What is Cyber Quantified?

Cyber Quantified is a cyber risk quantification and modeling tool providing a smarter way to optimize your cyber risk management strategy. By accurately predicting and quantifying the financial implications of cyber risk, Cyber Quantified gives you a new level of clarity and transparency on the cyber risk your organization faces, and confidence on how much insurance you need, plus the optimal price and structure of cover.

A smarter way to optimize your cyber risk management strategy.

Why quantify your cyber risk?

Threats like ransomware attacks capable of shutting down operations and supply chains loom large at board level and amongst shareholders. To your key stakeholders, cyber risk can feel like a ‘black box’ with potentially catastrophic impacts and insurance that seems to cost more and more each year, while the value it provides remains unknown.

So, how can you gain a deeper understand your cyber loss potential and the financial impact of the threats most likely to hit the business? What level and structure of cyberinsurance is most efficient? What material impact will risk controls have on the outcome of a threat or vulnerability?

Cyber Quantified provides answers by using analytics to predict and quantify the financial damages and volatility arising from the actuarial-forecasted scenarios most relevant to your organization, its sector and specific risk controls.

What are the key features of Cyber Quantified?

Cyber Quantified’s is designed for risk professionals to use, either independently, or ideally in collaboration with cyber experts to develop elevated and more transparent cyber risk management strategies. It works to remove historical barriers between the security and risk functions to better protect the business and support long-term resilience in the face of ever-changing cyber threats.

Cyber Quantified offers:

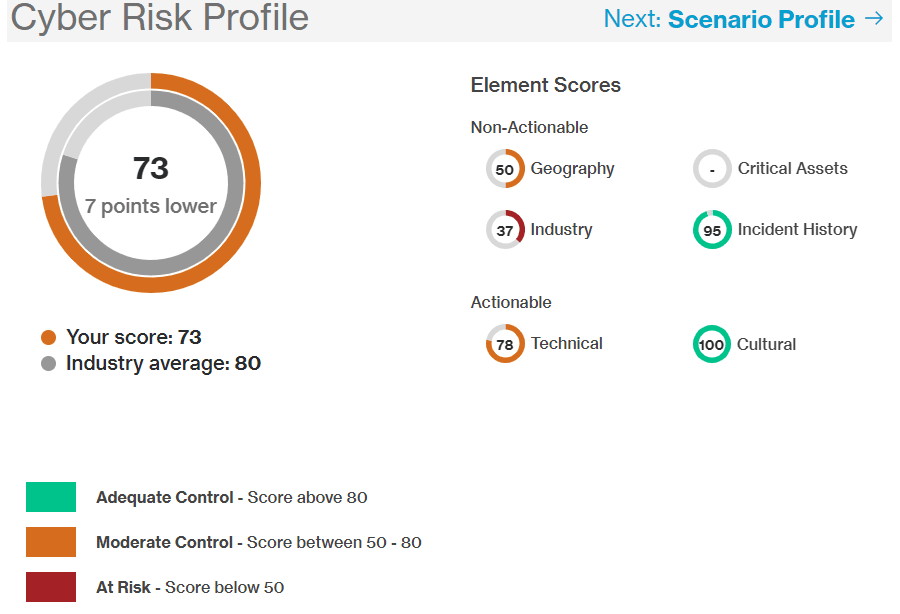

- 360⁰ view of your cyber risks, highlighting vulnerabilities and threats by examining risks in the context of your current controls

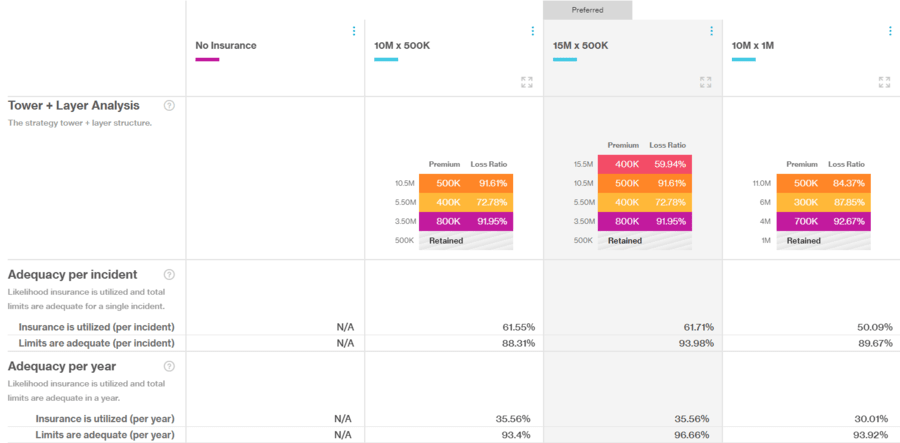

- Thorough quantification, allowing you to understand how cyber risk scenarios impact your organization in financial terms, with predicted frequency and severity of losses and breakdowns on how these scenarios contribute to total projected losses

- Visually compelling data, with severity projections across a range of confidence intervals, enabling informed decision-making that aligns cyber insurance purchasing with the risk mitigation activities of the chief information security officer (CISO)

- Projected losses broken down into discrete cost categories allowing you to understand what drives costs in the event of a cyber loss, whether that’s business interruption costs, the response to a ransomware attack, or any one of a wide range of factors that could generate costs

- Insurance strategy comparison with the ability to enter detailed sub limits, retentions and quota shares, revealing the options that deliver value

- Integrated Security Scorecard data, facilitates assessment of your technical and cultural control posture

- Concise and easily consumable outputs and reports, driving efficient communication with internal and external stakeholders on how you are identifying, mitigating and insuring against cyber risk.

How does Cyber Quantified deliver cyber risk transparency and cyber insurance value?

Cyber Quantified’s modelling and quantification platform incorporates the scenarios most relevant to your organization. Events are selected from WTW’s Scenario Library, a comprehensive and constantly growing database, based on a multitude of datapoints and real-time cyber incidents globally and across all sectors.

Cyber Quantified measures the financial damages and volatility arising from scenarios in light of your organization’s specific risk profile and cyber risk controls.

What are the key benefits of Cyber Quantified?

You can call on Cyber Quantified to help:

- Improve transparency around the impact of cyber risk on your organization and the risk controls it currently has or is considering

- Strengthen cyber risk governance using robust actuarial data

- Identify and quantify the universe of cyber risks and vulnerabilities that could threaten the business

- Facilitate strategic and tactical engagement with insurance markets with a view to achieving better value from your risk management strategy

- Articulate your cyber risk mitigation and transfer strategies to the C-suite, shareholders and other stakeholders in transparent, robust and auditable ways

- Elevate your approach to cyber risk management by breaking down traditional barriers between the risk function and the CISO

- Boost long-term organizational resilience by aligning cyber risk strategy with the strategic objectives of the business.

You can engage Cyber Quantified through direct licensed access to the tool, through our cyber brokerage team, and/or with a WTW cyber risk quantification consultant. Our consultants can help create alignment with your CISO and customize the model to your controls, threats, and business operations.

Disclaimer

WTW hopes you found the general information provided here informative and helpful. The information contained herein is not intended to constitute legal or other professional advice and should not be relied upon in lieu of consultation with your own legal advisors. In the event you would like more information regarding your insurance coverage, please do not hesitate to reach out to us. In North America, WTW offers insurance products through licensed entities, including Willis Towers Watson Northeast, Inc. (in the United States) and Willis Canada Inc. (in Canada).