We highlight the risk-return continuum for any combination of workers compensation, U.K. employers liability, general liability and auto liability in the U.S., Western Europe and Canada. Our precise evaluation of your risk informs your risk management strategy with:

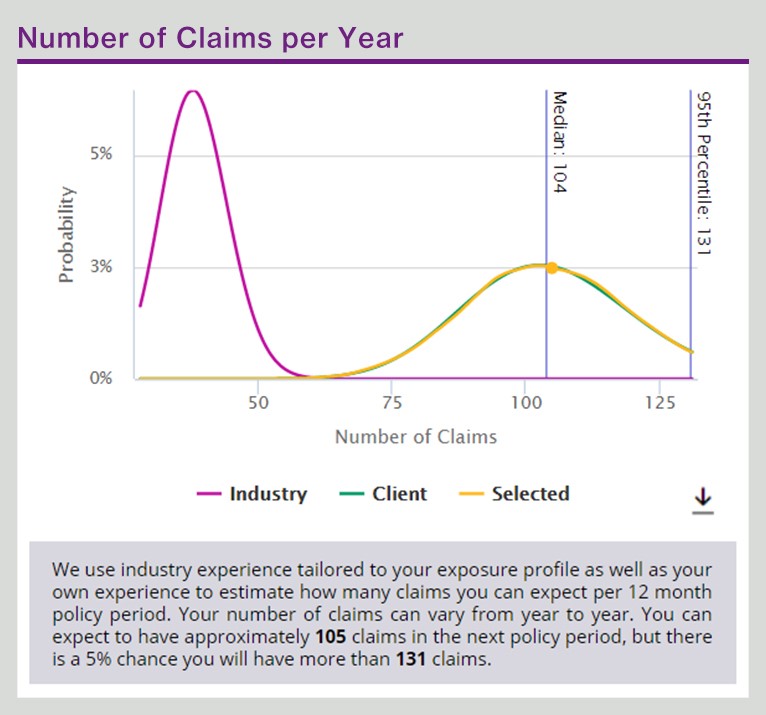

- A dynamic and actuarially sound view of your holistic casualty risk, blending your own loss history with industry factors customized to your industry, geographic and hazard risk profile

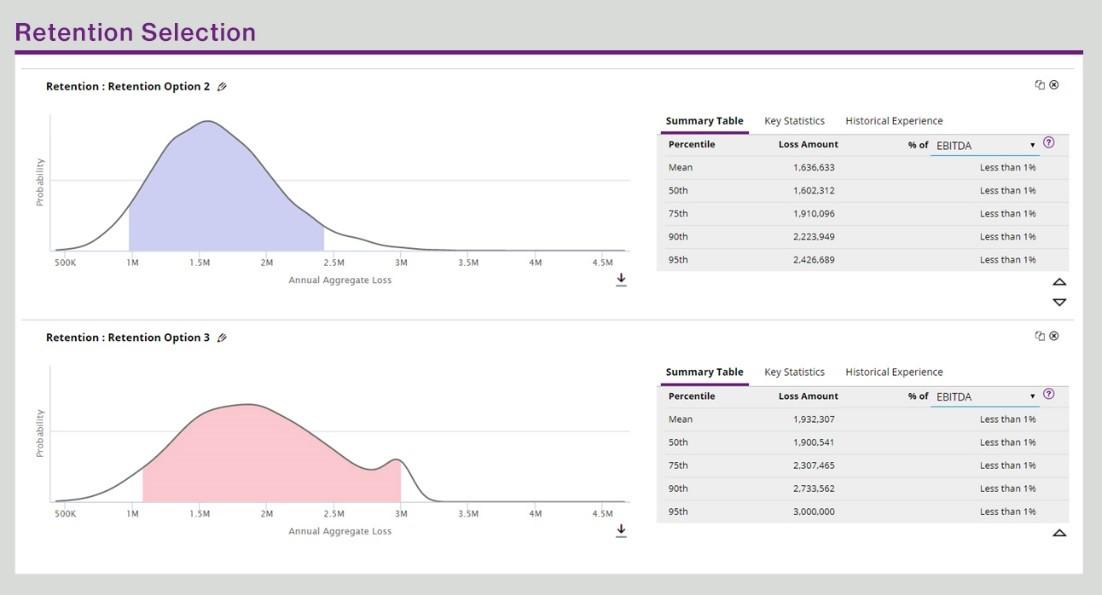

- Multiple alternative sets of forecasting analyses designed to drive retention selection or assess efficacy of guaranteed cost programs, evaluate both per occurrence and aggregate retention structures

