A Health Reimbursement Arrangement (HRA) is an employer-funded plan that offers employees and retirees a tax-free reimbursement option for qualified medical expenses. Qualified medical expenses include out-of-pocket expenses not covered by a health plan, as well as premiums such as Medicare Part B premiums or premiums for insurance purchased on the individual marketplace.

There are four types of HRAs: Standard HRA, Qualified Small Employer HRA (QSEHRA), Individual Coverage HRA (ICHRA), and Expected Benefit HRA (EBHRA). Each HRA type offers unique benefits and eligibility criteria.

HRAs offer a win-win solution, providing financial benefits and flexibility to both employers and employees while enhancing the overall healthcare benefit package. Understanding these HRAs helps employers choose the best option for their workforce, ensuring compliance with tax and healthcare regulations. By integrating HRAs into their benefits strategy, employers can offer a more comprehensive and attractive healthcare package, ultimately improving employee satisfaction and retention.

Key features of HRAs

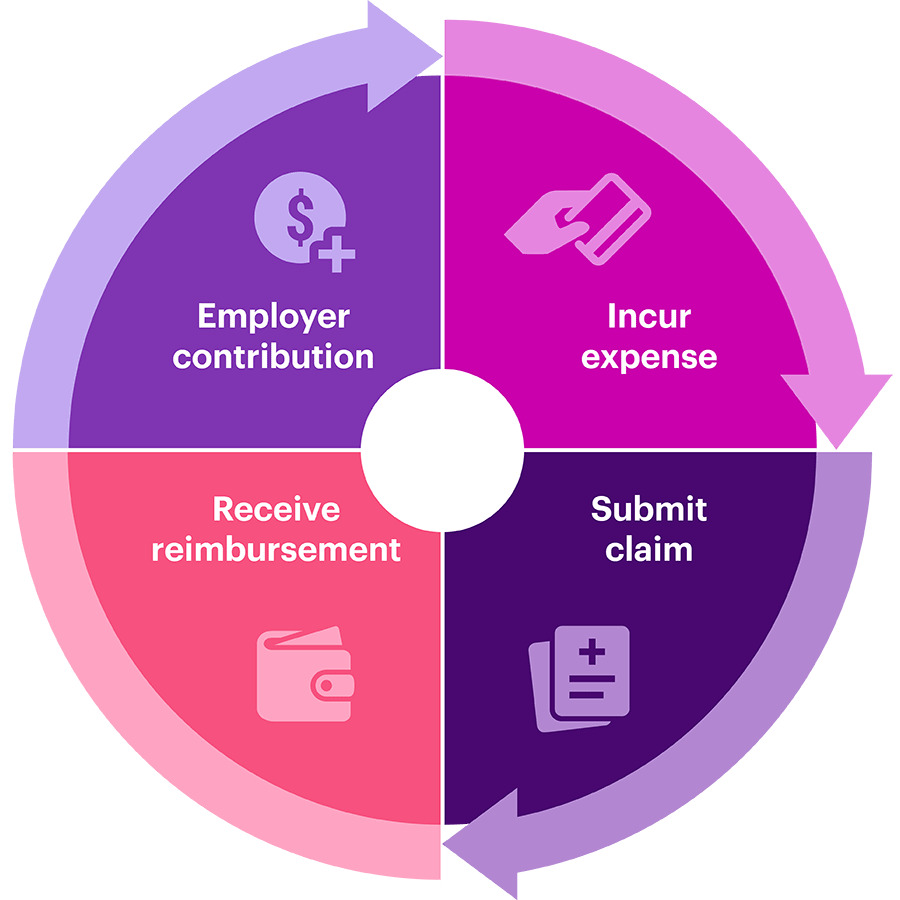

How HRAs work

The Health Reimbursement Arrangements is a valuable tool for employers seeking to offer flexible, tax-advantaged healthcare benefits. By understanding the different types of HRAs, their advantages, and the considerations for implementation, employers can effectively utilize HRAs to enhance their benefits offerings and support their employees' health and financial well-being.

Download

| Title | File Type | File Size |

|---|---|---|

| Types of HRAs | .1 MB | |

| Health Reimbursement Arrangement (HRA) | .4 MB |