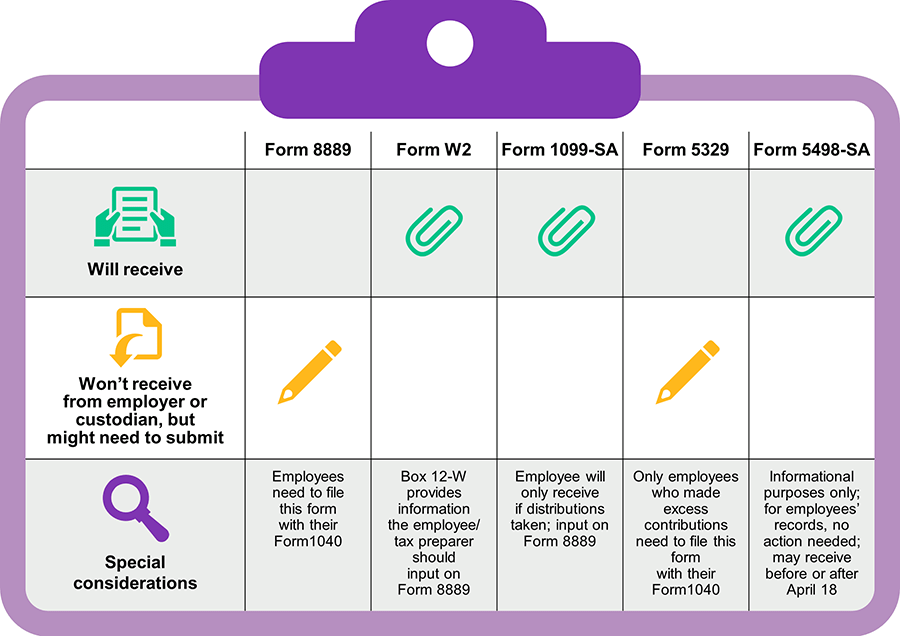

Tax time is here. The requirements for tax reporting on health savings accounts (HSAs) have not changed from past years, although they might seem complex given there are several forms to keep track of. Your employees with HSAs enjoy many tax advantages, but they also need to understand the specific IRS reporting requirements for these accounts. Employees may be confused about what to do with the tax forms they receive and how to account for their HSA contributions and distributions. To help clarify, we’ve put together a table outlining the IRS forms employees might need when filing taxes for their HSAs by the April 18, 2023 federal tax deadline, followed by an explanation of how each form is used.

While HSA contributions and distributions for eligible medical expenses are tax-free, they still must be reported to the IRS. Form 1040 must be used to file taxes, even if employees are not itemizing deductions.

Form 8889 is used by HSA account holders to report contributions and distributions and is required to be submitted with Form 1040. Other tax forms — the W-2 Wage and Tax Statement, and, in case of distributions, the 1099-SA — provide the information needed to complete Form 8889. Like Form 1040, employees will need to obtain a copy of Form 8889 for themselves; it will not be sent to them by their employer or HSA custodian. Employees may download the form and find the instructions online (About Form 8889) or contact their tax advisor for personalized guidance on completing it.

Form W-2 is sent by employers to report income and compensation paid to employees and taxes withheld. Box 12-W shows the combined pre-tax HSA contributions made by employees and employers. This amount should be used when reporting contributions on Form 8889. Keep in mind that contributions employees made on their own, outside of payroll deductions, will not be shown on the W-2.

Form 1099-SA is sent by HSA custodians and reports HSA distributions made during the tax year. Employees will only receive this form if they had a distribution in the tax year. If they take distributions from more than one HSA, they will receive a 1099 from each HSA custodian. Employees will also receive a 1099 if they inherited the HSA upon death of the HSA account holder. The information included on the 1099-SA is used to complete the distribution section of Form 8889. Employees do not need to include the 1099-SA with their Form 1040.

If employees made excess contributions to their HSA (beyond the limit set by the federal government), they must complete this form and include it with their Form 1040.

HSA custodians are required to send a Form 5498-SA to employees and the IRS each year. This form reports contributions deposited into the employees’ HSA for the tax year, such as pre-tax contributions taken from the employees’ paycheck, employer contributions and contributions employees made on their own. Timing of these forms varies between HSA custodians. Some administrators prepare the form before April 18 and then prepare revised forms to include any post-tax contributions made after the form was prepared. Other administrators wait until after April 18 to prepare the form to account for all contributions made for the prior tax year. This form is for informational purposes only and is not required to file taxes.

We hope this information clarifies the process and helps you educate your employees with HSAs — but, as always, if employees have questions about filing their taxes, we recommend they consult with a tax advisor or accountant for personalized guidance.