- Engages all levels of your organization with best-in-class visualizations of risk and cost, promoting financially driven decision support

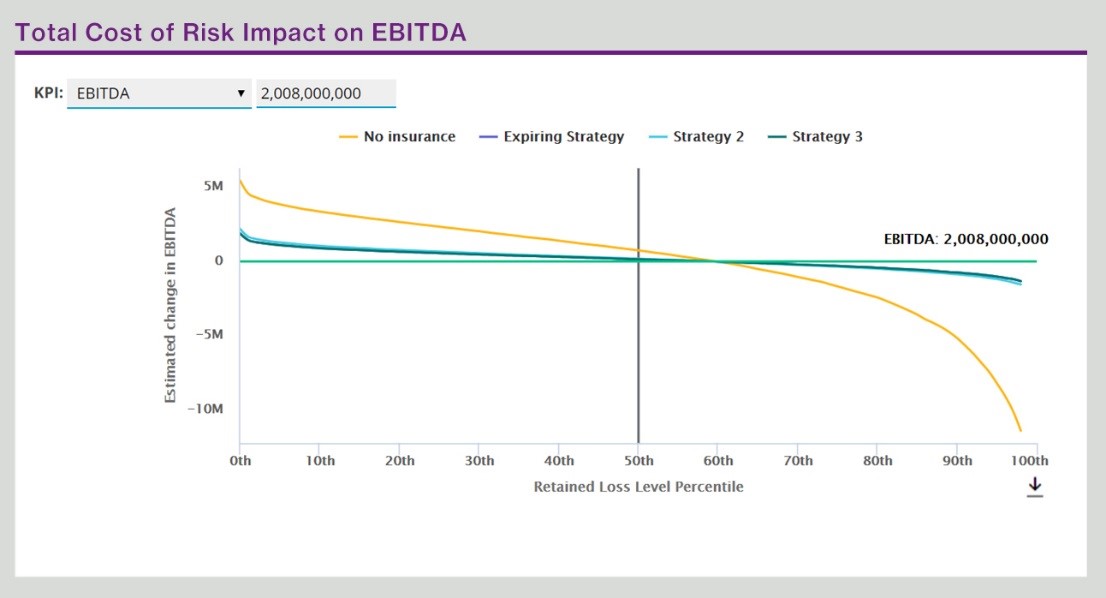

- Promotes a risk tolerance approach to your insurance strategy by linking risk and the associated retained loss volatility to key financial metrics like EBITDA

- Presents pricing indications, enabling you to compare against multiple market premium quotations

Why should you use Dynamic Casualty Forecast?

The Dynamic Casualty Forecast helps you evaluate the optimal retention strategy reflecting your budget and risk tolerance. It helps you to see the full range of the financial impact of retained casualty losses, compare the total cost of risk for alternative insurance strategies across multiple coverages and evaluate the historical profitability of your portfolio of casualty coverages.

For whom is it appropriate?

This tool is best for clients that have experienced at least 30 claims over the last three years, but can also be run with no loss data. The Dynamic Casualty Forecast can evaluate guaranteed cost programs and retentions levels up to $10 million.

What geographies does this tool support?

| U.S. | U.K. | Canada | Europe |

|---|---|---|---|

| Auto Liability | Motor Liability | Auto Liability | Motor Liability |

| General Liability | Employer Liability | ||

| Workers Compensation |

When should you use Dynamic Casualty Forecast?

- Ahead of your casualty insurance renewal to determine expected retained losses, evaluate retention changes and gain insight on excess layers

- Throughout the year to reevaluate updated loss runs

- When considering acquisitions or divestitures that may affect your casualty exposure

What can I do with information gained from Dynamic Casualty Forecast?

- Drive your retention strategy

- Evaluate the efficacy of guaranteed cost options

- Continue your analytics journey to policy renewal with Collateral Quantified

- Connection to Dynamic TCOR

Future enhancements

Planned expansion will include other geographies and types of risk. Global professional liability and medical professional liability are currently under development.