Retirement benefits are a key component of total rewards strategy and the employee experience. Our Global Benefits Attitudes Study 2024 found that 55% of employees said retirement benefits are an important reason to stay at a company. If you want to hire and retain the best talent, you need a competitive retirement strategy that focuses on positive employee outcomes, and balances employer workforce management and risk management.

Today defined contribution (DC) plans are the primary retirement savings vehicle for most U.S. employees however, sponsoring a plan has become increasingly complex and time-consuming. Defined contribution plans are also the target of excessive-fee and other litigation – leaving plan sponsors and fiduciaries exposed to meaningful risk.

The retirement landscape is changing and you have an opportunity to harness the advantage to your employees and your business.

What is a pooled employer plan (PEP)?

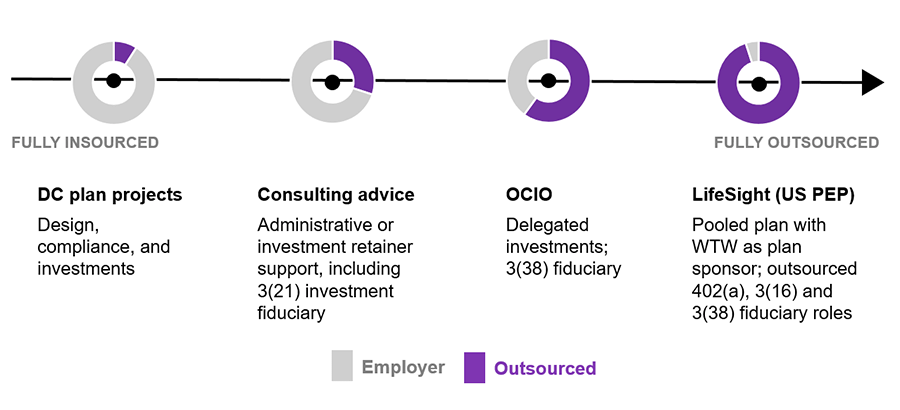

Pooled employer plans (PEPs) are the latest expansion in defined contribution plan outsourcing in the U.S., however pooled plan arrangements are already available across the globe in countries such as Australia, Belgium, Germany, Ireland, South Africa, and the United Kingdom. In the U.S., PEPs are expected to reshape the way retirement benefits are delivered. Our LifeSight PEP enables employers to fully outsource their 401(k) plans with peace of mind.

A PEP aims to build economies of scale and transfer fiduciary risk by allowing unrelated employers of any size to participate in a single defined contribution plan. LifeSight PEP allows employers to retain the flexibility to select key contribution and other design features that align with your business needs.

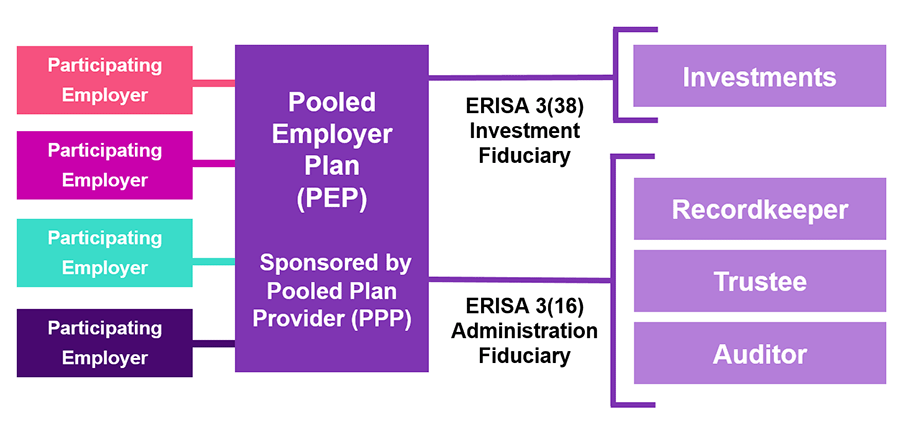

A PEP is sponsored by a Pooled Plan Provider (PPP), which is the named fiduciary and entity responsible for management and administration of the PEP. Participating employers shift nearly all oversight and governance to the PPP, including fiduciary responsibility for investments and plan administration. You maintain responsibility for selecting and monitoring the PPP. The PPP selects and monitors other service providers.

WTW is the PPP for the LifeSight PEP