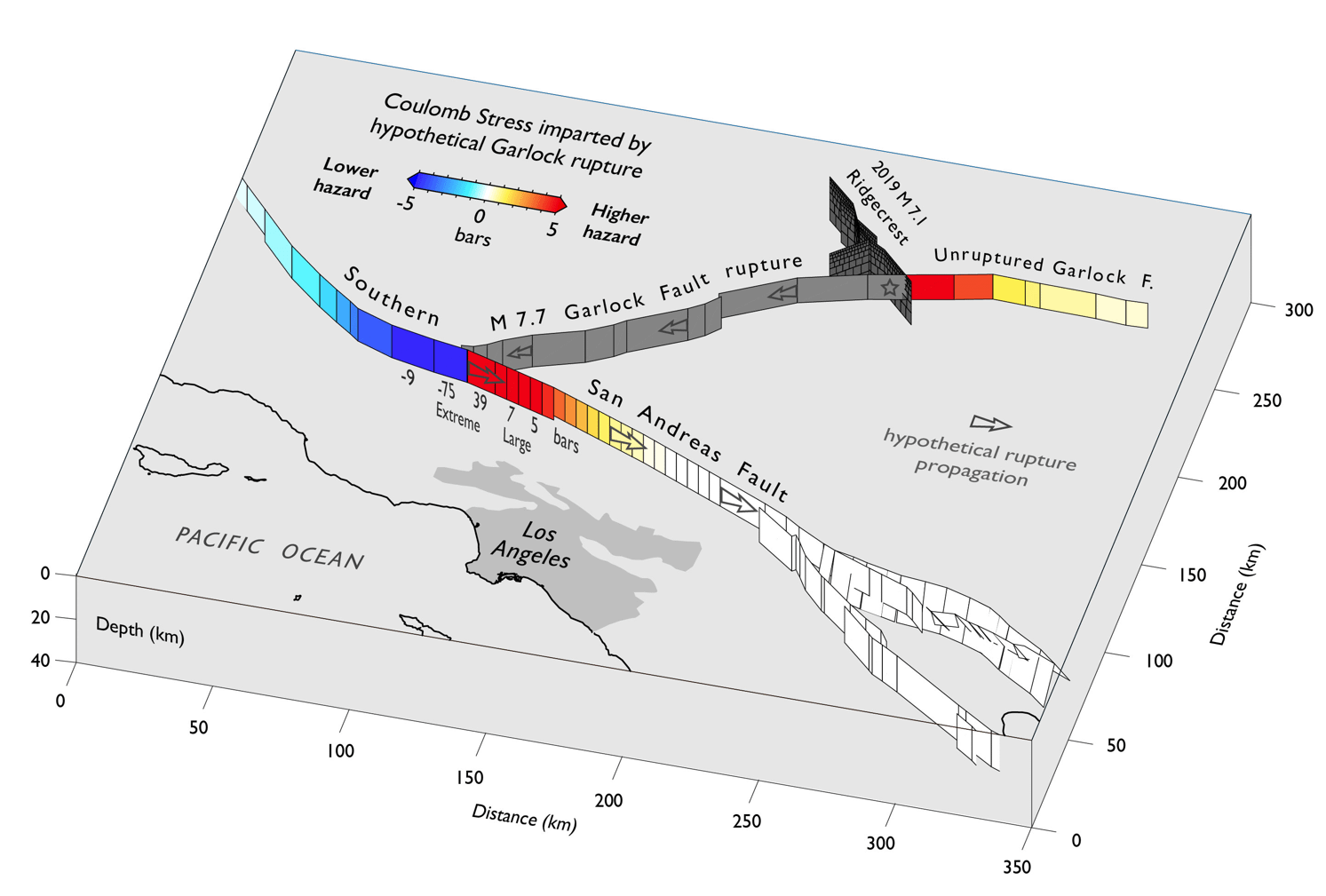

The analysis, recently published on the Bulletin of Seismological Society of America, also estimates that the central segment of the Garlock fault is now more ‘stressed’ as a result of the Ridgecrest event. The Garlock fault lies in an area of very little exposure and an event there would have limited impact. However, a large magnitude rupture (M>7.0) along this tectonic feature could have implications for the expected hazard for the Mojave section of San Andreas fault, in proximity to Los Angeles, as a result of the stress transfer.

