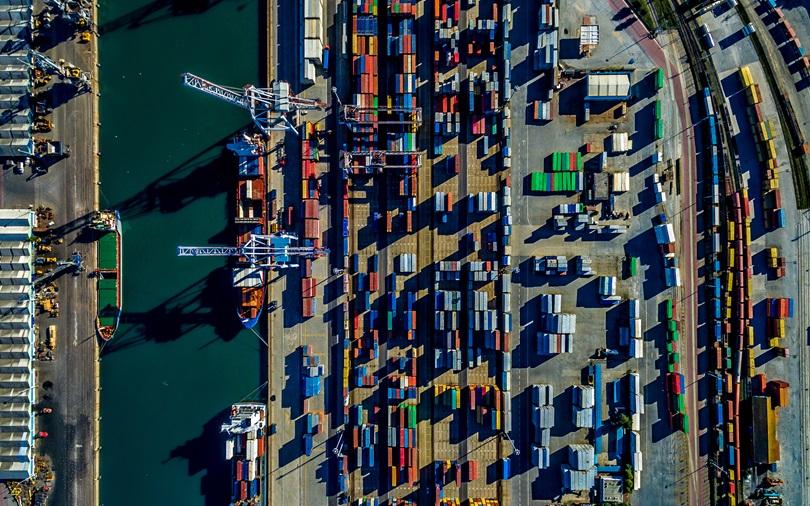

The cargo market provides a great deal of capacity for stock exposures, both on a primary and excess basis, enabling you to access the market where the highest economies can be obtained. Using the current property and cargo market cycles as a guide, we will advise you on the most cost-effective and comprehensive way to insure your transits and stock.

Potential benefits to using the marine market for your stock exposures include competitive deductibles, beneficial stock limits, lower total premium costs and freeing up the non marine market or local market capacity. Certain industries, such as pharmaceutical, high tech, commodities and oil lend themselves to this strategy as large limits can be placed competitively as excess layers.

Increasingly clients are placing their cargo risks on a stock throughput basis as it can include coverage for inland and/or international transits plus stock — including raw materials, work in progress, as well as finished goods.

A stock throughput can deliver all the benefits outlined above and:

- Seamless coverage for your exposures

- Potentially lower overall premium spend

- Simplification of the claims settlement process and reduced administration

Disclaimer

WTW offers insurance-related services through its appropriately licensed and authorised companies in each country in which WTW operates. For further authorisation and regulatory details about our WTW legal entities, operating in your country, please refer to our WTW website. It is a regulatory requirement for us to consider our local licensing requirements.