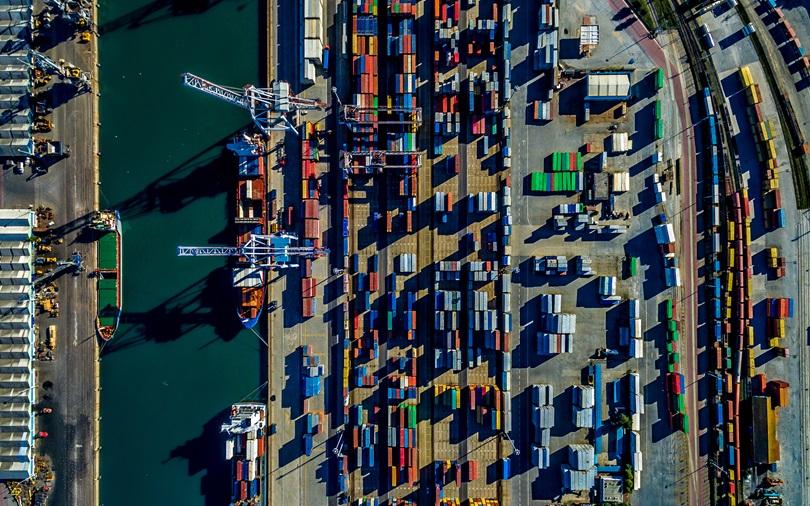

Protecting your goods while in-transit or held in inventory

The value and sensitivity of the products manufactured by life science companies makes the risk management of cargo a critical and strategic function.

Your supply chain is vulnerable to many risks:

- Complex geopolitical issues could threaten the distribution of products into unstable parts of the globe.

- Cargo theft and security threats are constant reminders that companies need to be vigilant.

- Temperature sensitivity, spoilage or deterioration of cargo including suspected damage/fear of loss.

Complementing our industry expertize, we have robust analytic capabilities and supply chain consultancy services, meaning that our life sciences practice group is well equipped to assist you in managing this complex risk environment.

How we serve our clients

We seek to obtain the most cost effective and robust program customized to your individual and unique needs, from raw material, through manufacturing to delivery of finished product to final destination.

We use our own team of actuaries to provide proactive claims advocacy, using industry sector expertize and knowledge to effectively negotiate with insurers and loss adjusters to achieve successful outcomes.

Using industry sector knowledge, our approach is to accurately profile your risk, ask the right questions to ensure we understand your risk exposures and assess the key factors which will drive premium.

To complement our risk focused approach and specialty insurance expertize, we use in house actuaries to provide analytics, loss modelling and risk retention analysis.

We can assist in bringing together your global exposures into one insurance program, ensuring your policy is streamlined, fully compliant and in line with sanction requirements.

Global WTW stats as at 18 March 2024

About our Life Science Practice

- We provide our clients with regular in-depth trends and insights on emerging risks impacting the life sciences industry and insurance marketplace to help them implement the right solutions for their organization.

- Our advanced loss modelling capabilities. Connected Risk Intelligence is an innovative development in risk consulting which visualizes risk in a single language and framework to empower organization to make better risk finance decisions.

- At WTW, we spend the time evaluating and analyzing your risk exposures in order to help minimize the total cost of risk. As well as supporting you to achieve your organization's goals.

- We provide direction and consultation on risk mitigation strategies and improvement opportunities to help enhance your organization's performance. We offer a range of solutions to address your people, risk and capital issues.

- Our service team offers access to specialists in different lines of business including: directors and officers liability, cyber, product liability, supply chain, cargo, assets and risk engineering.

Disclaimer

WTW offers insurance-related services through its appropriately licensed and authorised companies in each country in which WTW operates. For further authorisation and regulatory details about our WTW legal entities, operating in your country, please refer to our WTW website. It is a regulatory requirement for us to consider our local licensing requirements.