The rupture along Garlock fault could extend to the intersection with San Andreas, causing an increase of stress on the Mojave section of the San Andreas fault Northeast of Los Angeles

As with prior studies, Willis Re can condition natural catastrophe models to quantify the potential impacts of the July 2019 Ridgecrest sequence on current and future earthquake risk. This capability enables our clients to consider the following:

Identify how the impact varies over time – the stress transfer effects reduce over time with earthquake likelihood reverting back to the longer-term trend rate of incidence over time. When considering change in risk it is then important to consider how the view may change at various points in future, such as inception, the mid-point and end-point of Willis Re clients’ reinsurance programmes.

The first 6 months yield the strongest decline; this study calculates that during the first six months since the Ridgecrest earthquakes, there was a 4.0% chance of a large San Andreas rupture, with a reduction to 1.15% during the following year and with further decay expected by the end of 2020 to less than 1%.

“A little knowledge is a dangerous thing” and this is where our close, long-term partnership with academics pays off, as it allows us to get enough insights to interpret and apply the science to risk quantification in a balanced way, rather than sensationalizing results.

Example of a how Willis Re advised clients exposed to Mexico EQ risk

Tim joined Willis Re in 2011 and has responsibility for overseeing catastrophe analytics for Global clients, Willis Re’s Model Research & Evaluation also Willis Research Network functions. Tim has 17 years’ experience, starting out at a Lloyd’s syndicate where he led part of the response and reporting to the ’04 and ’05 hurricane seasons. Thereafter, Tim worked at RMS within the team that, for instance, built the 2007 UK flood model that many UK insurers still use today. Tim brings a wealth of UK and global flood modelling knowledge from his work with leading UK and European insurers, in addition to his experience working to support various international catastrophe pools. An economist by background, Tim is ACII qualified and has achieved CFA level 1.

An earthquake specialist at Willis Re, Crescenzo develops risk solutions to help clients accurately understand and mitigate their own risk.

Myrto is an Earthquake Specialist in the Model Research & Evaluation team for Willis Re International. The team is in charge of developing the Willis Re view of risk by assessing, comparing and adjusting catastrophe model vendors for all perils/territories in the international business. Myrto has been responsible for the co-ordination and delivery of earthquake catastrophe models evaluations for more than 30 territories around the world. Her areas of focus include technical evaluations, supporting clients in developing their view of risk and communicating study outputs with reinsurers. Myrto holds a PhD on Earthquake Engineering and prior to joining Willis in 2012 she worked as an earthquake engineer in a leading engineering consulting company.

Hélène joined Willis in 1998, specialising in natural hazard modelling and reinsurance optimisation. Since 2001, she has been leading multi-disciplinary teams, who research, design and develop analytical solutions and insights for risk identification, quantification and management. She currently leads the Willis Research Network, an award-winning public-private partnership, which harnesses over 60 science partners to form innovative long-term collaborations, improving our understanding of risks (natural hazards, technological risks, geopolitical drivers of risk) for the benefit of clients and society: using science to support resilience.

Hélène has extensive experience in spatial modelling, design of innovative solutions, and applying science to business challenges. Her current focus is on Climate advisory services (advising corporates on how leading-edge climate research can help them quantify their exposure to climate variability and climate change; exploring the links between climate change and national security) and on People Risks (how people can increase vulnerability or improve resilience: terrorism, societal resilience to systemic risks, including pandemics).

She holds a BSc in Economics & Political Science (Sciences Po), and an MSc in Environmental Economics (UCL).